Borana Weaves Ltd IPO: Key Details and Shariah Compliance Overview

Borana Weaves Ltd, a prominent textile manufacturer based in Surat, Gujarat, is launching its Initial Public Offering (IPO) on the NSE and BSE mainboards. The company specializes in producing high-quality microfilament woven fabrics and has a significant presence in the synthetic textile industry.

- IPO Code: BORANA

- Issue Type: Book Built Issue

- Issue Size: ₹144.89 crore

- Price Band: ₹205 to ₹216 per share

- Face Value: ₹10 per equity share

- Lot Size: 69 shares

- IPO Opening Date: May 20, 2025

- IPO Closing Date: May 22, 2025

- Allotment Date: May 23, 2025

- Listing Date: May 27, 2025

- Listing Platform: NSE and BSE

Company Overview

Established in Surat, Borana Weaves Ltd is among India’s top producers of high-quality microfilament woven fabrics. The company offers a seamless journey from fibre to fabric under one roof, utilizing cutting-edge technologies. With a legacy of 50 years in the textile industry, Borana Weaves has quadrupled its production capacity from 55 to 220 million metres annually between 2021 and 2024. The company prides itself on high productivity standards and superior quality, with 98% of its orders being repeat business, underscoring its commitment to customer satisfaction.

As of May 20, 2025, the Grey Market Premium (GMP) for Borana Weaves Ltd’s IPO is reported to be around ₹55, indicating a potential listing gain of approximately 25% over the upper end of the price band. This suggests a strong investor interest in the company’s shares ahead of its listing.

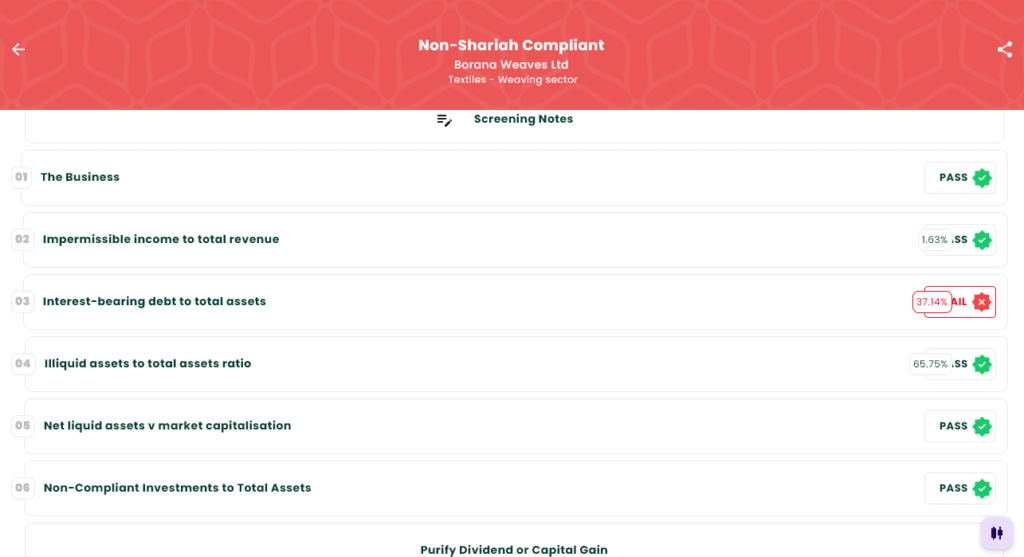

According to IslamicStock, Borana Weaves Ltd’s IPO is classified as “Non-Compliant” concerning Shariah principles. The screening notes indicate that the company fails to meet certain financial criteria essential for Shariah compliance. Specifically, the company’s interest-bearing debt exceeds the permissible threshold, which is a key factor in determining Shariah compliance.

Final Thoughts

Borana Weaves Ltd’s IPO presents an opportunity to invest in a well-established textile manufacturer with a significant market presence and a strong track record of quality and customer satisfaction. However, for investors considering Shariah-compliant investments, it’s important to note that the IPO has been classified as non-compliant due to its financial structure.

As always, prospective investors are encouraged to conduct their own research, read the official prospectus, and consider professional advice before making any decisions.

Disclaimer

This article is for informational purposes only and does not constitute investment advice or a recommendation to buy, sell, or subscribe to any securities. Readers are advised to consult with a SEBI-registered investment advisor before making any investment decisions. The information related to Shariah compliance is based on publicly available sources, including IslamicStock, and is intended solely for educational and general awareness purposes.