Understanding Shariah Compliance in IPOs and Stocks:

Investing wisely is essential for both financial growth and ethical alignment. For those interested in making investments that comply with Islamic law, understanding the Shariah status of Initial Public Offerings (IPOs) and stocks is crucial. This article aims to provide insights into the Shariah compliance of Mahendra Realtors & Infrastructure Ltd (MRIL), ensuring that your investment choices are not only profitable but also ethical.

Table of Contents

Analyzing The Company

Company Name: Mahendra Realtors & Infrastructure Ltd

Industry: Civil Construction

Listing At: NSE SME

Overview:

Mahendra Realtors & Infrastructure Limited (MRIL), formerly known as Mahendra Realtors & Infrastructure Private Limited, is a prominent construction company based in Mumbai, established in 2007. The company is a leading player in the industry, specializing in turnkey projects and contracting, and has successfully completed over 500 high-quality projects throughout India. MRIL distinguishes itself through its commitment to timely project delivery, the use of modern technologies, and superior craftsmanship.

With extensive experience in the construction field, MRIL is positioned as a top choice for construction services in the country. A search for a “Construction Company in India” often yields MRIL as a leading result. The company’s existing customers have provided positive reviews, affirming that MRIL is one of the best options for various construction services. Additionally, MRIL aims to offer its services at competitive prices, making them accessible to a wider range of clients.

For effective and efficient construction services from one of the best building repairing contractors in India, the company encourages potential clients to explore its high-quality services, which are available at an affordable price. Customers can expect an exceptional experience with the services provided by MRIL.

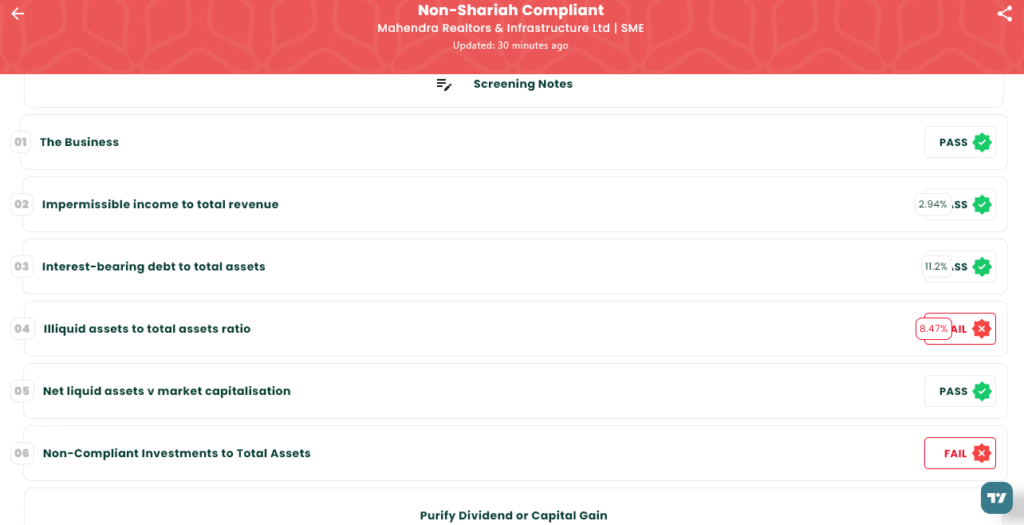

Shariah Status

The IPO is Non-Shariah Compliant, please see below image.

Additional Considerations:

When opting for Shariah-compliant investments, it is essential to regularly check the status in our App. This ensures that the evolving nature of businesses or other financial data does not compromise the compliance status of your investments.

IPO Timeline (Tentative Schedule)

| IPO Open Date | Tue, Aug 12, 2025 |

| IPO Close Date | Thu, Aug 14, 2025 |

| Tentative Allotment | Mon, Aug 18, 2025 |

| Initiation of Refunds | Tue, Aug 19, 2025 |

| Credit of Shares to Demat | Tue, Aug 19, 2025 |

| Tentative Listing Date | Wed, Aug 20, 2025 |

| Cut-off time for UPI mandate confirmation | 5 PM on August 14, 2025 |

Lot Size

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Individual investors (Retail) (Min) | 2 | 3,200 | ₹2,72,000 |

| Individual investors (Retail) (Max) | 2 | 3,200 | ₹2,72,000 |

| S-HNI (Min) | 3 | 4,800 | ₹4,08,000 |

| S-HNI (Max) | 7 | 11,200 | ₹9,52,000 |

| B-HNI (Min) | 8 | 12,800 | ₹10,88,000 |

Financials

A review of the financial data for Mahendra Realtors & Infrastructure Ltd. reveals a concerning picture. While the company’s revenue and profit after tax (PAT) saw an increase, a closer look at the figures raises questions. The provided table shows that despite a rise in assets and total income, the company’s total borrowings have also seen a significant jump, more than a quarter of the reported total. This substantial increase in debt could be a cause for alarm, indicating a potentially precarious financial position despite the positive top-line growth. The reliance on borrowings to fuel expansion may not be sustainable in the long run.

KPI

| KPI | Values |

|---|---|

| ROE | 23.43% |

| ROCE | 30.56 % |

| Debt/Equity | 0.22 |

| RoNW | 23.43% |

| PAT Margin | 11.91% |

| EBITDA Margin | 17.55% |

| Price to Book Value | 2.08 |

LINKS

Ready to invest in Shariah-compliant opportunities? Explore more at IslamicStock & consider opening a demat account from the below link!

- Open Demat Account:

- Visit our Website: www.IslamicStock.in

- Read our Blog: blog.islamicstock.in

- Download our App:

SEBI Disclaimer

Investing in IPOs involves risks. Please read the offer document carefully before investing. This article is for informational purposes only and does not constitute financial advice. Investors should consult their financial advisors before making any investment decisions.