Integrity Infrabuild Developers Ltd IPO: Key Details and Shariah Compliance Status

Integrity Infrabuild Developers Ltd is launching its Initial Public Offering (IPO) on the NSE SME platform. The company is active in the construction industry and has completed several civil works projects for government bodies in Gujarat.

IPO Snapshot

- IPO Code: INTEGRITY

- Issue Type: Fixed Price Issue

- Issue Size: ₹12 crore (12,00,000 equity shares)

- Price per Share: ₹100

- Face Value: ₹10

- Lot Size: 1,200 shares (₹1,20,000 minimum investment)

- IPO Opening Date: May 13, 2025

- IPO Closing Date: May 15, 2025

- Basis of Allotment: May 16, 2025

- Listing Date: May 20, 2025

- Platform: NSE SME

Company Background

The company was started in 2017 and is a registered Class-A contractor with the Government of Gujarat. It focuses on building roads, drains, water supply systems, and other infrastructure works. The company also partners with other firms to handle larger contracts.

As of March 31, 2025, Integrity Infrabuild had completed projects worth ₹4,291 lakhs and had a pending order book of ₹16,307 lakhs.

Grey Market Premium (GMP)

As per market sources, the grey market premium for the IPO is currently ₹0. This means there is no premium being reported over the issue price of ₹100 as of now.

Shariah Compliance Status

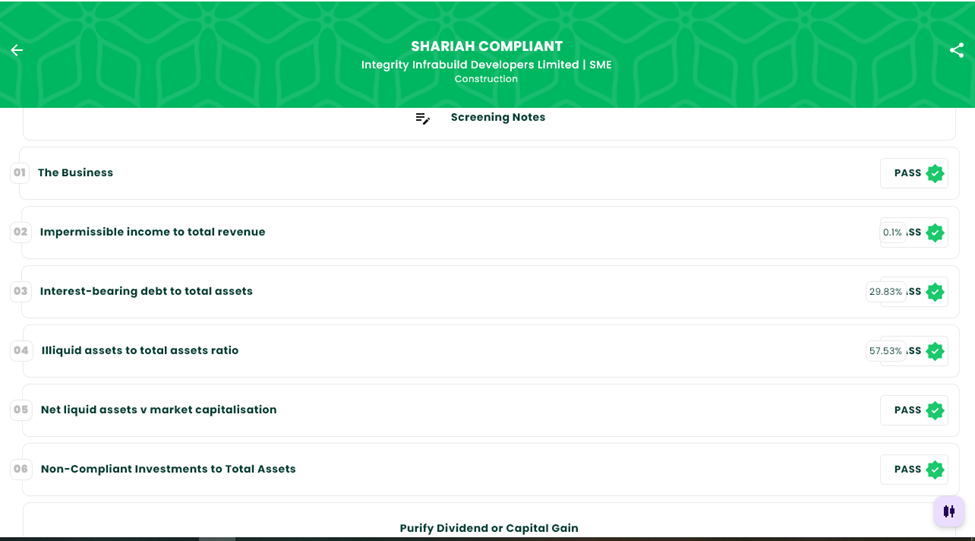

According to IslamicStock, the IPO of Integrity Infrabuild Developers Ltd is Shariah Compliant.

The company has passed all key filters for Shariah-based investing. These include low impermissible income, acceptable levels of debt, and low non-compliant investments. One notable point mentioned in the screening notes is that the unsecured loan of ₹291.08 lakhs from a director or partner is interest-free.

Additionally, as of December 2024, the company showed strong financial health with steady revenue and manageable debt levels.

Final Thoughts

Integrity Infrabuild Developers Ltd’s IPO includes detailed financial information and has also been assessed for ethical investment standards. Based on IslamicStock’s independent review, it meets the financial and business activity filters to be classified as Shariah compliant. This may be useful for investors who take such criteria into account when reviewing IPOs.

As always, prospective investors are encouraged to conduct their own research, read the official prospectus, and consider professional advice before making any decisions.

Disclaimer

This article is for informational purposes only. It does not provide investment advice or a recommendation to buy, sell, or subscribe to any securities. Please consult with a SEBI-registered investment advisor before making any investment decision. The Shariah compliance information is based on publicly available data from IslamicStock and is intended for educational use only.