Dar Credit & Capital Ltd IPO: Key Details and Shariah Compliance Overview

Dar Credit & Capital Ltd, a Kolkata-based Non-Banking Financial Company (NBFC), is launching its Initial Public Offering (IPO) on the NSE SME platform. The company focuses on providing financial services to underserved segments, including low-income customers in urban, semi-urban, and rural areas.

- IPO Code: DCCL

- Issue Type: Bookbuilding Tyoe

- Issue Size: ₹25.66 crore

- Price Band: ₹57 to ₹60 per share

- Face Value: ₹10 per equity share

- Lot Size: 2,000 shares (₹1,14,000 minimum investment)

- IPO Opening Date: May 21, 2025

- IPO Closing Date: May 23, 2025

- Allotment Date: May 26, 2025

- Listing Date: May 28, 2025

- Listing Platform: NSE SME

Established in 1994, Dar Credit & Capital Ltd is an NBFC registered with the Reserve Bank of India. The company aims to provide professional financial services to low-income customers, improving their quality of life by offering access to credit and other financial products.

As of May 21, 2025, the Grey Market Premium (GMP) for Dar Credit & Capital Ltd’s IPO is reported to be around ₹15, indicating a potential listing gain of approximately 21% over the upper end of the price band.

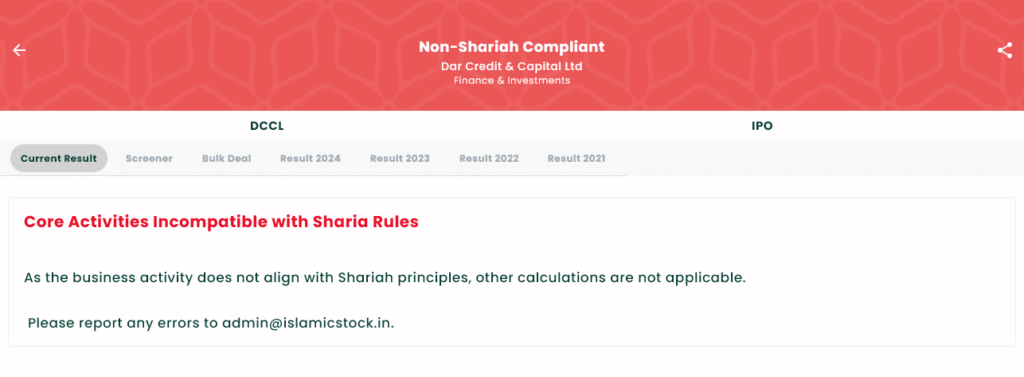

According to IslamicStock, Dar Credit & Capital Ltd’s IPO is classified as “Non-Compliant” concerning Shariah principles. The screening notes indicate that the company fails to meet the initial screening criteria due to its core business activities as an NBFC, which involve interest-based lending. As a result, further financial ratio analysis is not required, and the IPO is deemed non-compliant from a Shariah investment perspective.

Final Thoughts

Dar Credit & Capital Ltd’s IPO offers an opportunity to invest in a company focused on providing financial services to underserved segments of the population. However, for investors considering Shariah-compliant investments, it’s important to note that the IPO has been classified as non-compliant due to the nature of its core business activities.

As always, prospective investors are encouraged to conduct their own research, read the official prospectus, and consider professional advice before making any decisions.

Disclaimer

This article is for informational purposes only and does not constitute investment advice or a recommendation to buy, sell, or subscribe to any securities. Readers are advised to consult with a SEBI-registered investment advisor before making any investment decisions. The information related to Shariah compliance is based on publicly available sources, including IslamicStock, and is intended solely for educational and general awareness purposes.