Table of Contents

1. IPO Snapshot

Symbol: MAYASHEEL

IPO Open Date: June 20, 2025

IPO Close Date: June 24, 2025

IPO Allotment Date: June 25, 2025

IPO Listing Date: June 27, 2025

Issue Size: ₹27.28 Crores

Issue Type: Bookbuilding

Price Band: ₹44 to ₹47 per share

Lot Size: 3000 shares

Minimum Investment: ₹141,000

Listing Exchange: NSE SME

2. Company Overview

Mayasheel Ventures Ltd operates in the infrastructure and construction industry, focusing on delivering diverse and reliable services in its domain. The company emphasizes high-quality standards in all projects, showcasing its expertise in construction. The firm’s robust portfolio demonstrates its ability to manage complex projects effectively. Its SME IPO aims to strengthen financial standing, improve operations, and fuel business growth.

The company has shown steady performance over the years, with strategic initiatives aligning with market demand. Their approach toward innovation and operational efficiency positions them as a promising entity in the infrastructure segment.

3. Grey Market Premium (GMP)

The Grey Market Premium (GMP) gives an early idea of how much interest there is in an IPO and what kind of listing performance investors might expect. As of June 23, 2025, around 5:00 PM, the GMP for Mayasheel Ventures Ltd is ₹5. Although it’s not very high, it does show that there is a stable level of interest from investors. Anyone considering this IPO should follow the GMP trend regularly to get a better sense of possible listing-day gains.

4. Shariah Compliance Status

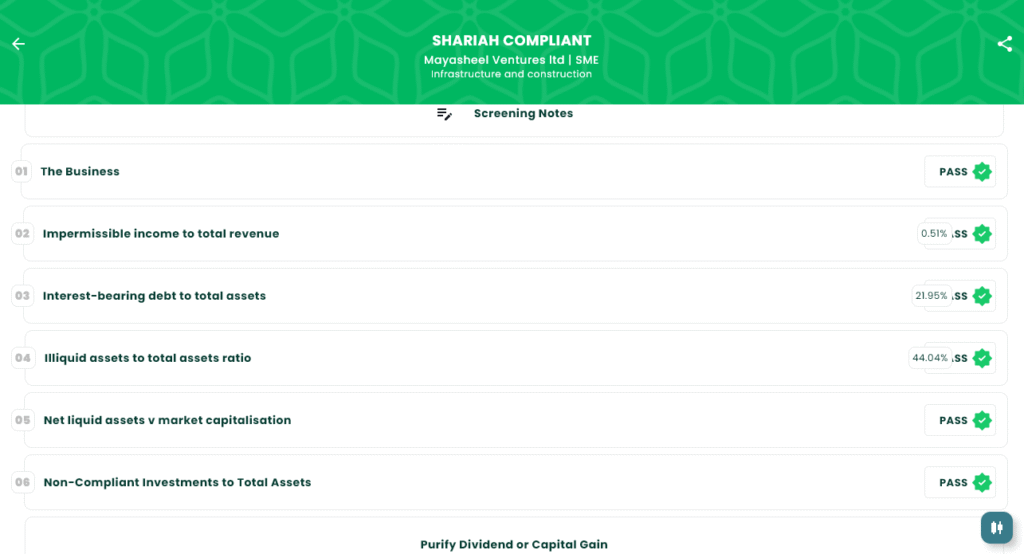

According to the IslamicStock Screener, Mayasheel Ventures Ltd has been marked as Shariah compliant.

✅ The business activity of the company aligns with ethical investing principles as required under Shariah norms.

✅ The impermissible income to total revenue is less than 5 percent.

✅ The interest-bearing debt to total assets is less than 33 percent.

✅ The illiquid assets to total assets ratio is greater than 20%.

✅ The net liquid assets compared to market capitalization is less, which is the requirement for this rule.

✅ The non-compliant investments to total assets have also passed the screening as it’s less than 33%.

An important note to highlight is that an unsecured interest-free loans amounting to ₹1,230.12 lakhs, received from directors and their relatives, have been excluded from total borrowings. This clarification shows transparency in IslamicStock’s screening methodolgy and helps investors make informed decisions. All key financial ratios fall within the Shariah limits, ensuring that the investment is permissible for faith-based investors. The compliance status adds an extra layer of confidence for those who strictly follow Islamic finance principles.

5. Subscription Status

As of June 23, 2025 (Day 2 at aroud 05:00 PM), the Mayasheel Ventures IPO has been subscribed 5.24 times overall. Here’s how the response looks across categories:

- The Qualified Institutional Buyers (QIB) category was subscribed 7 times, though it came from just 2 large applications.

- The Non-Institutional Investors (NII) category saw a 1.68 times subscription with 159 applications.

- The Retail category showed strong interest, subscribed 5.76 times with 3,709 applications.

In total, around 3,870 applications have been received so far, with bids placed for over 2 crore shares against 38.64 lakh shares on offer.

6. Final Thoughts

Mayasheel Ventures Ltd presents an opportunity for investors seeking exposure to the infrastructure and construction industry. Its compliance with Shariah principles, coupled with its focus on operational efficiency and financial growth, enhances its appeal. The IPO offers a chance to invest in a company that is strategically positioned for long-term growth in its sector.

However, investors should remain cautious, analyze the company’s financials thoroughly, and consider market conditions before making any investment decisions.

7. Disclaimer

This article is for informational purposes only and does not constitute investment advice or a recommendation. Please consult with a qualified financial advisor before making any investment decisions. Investing in IPOs is subject to market risk, and past performance is not indicative of future results. Always read the Red Herring Prospectus (RHP) and do your own research before applying.