Understanding Shariah Compliance in IPOs and Stocks:

Investing wisely is essential for both financial growth and ethical alignment. For those interested in making investments that comply with Islamic law, understanding the Shariah status of Initial Public Offerings (IPOs) and stocks is crucial. This article aims to provide insights into the Shariah compliance of LGT Business Connextions Ltd, ensuring that your investment choices are not only profitable but also ethical.

Table of Contents

Analyzing The Company

Company Name: LGT Business Connextions Ltd

Industry: Tour, Travel Related Services

Listing At: BSE SME

Overview:

Founded in 2016, LGT Holidays has established itself as a trusted name in the travel and tourism industry. The company is dedicated to crafting unforgettable travel experiences and exceptional events, bringing clients’ visions to life with a commitment to excellence and care.

Its journey is marked by innovation, dedication, and a passion for creating memorable moments. A notable milestone for LGT Holidays is its status as a public limited company, a distinction that sets it apart in the industry. This achievement underscores the company’s commitment to transparency, trust, and upholding the highest standards of service. As a public limited company, LGT Holidays maintains a culture of accountability and excellence, ensuring the trust and satisfaction of its stakeholders.

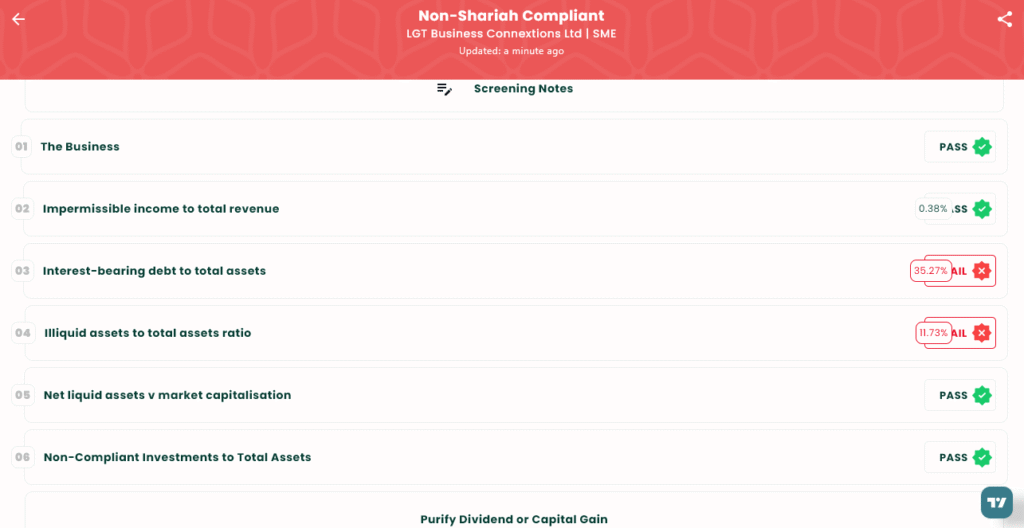

Shariah Status

The IPO is Non-Shariah Compliant, please see below image.

Additional Considerations:

When opting for Shariah-compliant investments, it is essential to regularly check the status in our App. This ensures that the evolving nature of businesses or other financial data does not compromise the compliance status of your investments.

IPO Timeline (Tentative Schedule)

| IPO Open Date | Tue, Aug 19, 2025 |

| IPO Close Date | Thu, Aug 21, 2025 |

| Tentative Allotment | Fri, Aug 22, 2025 |

| Initiation of Refunds | Mon, Aug 25, 2025 |

| Credit of Shares to Demat | Mon, Aug 25, 2025 |

| Tentative Listing Date | Tue, Aug 26, 2025 |

| Cut-off time for UPI mandate confirmation | 5 PM on August 21, 2025 |

Lot Size

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Individual investors (Retail) (Min) | 2 | 2,400 | ₹2,56,800 |

| Individual investors (Retail) (Max) | 2 | 2,400 | ₹2,56,800 |

| HNI (Min) | 3 | 3,600 | ₹3,85,200 |

Financials

Based on the financial overview for the year ending March 31, 2025, the company’s growth appears precarious. While total income and profit after tax saw increases of 12.6% and 43.8% respectively, this growth was fueled by a worrying 240% rise in total borrowings, from ₹2.82 crore to ₹9.58 crore. This significant debt accumulation raises concerns about the sustainability of its expansion.

KPI

| KPI | Values |

|---|---|

| ROE | 41.89% |

| ROCE | 45.19% |

| Debt/Equity | 0.77 |

| RoNW | 41.89% |

| PAT Margin | 5.19% |

| EBITDA Margin | 7.62% |

| Price to Book Value | 6.02 |

LINKS

Ready to invest in Shariah-compliant opportunities? Explore more at IslamicStock & consider opening a demat account from the below link!

- Open Demat Account:

- Visit our Website: www.IslamicStock.in

- Read our Blog: blog.islamicstock.in

- Download our App:

SEBI Disclaimer

Investing in IPOs involves risks. Please read the offer document carefully before investing. This article is for informational purposes only and does not constitute financial advice. Investors should consult their financial advisors before making any investment decisions.