Understanding Shariah Compliance in IPOs and Stocks:

Investing wisely is essential for both financial growth and ethical alignment. For those interested in making investments that comply with Islamic law, understanding the Shariah status of Initial Public Offerings (IPOs) and stocks is crucial. This article aims to provide insights into the Shariah compliance of Renol Polychem Ltd (RENOL), ensuring that your investment choices are not only profitable but also ethical.

Table of Contents

What is Shariah Compliance?

Shariah compliance refers to the adherence to Islamic law, which governs various aspects of life, including financial transactions. When it comes to investments, certain criteria must be met to ensure that they are permissible under Shariah law. For example, investments should avoid sectors related to alcohol, gambling, pork, and any form of interest (Riba), etc.

Analyzing Renol Polychem Ltd (RENOL)

Company Name: Renol Polychem Ltd

Industry: Chemicals & Petrochemicals

Listing At: NSE SME

Overview:

Renol Polychem Limited stands as India’s rapidly expanding Masterbatches manufacturer. With extensive experience in the Master Batch Industry, their facility in Rajkot, Gujarat, offers excellent connectivity to India’s capital through robust transport networks and shipping ports, alongside convenient access to raw materials. This strategic location reinforces their position as a highly reliable Masterbatches manufacturer in India.

Their mission, under the brand name ‘Renol Polychem Limited,’ is to be a leading producer of color and additive masterbatches. They are committed to continuous improvement in their products, processes, and services to consistently meet customer needs and foster business prosperity. The company aspires to be the nation’s premier masterbatches manufacturer, capable of fulfilling the competitive demands of their valued customers. Renol Polychem Limited emphasizes that the “how” of achieving their mission and vision is as crucial as the mission and vision themselves, recognizing their people as their core strength and the driving force behind their reputation and vitality. Involvement and teamwork are central to their human values, and their products are seen as a direct reflection of their work culture and ethics.

Customers choose Renol Polychem Limited for their commitment to quality. All masterbatches are produced using state-of-the-art high-torque Co-rotating Twin Screw Extruders. These extruders facilitate a continuous manufacturing process with superior control over production parameters such as feed rate, temperature, and torque. Twin Screw Extruders are renowned for yielding top-quality masterbatches due to their distinct elements for mixing, kneading, and conveying, which ensure consistency and high dispersion efficiency. Furthermore, Renol dedicates each machine to the production of a specific color, allowing for tailored machine and element configurations to achieve the highest loading and best quality for that particular color. This specialized approach results in benefits such as higher output, enhanced control, reduced wastages, and subsequently lower costs, which are ultimately passed on to their customers.

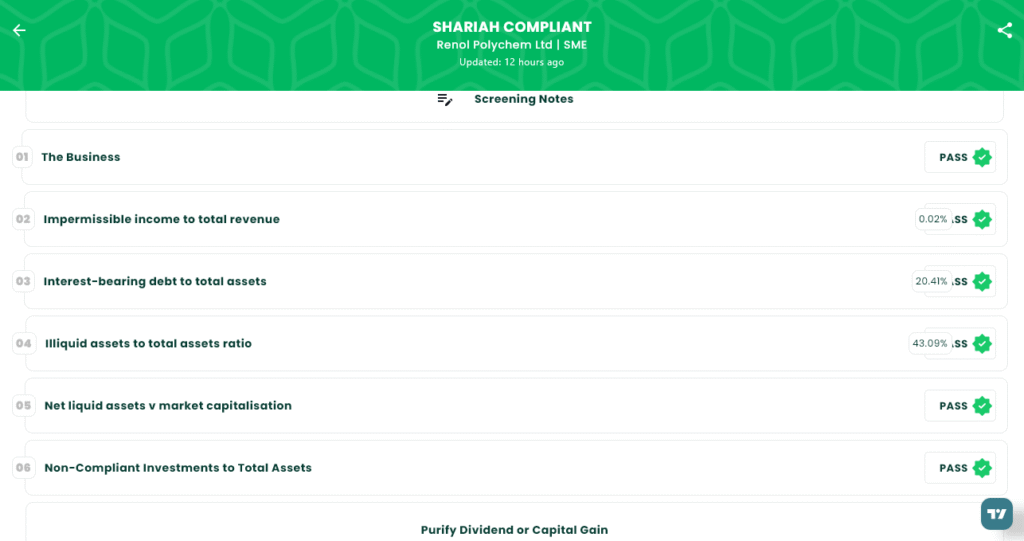

Shariah Status

The IPO is Shariah Compliant, please see below image.

Additional Considerations:

When opting for Shariah-compliant investments, it is essential to regularly check the status in our App. This ensures that the evolving nature of businesses or other financial data does not compromise the compliance status of your investments.

IPO Timeline (Tentative Schedule)

| IPO Open Date | Wed, Jul 31, 2025 |

| IPO Close Date | Fri, Aug 4, 2025 |

| Tentative Allotment | Mon, Aug 5, 2025 |

| Initiation of Refunds | Tue, Aug 6, 2025 |

| Credit of Shares to Demat | Tue, Aug 6, 2025 |

| Tentative Listing Date | Wed, Aug 7, 2025 |

| Cut-off time for UPI mandate confirmation | 5 PM on August 4, 2025 |

Lot Size

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Individual investors (Retail) (Min) | 2 | 2,400 | ₹2,52,000 |

| Individual investors (Retail) (Max) | 2 | 2,400 | ₹2,52,000 |

| S-HNI (Min) | 3 | 3,600 | ₹3,78,000 |

| S-HNI (Max) | 7 | 8,400 | ₹8,82,000 |

| B-HNI (Min) | 8 | 9,600 | ₹10,08,000 |

Financials

Renol Polychem Ltd. demonstrated significant growth between the financial years ending March 31, 2024, and March 31, 2025. The company’s revenue surged by 859%, increasing from ₹6.52 crore to ₹12.02 crore. Concurrently, Profit After Tax (PAT) experienced a substantial rise of 226%, growing from ₹1.53 crore to ₹1.14 crore. This robust performance is also reflected in other key metrics: Assets increased from ₹15.49 crore to ₹25.86 crore, and Net Worth improved from ₹8.69 crore to ₹14.47 crore. Reserves and Surplus also saw healthy growth, indicating a strengthening financial position.

KPI

| KPI | Values |

|---|---|

| ROE | 45.37% |

| ROCE | 64.18% |

| Debt/Equity | 0.52 |

| RoNW | 45.37% |

| PAT Margin | 8.02% |

| EBITDA Margin | 11.36% |

| Price to Book Value | 4.32 |

LINKS

Ready to invest in Shariah-compliant opportunities? Explore more at IslamicStock & consider opening a demat account from the below link!

- Open Demat Account:

- Visit our Website: www.IslamicStock.in

- Read our Blog: blog.islamicstock.in

- Download our App:

SEBI Disclaimer

Investing in IPOs involves risks. Please read the offer document carefully before investing. This article is for informational purposes only and does not constitute financial advice. Investors should consult their financial advisors before making any investment decisions.