Table of Contents

1. IPO Snapshot

Symbol: ARISINFRA

IPO Open Date: June 18, 2025

IPO Close Date: June 20, 2025

IPO Allotment Date: June 23, 2025

IPO Listing Date: June 25, 2025

Issue Size: Approx ₹500 crore (fresh issue)

Issue Type: Book built issue on mainboard

Price Band: ₹210 to ₹222 per share

Lot Size: 67 shares

Minimum Investment: Just under ₹15,000 per lot

Listing Exchange: BSE and NSE

2. Company Overview

Arisinfra Solutions Ltd is a tech-driven B2B platform in the construction materials sector. Founded in 2021 and backed by notable investors including the co-founder of PharmEasy, the company sources and delivers materials such as steel, cement, GI pipes, MS wires, chemicals, aggregates, and electrical goods directly to contractors and developers. Its platform integrates digital procurement, vendor management, quality checks, and financing options. It has served over 2,100 customers across 963 postal codes via a network of more than 1,450 vendors, delivering over 10 million tonnes of materials. The company’s fresh funds are earmarked for repaying debt, supporting working capital, and investing in its subsidiary Buildmex Infra, strengthening its technology and supply chain infrastructure.

3. Grey Market Premium (GMP)

The unofficial grey market shows a premium of around ₹25 over the upper band, reflecting a potential listing gain of about 11 percent. While this indicates strong pre-listing interest, GMP figures can rise or fall quickly and should not be the sole basis for investment decisions.

4. Shariah Compliance Status

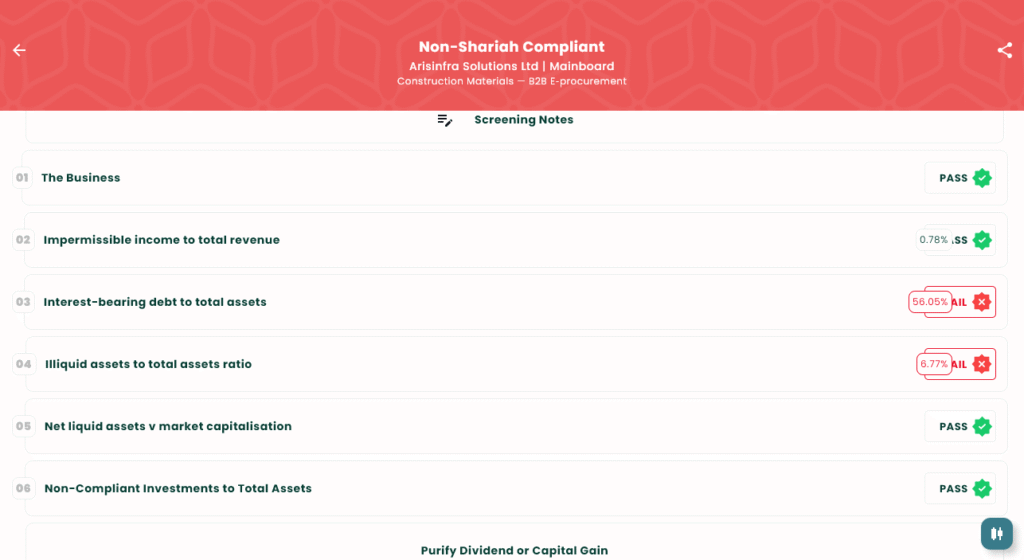

Arisinfra Solutions Ltd is classified as non‑Shariah compliant according to IslamicStock’s screening criteria:

✅ The business activity is halal, but overall failed financial screens.

✅ The impermissible income to total revenue is less than 5 percent.

❌ The interest‑bearing debt to total assets ratio is about 56 percent, exceeding the 33 percent limit.

❌ The illiquid assets to total assets ratio is roughly 6.8 percent, below the 20 percent minimum.

✅ The net liquid assets compared to market capitalisation meet Shariah standards.

✅ The non‑compliant investments to total assets ratio is below 33 percent.

The company fails two key tests: high debt levels and insufficient illiquid asset coverage, making it unsuitable for Shariah-based investors.

5. Subscription Status

As of now, the IPO of Arisinfra Solutions Ltd has not yet opened for subscription. The bidding window is scheduled to begin on June 18, 2025. Investors will be able to subscribe under various categories such as Qualified Institutional Buyers (QIBs), Non-Institutional Investors (NIIs), and Retail Individual Investors (RIIs). The real-time subscription data will be available from the first day of bidding and updated regularly until the close date. Investors are advised to track the daily figures for a better understanding of market demand.

6. Final Thoughts

Arisinfra Solutions is well-positioned with a tech-enabled model aimed at solving procurement issues in the fast-growing construction sector. The industry is expected to expand as infrastructure spending increases in the coming years. A healthy grey market premium and strong subscription reflect investor optimism.

However, two key concerns are its high interest-bearing borrowings and low coverage of illiquid assets, making it a non-compliant Shariah IPO. While the platform is asset-light and digital-first, the elevated debt levels pose financial risk. Profitability is still evolving, with modest recent gains offset by past losses and a high price band.

Overall, conservative investors or those following religious investment guidelines may prefer to wait until financial metrics improve or look at other sectors.

7. Disclaimer

This article is for informational and educational purposes only and does not qualify as financial advice. Investors should consult their financial advisor and review the red herring prospectus before applying. Stock investments carry risk, and past performance does not guarantee future results.