The Indian IPO market continues to offer a diverse range of opportunities, including those from niche sectors. The upcoming Moving Media Entertainment Ltd IPO is poised to attract attention as it operates within the dynamic media and entertainment industry. This article aims to provide a clear and comprehensive guide for general consumers, industry experts, and potential investors, covering its key details, current subscription trends, Grey Market Premium, and, importantly, its Shariah compliance status.

Understanding the specifics of companies in the media and entertainment sector, along with their financial health and ethical considerations, is crucial for informed investment decisions.

Table of Contents

About Moving Media Entertainment Ltd: Captivating Audiences Through Diverse Content

Moving Media Entertainment Ltd (MMEL) is a player in the media and entertainment industry. The company is likely involved in various aspects of content creation, distribution, and media services. This can encompass activities such as film production, digital content creation, advertising, event management, or other related media ventures. MMEL is well-positioned to adapt to changing market demands and consumer preferences.

In an age dominated by digital consumption and diverse entertainment platforms, companies like Moving Media Entertainment play a role in producing engaging content and delivering unique experiences to audiences across various mediums. Their objective is often to leverage creativity and technology to stay competitive in a fast-evolving sector.

Moving Media Entertainment IPO Snapshot: Key Details You Need to Know

The Moving Media Entertainment Ltd IPO is an NSE SME Bookbuilding issue. Here are its essential details, based on the tentative schedule:

- IPO Open Date: Thursday, June 26, 2025

- IPO Close Date: Monday, June 30, 2025

- Issue Price Band: ₹66 to ₹70 per equity share

- Face Value: ₹10 per share

- Sale Type: Fresh Capital

- Total Issue Size: 62,00,000 shares (aggregating up to ₹43.40 Crore)

- Reserved for Market Maker: 14,98,000 shares (aggregating up to ₹10.49 Crore) for GRETEX Share Broking Private Limited.

- Net Offered to Public: 47,02,000 shares (aggregating up to ₹32.91 Crore)

- Minimum Lot Size for Retail: 2000 Shares (Amount: ₹1,40,000 at upper price band)

- Listing At: NSE SME

- Tentative Allotment: Tuesday, July 1, 2025

- Tentative Listing Date: Thursday, July 3, 2025

- Cut-off time for UPI mandate confirmation: 5 PM on June 30, 2025

(Source: Chittorgarh IPO Details – Moving Media Entertainment IPO)

Crucial Insight: Shariah Status of Moving Media Entertainment Ltd IPO

For investors who prioritize ethical and Shariah-compliant investments, assessing a company’s adherence to Islamic finance principles is paramount. Shariah law sets guidelines for permissible business activities and financial ratios, such as debt levels and impermissible income.

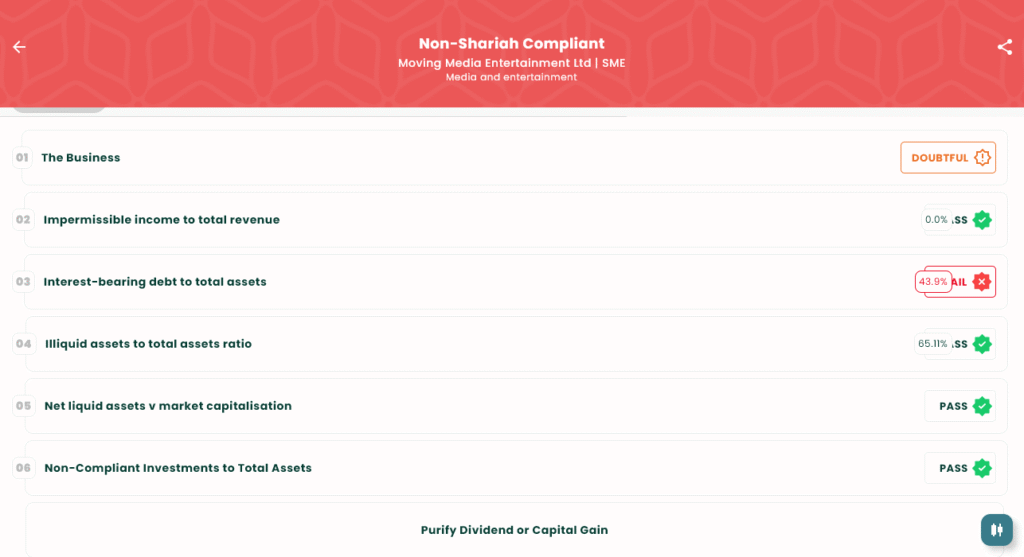

Based on our detailed screening, Moving Media Entertainment Ltd is categorized as “Non-Shariah Compliant.”

As indicated by the screening:

- The Business: Is marked as “DOUBTFUL.” This suggests that even the core business activities might present concerns regarding their alignment with Shariah principles, potentially due to the nature of some media or entertainment content/services.

- Impermissible income to total revenue: Is well within the acceptable limits.

- Interest-bearing debt to total assets: Is 43.9%, which is marked as “FAIL.” This ratio significantly exceeds generally accepted Shariah screening thresholds (33%) for interest-bearing debt, making it a clear reason for non-compliance.

- Illiquid assets to total assets ratio: Is passing the criteria.

- Net liquid assets v market capitalisation & Non-Compliant Investments to Total Assets: Both pass the screening criteria.

The “DOUBTFUL” business activity combined with a high interest-bearing debt ratio are critical factors for users of platforms like our app, IslamicStock, who rely on such detailed screenings for ethical investing.

Understanding IPO Subscription Status

The subscription status of an IPO provides a real-time indication of the demand for the shares from various investor categories: Qualified Institutional Buyers (QIBs), Non-Institutional Investors (NIIs), and Retail Individual Investors (RIIs).

As of June 26, 2025, at around 12:40 PM (Day 1), the Moving Media Entertainment IPO Subscription Status (Bidding Detail) is as follows:

- QIB: 0.00 times subscribed (0 applications)

- NII: 0.28 times subscribed (1,96,000 shares bid by 27 applications)

- Retail: 0.63 times subscribed (10,40,000 shares bid by 520 applications)

- Total: 0.38 times subscribed (547 total applications for 12,36,000 shares bid)

(Source: Chittorgarh IPO Subscription – Moving Media Entertainment)

On Day 1, the IPO is currently undersubscribed across all categories, with retail showing a higher, though still less than full, interest. Monitoring this status daily throughout the bidding period is important to gauge overall investor interest as it progresses.

Grey Market Premium (GMP) Insights

The Grey Market Premium (GMP) is an unofficial, speculative price at which IPO shares trade before their official listing on the stock exchange. It serves as an early, unofficial indicator of market sentiment, reflecting the premium (or discount) over the IPO’s issue price that investors are willing to pay in the unofficial market.

For the Moving Media Entertainment Ltd IPO, the current GMP is:

- Moving Media Entertainment IPO GMP Today (June 26, 2025): ₹15

- Expected Listing Price (Upper Band + GMP): ₹70 (Upper Price Band) + ₹15 (GMP) = ₹85

- Expected % Gain/Loss: (₹15 / ₹70) * 100% = 21.43%

Important Note: GMP is not an official indicator. It is highly speculative, unregulated, and can change drastically based on market news, sentiment, and other factors. It should only be used as a very rough guide and not as a guarantee of listing performance. Investors should always base their decisions on thorough research of the company’s fundamentals, financials, and the overall market.

Making an Informed Investment Decision

Investing in an upcoming IPO requires careful consideration. For the Moving Media Entertainment Ltd IPO, potential investors should review several factors:

- Company Fundamentals: Thoroughly evaluate MMEL’s business model, financial performance, growth strategies, and competitive landscape within the media and entertainment sector.

- Industry Outlook: Assess the prospects of the media and entertainment industry, including evolving consumption patterns, technological advancements, and regulatory environment.

- IPO Valuations: Assess if the IPO price band offers a reasonable valuation compared to its peers and industry growth potential.

- Risk Factors: Understand the specific risks detailed in the company’s Red Herring Prospectus (RHP), particularly those related to content creation, audience engagement, and market competition.

- Shariah Compliance: For investors strictly adhering to Shariah principles, the “Non-Shariah Compliant” status due to both a “DOUBTFUL” business activity and a high interest-bearing debt ratio is a significant factor against investment.

Disclaimer

This article is for informational and educational purposes only and should not be considered financial advice. IPO investments carry inherent risks, and there is no guarantee of returns. Readers are strongly encouraged to conduct their own due diligence, consult with a SEBI-registered financial advisor, and carefully read the Red Herring Prospectus (RHP) before making any investment decisions. The information on Shariah compliance is based on the provided screening and common interpretations of Islamic finance principles, specifically highlighting the doubtful business activity and the debt ratio as reasons for non-compliance.

To learn more about IPOs, detailed company analyses, and Shariah-compliant investment options, visit our website at IslamicStock Website, explore insightful articles on our blog at IslamicStock Blog, and download our application, IslamicStock, for in-depth screenings and investment guidance.