PatelChem Specialities Limited, established in India in 2008, is a GMP & ISO Certified and FDA Approved Manufacturer-Exporter.Their product portfolio includes:

Rheollose® – Carboxymethyl Cellulose Sodium

Disolwell® – Croscarmellose Sodium

BlowTab® – Sodium Starch Glycolate

Swellcal® – Calcium CMC

Hindcel® – Microcrystalline Cellulose

PharLub™ – Magnesium Stearate

AmyloTab™ C – Pregelatinized Starch

Sodium chloro Acetate

They are dedicated to promoting quality products across pharmaceutical, food & beverage, cosmetics, and industrial sectors, with a strong focus on international standards.

Table of Contents

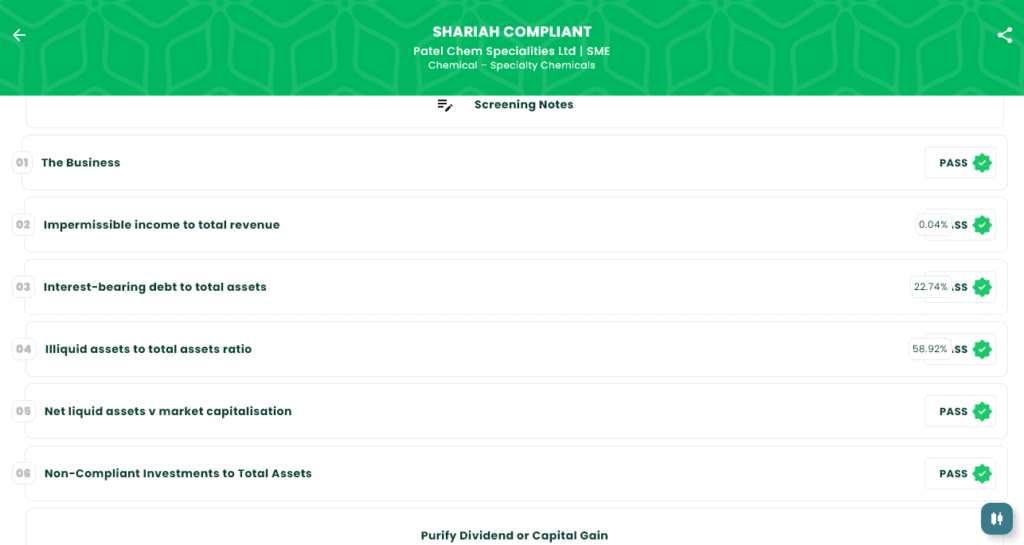

Shariah Status

Based on the our screening method, Patel Chem Specialities Ltd (SME) is deemed Shariah Compliant. This assessment includes:

Note: It is recommended to learn from the IslamicStock app and do your own research. You can download detailed reports and do your own calculations. Update us if you find anything wrong in the app.

Valuable Insights for Users

Patel Chem Specialities Ltd operates with manufacturing plants in Gujarat and exports to over 25 countries across East Asia, Europe, and North America. The company delivered robust performance in FY2024-25, with revenue rising about 28% to ₹105.55 Cr and Profit After Tax (PAT) increasing to ₹10.57 Cr, with margins improving close to 10%. The company also significantly reduced its debt-to-equity ratio from ~0.79x to ~0.42%, demonstrating stronger internal cash flows and a cleaner financial structure. ESG-wise, capacity expansion, export diversification, and a healthy order funnel suggest a stable outlook.

About the Company

Patel Chem Specialities Limited is a recognized leader in manufacturing high-quality pharmaceutical excipients—raw materials crucial for drug formulation. With decades of experience, they specialize in a comprehensive range of excipients, including Sodium Carboxy Methyl Cellulose (Sodium CMC), Sodium Starch Glycolate (SSG), Croscarmellose sodium (CCS), Calcium CMC, Magnesium stearate, pregelatinised starch, and the key API intermediate Sodium Monochloroacetate.

Vision: To be a global leader in providing innovative and high-quality pharmaceutical excipients, ensuring the safety, efficacy, and reliability of drug formulations worldwide. The company is committed to sustainability, continuous improvement, and fostering strong partnerships with clients to help them create products that enhance global quality of life.

Quality First: Prioritizing the highest standards for safety, reliability, and consistency.

Innovation: Continuously improving our processes and products to meet the evolving needs of the pharmaceutical industry.

Customer Focus: Building long-term relationships and providing tailored solutions.

Integrity: Maintaining ethical practices through transparency, honesty, and accountability.

Sustainability: Committed to environmentally sustainable practices, minimizing waste and energy use.

Collaboration: Valuing teamwork, respect, and mutual support for collective success.

Operations: Patel Chem Specialities Limited integrates cutting-edge technology, stringent quality management, and customer-focused service. They boast state-of-the-art manufacturing facilities, rigorous quality control adhering to GMP and ISO standards, and a dedicated R&D team driving innovation. Their efficient supply chain ensures timely delivery, while sustainable practices minimize environmental impact.

Environment: Environmental sustainability is a core principle. The company invests in technologies to minimize energy consumption, reduce emissions, and lower water usage. They have comprehensive waste management systems, prioritize energy efficiency, use eco-friendly packaging, and adhere strictly to environmental regulations. Employee awareness and training further embed their commitment to a positive environmental impact.

Quality Practice: As an ISO Certified Company, Patel Chem Specialities Limited follows stringent quality standards and procedures. This includes rigorous testing of all parameters from raw materials to finished goods as per FDA/Pharma Regulations, maintained and recorded by all employees.

Research and Development: With a full-fledged R&D facility and a team of highly qualified professionals, Patel Chem Specialities Limited focuses on continuous efforts and innovation to deliver the best quality products as per customer requirements, both locally and internationally.

Facts:

Manufacturing plant in a large chemical compound with dedicated departments.

Total Production land: 7000 square yards.

Total manufacturing installed capacity: 3000 MT/year.

Cost reduction achieved in the last two years through continuous product & process improvements.

100% repeat order rate.

Qualified and highly experienced professionals.

High-level qualified expertise performing advanced Research & Development.

Advantages:

Committed to strong technical support during product development and after-sales.

Known for providing customized standards and specifications.

Highly competitive pricing to maintain customer competitiveness.

High flexibility to remain competitive with market volatility.

Offer only quality products & services.

IPO Snapshots

IPO Dates: July 25, 2025 to July 29, 2025

Face Value: ₹10 per share

Issue Price: ₹84 per share

Lot Size: 1,600 Shares

Sale Type: Fresh Capital

Total Issue Size: 70,00,000 shares (aggregating up to ₹58.80 Cr)

Reserved for Market Maker: 3,53,600 shares (aggregating up to ₹2.97 Cr) – Globalworth Securities Limited

Net Offered to Public: 66,46,400 shares (aggregating up to ₹55.83 Cr)

Issue Type: Bookbuilding IPO

Listing At: BSE SME

Share Holding Pre Issue: 1,78,70,000 shares

Share Holding Post Issue: 2,48,70,000 shares

Patel Chem Specialities IPO Timeline (Tentative Schedule

IPO Open Date: Fri, Jul 25, 2025

IPO Close Date: Tue, Jul 29, 2025

Tentative Allotment: Wed, Jul 30, 2025

Initiation of Refunds: Thu, Jul 31, 2025

Credit of Shares to Demat: Thu, Jul 31, 2025

Tentative Listing Date: Fri, Aug 1, 2025

Cut-off time for UPI mandate confirmation: 5 PM on July 29, 2025

IPO Snapshots – Lot Size

Investors can bid for a minimum of 3,200 shares and in multiples of 1,600 shares thereafter.

| Application | Lots | Shares | Amount |

| Individual investors (Retail) (Min) | 2 | 3,200 | ₹2,68,800 |

| Individual investors (Retail) (Max) | 2 | 3,200 | ₹2,68,800 |

| S-HNI (Min) | 3 | 4,800 | ₹4,03,200 |

| S-HNI (Max) | 7 | 11,200 | ₹9,40,800 |

| B-HNI (Min) | 8 | 12,800 | ₹10,75,200 |

Financials

Patel Chem Specialities Ltd.’s revenue increased by 28% and profit after tax (PAT) rose by 38% between the financial year ending March 31, 2025 and March 31, 2024.

| Period Ended | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

| Assets | 65.31 | 46.97 | 37.08 |

| Revenue | 105.55 | 82.72 | 69.75 |

| Profit After Tax | 10.57 | 7.66 | 2.89 |

| EBITDA | 15.80 | 12.02 | 5.83 |

| Net Worth | 35.40 | 19.52 | 11.87 |

| Reserves and Surplus | 17.53 | 18.52 | 10.87 |

KPI

The market capitalization of Patel Chem Specialities IPO is ₹208.91 Cr. KPI as of Mon, Mar 31, 2025.

| KPI | Values |

| ROE | 29.85% |

| ROCE | 36.26% |

| Debt/Equity | 0.42 |

| RoNW | 24.32% |

| PAT Margin | 10.01% |

| EBITDA Margin | 14.97% |

| Price to Book Value | 4.11 |

Objective of the IPO

The Company Patel Chem IPO proposes to utilise the Net Proceeds from the Issue towards the following objects:

- Funding capital expenditure requirement of the Company (₹431.48 Mn)

- General corporate purposes

GMP

The Grey Market Premium (GMP) for Patel Chem Specialities as on 26th July at around 12:30 PM was around ₹45, representing approx 53.57% premium over the issue price.

Ready to invest in Shariah-compliant opportunities? Open your demat account today and explore more.

Open Demat Account:

Angel One: https://angel-one.onelink.me/Wjgr/92znd9xl

Zerodha: https://zerodha.com/?c=NGT561&s=CONSOLE

Visit our Website: https://www.IslamicStock.in

Read our Blog: https://blog.islamicstock.in

Download our App:

Android: https://play.google.com/store/apps/details?id=com.halal.stocks&hl=en_IN

iOS: https://apps.apple.com/in/app/islamicstock-screener-india/id1627541365

SEBI Disclaimer

Investing in IPOs involves risks. Please read the offer document carefully before investing. This article is for informational purposes only and does not constitute financial advice. Investors should consult their financial advisors before making any investment decisions.