Accretion Pharmaceuticals Ltd IPO: Key Details and Shariah Compliance Review

Accretion Pharmaceuticals Ltd. is offering its Initial Public Offering (IPO) on the NSE SME platform. The company is involved in the pharmaceutical sector, focusing on bulk drugs and formulations.

IPO Snapshot

- IPO Code: ACCPL

- Issue Type: Bookbuilding IPO

- Issue Size: ₹29.75 crore

- Price per Share: ₹96 to ₹101

- Face Value: ₹10

- Lot Size: 1,200 shares

- IPO Opening Date: May 14, 2025

- IPO Closing Date: May 16, 2025

- Basis of Allotment: May 19, 2025

- Listing Date: May 21, 2025

- Platform: NSE SME

Company Background

Accretion Pharmaceuticals Ltd. is based in India and works in the production of bulk drugs and pharmaceutical formulations. The company is focused on manufacturing various pharmaceutical products used in healthcare and medicines. It is part of a growing industry that supplies essential drugs for both domestic use and exports.

The business is considered to have strong profit margins and stable returns, which often appeals to investors looking at companies with solid operating performance.

Grey Market Premium (GMP)

Based on the latest market information, the grey market premium (GMP) for the ACCPL IPO is currently hovering around ₹20. This suggests a positive investor interest in the shares ahead of the official listing. However, it is important to note that grey market trends are unofficial and can be volatile, as market conditions may change rapidly. Investors should exercise caution and consider all factors before making any investment decisions

Shariah Compliance Status

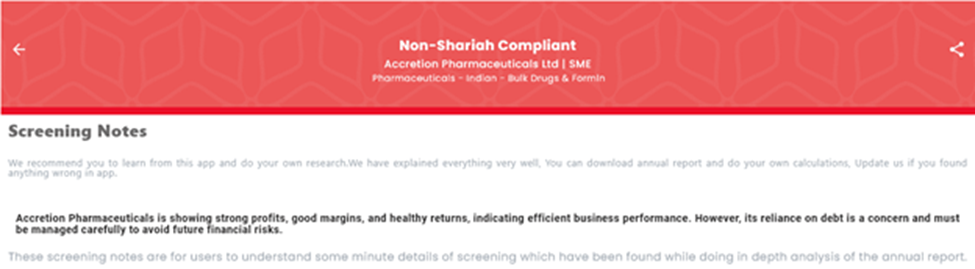

Accretion Pharmaceuticals Ltd. has been reviewed by IslamicStock for its compliance with Shariah investment principles. Based on the screening results, this IPO is marked as non-Shariah compliant.

The main reason for the non-compliant status is the company’s interest-bearing debt. According to the data, the interest-based debt is at 34.48% of total assets, which is above the generally accepted limit of 33% in most Islamic finance frameworks.

Other factors, such as impermissible income and investments, are within acceptable limits, and the company’s core business, i.e., pharmaceuticals, is also considered permissible.

The screening notes mention that the company is showing strong financial performance with good profits and margins. However, it also highlights that the high level of debt may lead to future financial risks if not managed carefully.

Final Thoughts

The IPO of Accretion Pharmaceuticals Ltd. has been evaluated from a financial and ethical investment perspective. As per the independent screening by IslamicStock, the company does not meet all the key conditions required for Shariah compliance, mainly due to its level of debt. This classification may be helpful for investors who review IPOs based on religious or ethical criteria.

As with any financial decision, readers should study the official offer documents, stay updated with verified data, and speak to qualified professionals if needed.

Disclaimer

This article is for informational purposes only. It does not provide investment advice or a recommendation to buy, sell, or subscribe to any securities. Readers are encouraged to consult with a SEBI-registered investment advisor before making any financial decision. The Shariah compliance status is based on publicly available information from IslamicStock and is intended for general educational use.