Understanding Shariah Compliance in IPOs and Stocks:

Investing wisely is essential for both financial growth and ethical alignment. For those interested in making investments that comply with Islamic law, understanding the Shariah status of Initial Public Offerings (IPOs) and stocks is crucial. This article aims to provide insights into the Shariah compliance of Cash UR Drive Marketing Limited IPO (CASHURDRIVE), ensuring that your investment choices are not only profitable but also ethical.

Table of Contents

What is Shariah Compliance?

Shariah compliance refers to the adherence to Islamic law, which governs various aspects of life, including financial transactions. When it comes to investments, certain criteria must be met to ensure that they are permissible under Shariah law. For example, investments should avoid sectors related to alcohol, gambling, pork, and any form of interest (Riba), etc.

Analyzing Cash UR Drive Marketing Limited IPO (CASHURDRIVE)

Company Name: Cash UR Drive Marketing Limited

Industry: Media

Listing At: NSE SME

Overview:

In 2009, CASHurDRIVE was founded with a visionary idea: to transform everyday commutes into dynamic advertising canvases. The company imagined a world where vehicles could do more than just travel from point A to point B; they could communicate, inspire, and drive brand messages.

CASHurDRIVE has since established itself as a pioneering and leading media advertising company in India, specializing in “branding on wheels.” They cater to transit media, utilizing various vehicles such as cabs, buses, autos, and commercial vehicles as mobile billboards. Their mission is to connect brands with consumers across India by making their business goals a dazzling reality through innovative advertising solutions. CASHurDRIVE operates in the most innovative space for advertising, ensuring brands achieve widespread visibility and engagement.

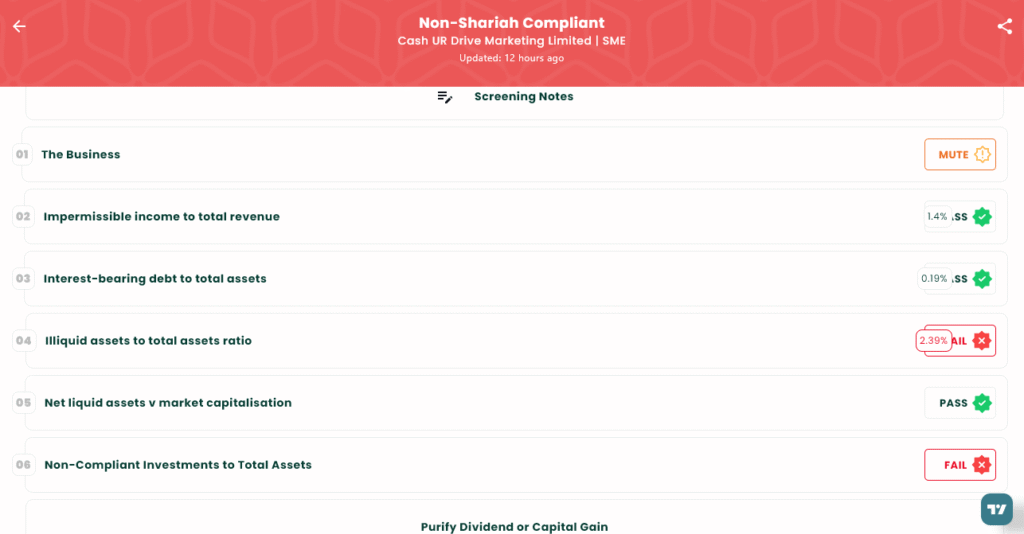

Shariah Status

The IPO is Non-Shariah Compliant, please see below image.

Additional Considerations:

When opting for Shariah-compliant investments, it is essential to regularly check the status in our App. This ensures that the evolving nature of businesses or other financial data does not compromise the compliance status of your investments.

IPO Timeline (Tentative Schedule)

| IPO Open Date | Wed, Jul 31, 2025 |

| IPO Close Date | Fri, Aug 4, 2025 |

| Tentative Allotment | Mon, Aug 5, 2025 |

| Initiation of Refunds | Tue, Aug 6, 2025 |

| Credit of Shares to Demat | Tue, Aug 6, 2025 |

| Tentative Listing Date | Wed, Aug 7, 2025 |

| Cut-off time for UPI mandate confirmation | 5 PM on August 4, 2025 |

Lot Size

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Individual investors (Retail) (Min) | 2 | 2,000 | ₹2,60,000 |

| Individual investors (Retail) (Max) | 2 | 2,000 | ₹2,60,000 |

| S-HNI (Min) | 3 | 3,000 | ₹3,90,000 |

| S-HNI (Max) | 7 | 7,000 | ₹9,10,000 |

| B-HNI (Min) | 8 | 8,000 | ₹10,40,000 |

Financials

The financial performance of Cash Ur Drive Marketing Ltd. for the fiscal years ending March 31, 2025, 2024, and 2023, highlighting significant growth in the most recent period. Notably, between FY2024 and FY2025, the company experienced a 45% increase in revenue and a substantial 92% rise in profit after tax (PAT), indicating robust operational efficiency and profitability. Key financial metrics presented in the table further illustrate this upward trend, with Assets growing from 93.36 to 94.39, Revenue climbing from 97.77 to 142.18, Profit After Tax increasing from 9.22 to 17.68, EBITDA rising from 8.81 to 20.67, Net Worth expanding from 23.59 to 55.98, and Reserves and Surplus growing from 17.59 to 42.80, all figures showing a consistent positive trajectory over the three years.

KPI

| KPI | Values |

|---|---|

| ROE | 44.43% |

| ROCE | 41.55% |

| RoNW | 44.43% |

| PAT Margin | 12.69% |

| EBITDA Margin | 14.84% |

| Price to Book Value | 6.61 |

LINKS

Ready to invest in Shariah-compliant opportunities? Explore more at IslamicStock & consider opening a demat account from the below link!

- Open Demat Account:

- Visit our Website: www.IslamicStock.in

- Read our Blog: blog.islamicstock.in

- Download our App:

SEBI Disclaimer

Investing in IPOs involves risks. Please read the offer document carefully before investing. This article is for informational purposes only and does not constitute financial advice. Investors should consult their financial advisors before making any investment decisions.