Understanding Shariah Compliance in IPOs and Stocks:

Investing wisely is essential for both financial growth and ethical alignment. For those interested in making investments that comply with Islamic law, understanding the Shariah status of Initial Public Offerings (IPOs) and stocks is crucial. This article aims to provide insights into the Shariah compliance of VMS TMT Ltd, ensuring that your investment choices are not only profitable but also ethical.

Table of Contents

Analyzing The Company

Company Name: VMS TMT Ltd

Industry: Industrial Products

Listing At: NSE & BSE (Mainboard)

Overview:

VMS TMT Limited, an Indian company founded in 2013, specializes in manufacturing Thermo Mechanically Treated (TMT) Bars. These high-strength steel bars are essential for modern construction due to their exceptional durability, ductility, and resistance to seismic activity. The company’s manufacturing facility is strategically located in Bhayla Village, near Ahmedabad, Gujarat, which is a key hub for its operations and distribution.

Leadership and Operations

The company’s leadership consists of its promoters: Varun Manojkumar Jain, who serves as Chairman and Managing Director; Rishabh Sunil Singhi, a Whole Time Director; and Manojkumar Jain, a non-executive Director. They are supported by a skilled and experienced management team and a workforce of 230 permanent employees. This collective experience allows the company to understand and adapt to market trends, manage its business effectively, and maintain strong customer relationships.

VMS TMT’s business is heavily concentrated in the state of Gujarat. Over the past three fiscal years, the company has derived over 97% of its revenue from this region. Its primary products are TMT Bars, which accounted for more than 91% of its total revenue. The company also generates revenue from the sale of scrap, binding wires, and billets.

Business Model and Market Presence

The company’s business model serves both retail and institutional customers, with a strong focus on Tier II and Tier III cities within Gujarat, excluding the Saurashtra and Kutch districts. The company has a diverse customer base, with retail sales making up a significant portion of its total revenue, particularly in the three months ending June 30, 2025, where retail sales constituted nearly 87% of total revenue.

VMS TMT has established a strategic non-exclusive distribution network to reach its customers. As of July 31, 2025, this network includes three distributors and 227 dealers. The company relies on these partners to expand its reach and ensure its products are widely available. A key component of its market strategy is a retail license agreement with Kamdhenu Limited, signed in November 2022. This agreement allows VMS TMT to market and sell its TMT Bars under the well-known “Kamdhenu NXT” brand within Gujarat, which enhances its brand recognition and market position.

Manufacturing and Supply Chain

The manufacturing process at the Bhayla Village facility uses advanced machinery and automation to produce high-quality TMT Bars. A major development in the company’s operations is its backward integration project. Previously, the main raw material was iron billets, which were sourced from local suppliers. With the recent installation of a thirty-ton electric induction furnace, VMS TMT can now produce its own billets in-house. This new furnace has an annual capacity of 216,000 metric tons and is expected to significantly reduce production costs and coal consumption.

The company’s supply chain is supported by a third-party transportation and logistics provider that operates a fleet of over 50 trucks. This allows for convenient doorstep delivery to both retail and institutional customers, which the company considers a strategic advantage over its competitors.

Commitment to Quality and Sustainability

VMS TMT places a strong emphasis on quality, environment, health, and safety. Its products meet the standards set by the Bureau of Indian Standards (BIS). The company also holds several key certifications, including ISO 9001:2015 for quality management, ISO 45001:2018 for occupational health and safety, and ISO 14001:2015 for environmental management.

In line with its sustainability goals, the company has initiated a project to set up a 15MW solar power plant. This plant will be used for captive power consumption, which is expected to reduce the company’s electricity expenses and lower its carbon footprint. These efforts highlight VMS TMT’s commitment to sustainable business practices and high-quality standards.

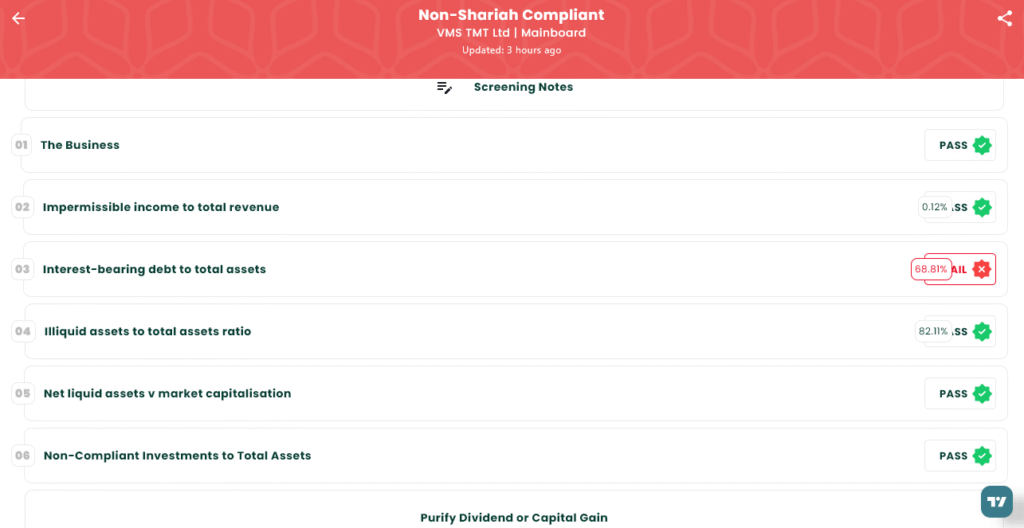

Shariah Status

The IPO is Non-Shariah Compliant, please see below image.

IPO Timeline (Tentative Schedule)

- IPO Open Date: Monday, September 17, 2025

- IPO Close Date: Wednesday, September 19, 2025

- Tentative Allotment: Thursday, September 22, 2025

- Initiation of Refunds: Monday, September 23, 2025

- Credit of Shares to Demat: Monday, September 23, 2025

- Tentative Listing Date: Tuesday, September 24, 2025

- Cut-off time for UPI mandate confirmation: 5 PM on September 19, 2025

Lot Size

| Application Type | Lots (Min) | Shares (Min) | Amount (Min) | Lots (Max) | Shares (Max) | Amount (Max) |

| Retail | 1 | 150 | ₹14,850 | 13 | 1,950 | ₹1,93,050 |

| S-HNI | 14 | 2,100 | ₹2,07,900 | 67 | 10,050 | ₹9,94,950 |

| B-HNI | 68 | 10,200 | ₹10,09,800 |

Financials

VMS TMT Ltd. has shown a mixed financial performance over the past few years. Between the fiscal years ending March 31, 2024, and March 31, 2025, the company’s total income decreased by 12% to ₹771.41 crore. However, it successfully improved its profitability, with profit after tax (PAT) increasing by 14% to ₹15.42 crore. The company has demonstrated a consistent trend of rising assets and net worth, which indicates expansion and strengthening of its financial position. Total assets grew to ₹412.06 crore and net worth to ₹73.19 crore as of March 31, 2025. This growth is accompanied by an increase in total borrowings, which reached ₹275.72 crore in fiscal 2025. For the three-month period ending June 30, 2025, the company reported a total income of ₹213.39 crore and a PAT of ₹8.58 crore.

KPI

| KPI | Value |

| ROCE | 12.79% |

| Debt/Equity | 6.06 |

| RoNW | 20.14% |

| PAT Margin | 1.91% |

| EBITDA Margin | 5.91% |

| Price to Book Value | 7.43 |

LINKS

Ready to invest in Shariah-compliant opportunities? Explore more at IslamicStock & consider opening a demat account from the below link!

- Open Demat Account:

- Visit our Website: www.IslamicStock.in

- Read our Blog: blog.islamicstock.in

- Download our App:

SEBI Disclaimer

Investing in IPOs involves risks. Please read the offer document carefully before investing. This article is for informational purposes only and does not constitute financial advice. Investors should consult their financial advisors before making any investment decisions.