Understanding Shariah Compliance in IPOs and Stocks:

Investing wisely is essential for both financial growth and ethical alignment. For those interested in making investments that comply with Islamic law, understanding the Shariah status of Initial Public Offerings (IPOs) and stocks is crucial. This article aims to provide insights into the Shariah compliance of FlySBS Aviation Ltd IPO (FLYSBS), ensuring that your investment choices are not only profitable but also ethical.

Table of Contents

What is Shariah Compliance?

Shariah compliance refers to the adherence to Islamic law, which governs various aspects of life, including financial transactions. When it comes to investments, certain criteria must be met to ensure that they are permissible under Shariah law. For example, investments should avoid sectors related to alcohol, gambling, pork, and any form of interest (Riba), etc.

Analyzing FlySBS Aviation Ltd (FLYSBS)

Company Name: FlySBS Aviation Ltd

Industry: Transport Services

Listing At: NSE SME

Overview:

FlySBS Aviation pioneering in the space of fulfilling the dream of owning the private jet aircraft, giving our customers the choice to experience the wide variety of Private Jets of their choice while paying only for the hours they need. FlySBS Aviation is driven by experienced Industry Professionals and professionals with cross-functional experience with a vision to become the No.1 Private Jet Chartering Company in India.

FlySBS Aviation provides a range of private jet services, including:

- Ultra-Luxury Jets

- Large Luxury Jets

- Super Luxury Jets

- High-Speed Jets

Shariah Status

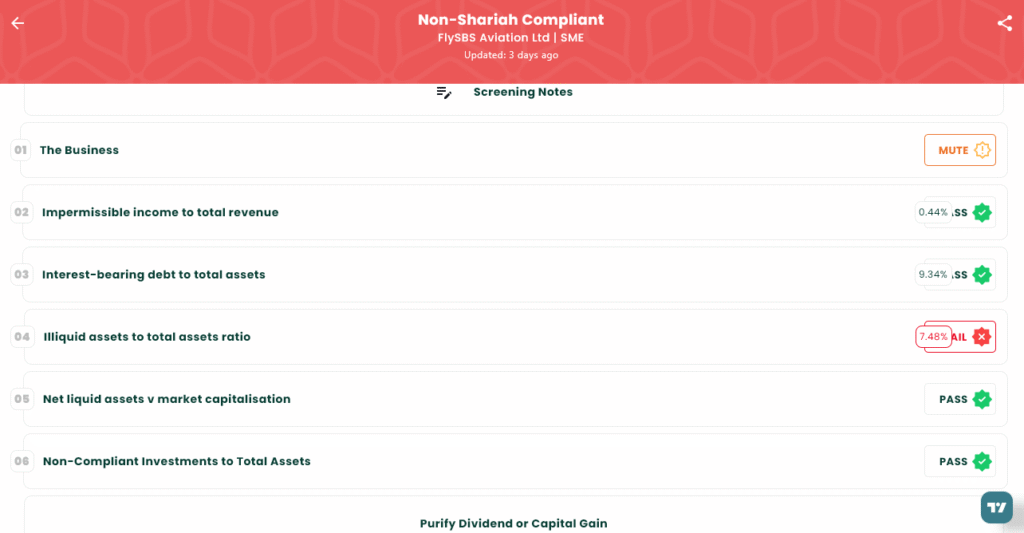

The IPO is Non-Shariah Compliant, please see below image.

Additional Considerations:

When opting for Shariah-compliant investments, it is essential to regularly check the status in our App. This ensures that the evolving nature of businesses or other financial data does not compromise the compliance status of your investments.

IPO Timeline (Tentative Schedule)

| IPO Open Date | Fri, Aug 1, 2025 |

| IPO Close Date | Tue, Aug 5, 2025 |

| Tentative Allotment | Wed, Aug 6, 2025 |

| Initiation of Refunds | Thu, Aug 7, 2025 |

| Credit of Shares to Demat | Thu, Aug 7, 2025 |

| Tentative Listing Date | Fri, Aug 8, 2025 |

| Cut-off time for UPI mandate confirmation | 5 PM on August 5, 2025 |

Lot Size

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Individual investors (Retail) (Min) | 2 | 1,200 | ₹2,70,000 |

| Individual investors (Retail) (Max) | 2 | 1,200 | ₹2,70,000 |

| S-HNI (Min) | 3 | 1,800 | ₹4,05,000 |

| S-HNI (Max) | 7 | 4,200 | ₹9,45,000 |

| B-HNI (Min) | 8 | 4,800 | ₹10,80,000 |

Financials

Based on the financial data for Flysbs Aviation Ltd., the company showed exceptional growth in the financial year ending March 31, 2025. Revenue increased by a remarkable 83%, and profit after tax (PAT) soared by 153%, reflecting strong operational performance. However, this aggressive expansion also comes with some negative points. The company’s total borrowing saw a massive increase, from ₹2.56 crore to ₹17.93 crore, a nearly sevenfold rise. This significant increase in debt could pose a risk, as it makes the company more vulnerable to interest rate fluctuations and may strain its cash flow in the future if not managed effectively. The increase in borrowing is notable, especially when compared to the growth in reserves and surplus.

KPI

| KPI | Values |

|---|---|

| ROE | 32.25% |

| ROCE | 41.80% |

| Debt/Equity | 0.14 |

| RoNW | 32.25% |

| PAT Margin | 14.54% |

| EBITDA Margin | 21.20% |

| Price to Book Value | 2.23 |

LINKS

Ready to invest in Shariah-compliant opportunities? Explore more at IslamicStock & consider opening a demat account from the below link!

- Open Demat Account:

- Visit our Website: www.IslamicStock.in

- Read our Blog: blog.islamicstock.in

- Download our App:

SEBI Disclaimer

Investing in IPOs involves risks. Please read the offer document carefully before investing. This article is for informational purposes only and does not constitute financial advice. Investors should consult their financial advisors before making any investment decisions.