Understanding Shariah Compliance in IPOs and Stocks:

Investing wisely is essential for both financial growth and ethical alignment. For those interested in making investments that comply with Islamic law, understanding the Shariah status of Initial Public Offerings (IPOs) and stocks is crucial. This article aims to provide insights into the Shariah compliance of Sellowrap Industries Ltd IPO, ensuring that your investment choices are not only profitable but also ethical.

Table of Contents

What is Shariah Compliance?

Shariah compliance refers to the adherence to Islamic law, which governs various aspects of life, including financial transactions. When it comes to investments, certain criteria must be met to ensure that they are permissible under Shariah law. For example, investments should avoid sectors related to alcohol, gambling, pork, and any form of interest (Riba), etc.

Analyzing Sellowrap Industries Ltd IPO

Company Name: Sellowrap Industries Ltd

Industry: Industrial Products

Listing At: NSE SME

Overview:

Sellowrap Industries Limited (Formerly known as Sellowrap Industries Private Limited) is a manufacturing company, headquartered in Mumbai, specializing in the production of customized components for the automotive and white goods industries. Operating in the B2B sector, we offer both adhesive and non-adhesive processed components, delivering solutions that emphasize quality, cost-efficiency, and maximum customer value.

With more than four decades of experience, the SK Group, comprising Sellowrap Industries Limited (Formerly known as Sellowrap Industries Private Limited), its Promoter Company M/s. Saurabh Marketing Private Limited, its Associate companies M/s. Sellowrap EPP Private Limited & M/s. Prystine Food & Beverages Private Limited and Group Company M/s. Proton Consultancy Services Private Limited has established itself in diverse industries. Our Company, Sellowrap Industries Limited has been serving major Original Equipment Manufacturers (OEMs) in India and abroad, by manufacturing components from a wide range of foam and plastic grades. Under the leadership of Mr. Sushil Kumar Poddar and Mr.Saurabh Poddar, with 32 and 18 years of experience respectively, Sellowrap Industries Limited continues to achieve robust growth by integrating innovation, operational efficiency and a customer-centric approach. For further details with respect to Group Companies.

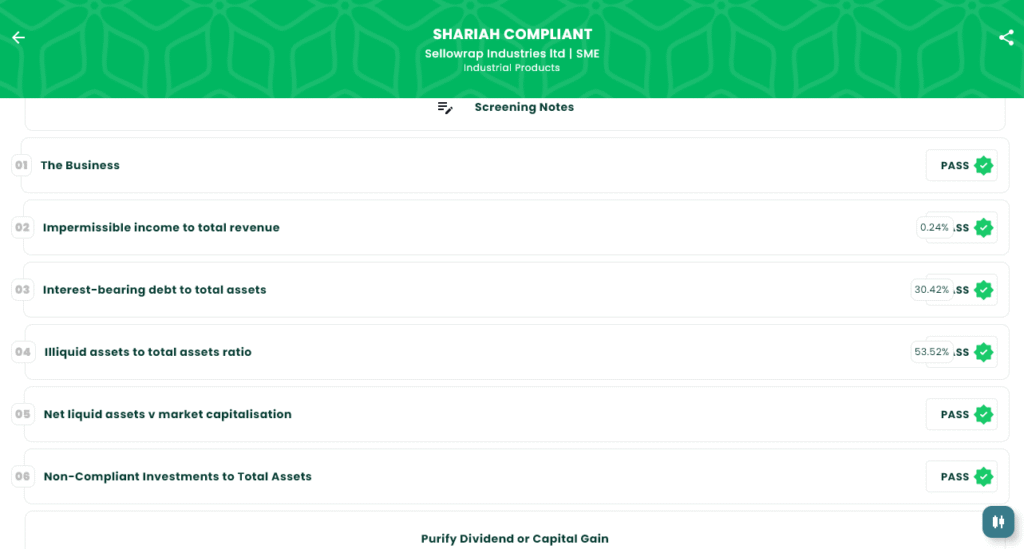

Shariah Status

The IPO is Shariah Compliant, please see below image.

Additional Considerations:

When opting for Shariah-compliant investments, it is essential to regularly check the status in our app. This ensures that the evolving nature of businesses or other financial data does not compromise the compliance status of your investments.

IPO Timeline (Tentative Schedule)

Sellowrap Industries IPO opens on July 25, 2025, and closes on July 29, 2025.

| IPO Open Date | Fri, Jul 25, 2025 |

| IPO Close Date | Tue, Jul 29, 2025 |

| Tentative Allotment | Wed, Jul 30, 2025 |

| Initiation of Refunds | Thu, Jul 31, 2025 |

| Credit of Shares to Demat | Thu, Jul 31, 2025 |

| Tentative Listing Date | Fri, Aug 1, 2025 |

| Cut-off time for UPI mandate confirmation | 5 PM on July 29, 2025 |

Grey Market Premium (GMP)

The Grey Market Premium (GMP) for Sellowrap Industries Ltd IPO is currently ₹18, representing an 21.69% premium over the issue price.

LINKS

Ready to invest in Shariah-compliant opportunities? Explore more at IslamicStock.in & consider opening a demat account from below link!

- Open Demat Account:

- Visit our Website: www.IslamicStock.in

- Read our Blog: blog.islamicstock.in

- Download our App:

SEBI Disclaimer

Investing in IPOs involves risks. Please read the offer document carefully before investing. This article is for informational purposes only and does not constitute financial advice. Investors should consult their financial advisors before making any investment decisions.