Understanding Shariah Compliance in IPOs and Stocks:

Investing wisely is essential for both financial growth and ethical alignment. For those interested in making investments that comply with Islamic law, understanding the Shariah status of Initial Public Offerings (IPOs) and stocks is crucial. This article aims to provide insights into the Shariah compliance of Current Infraprojects Limited, ensuring that your investment choices are not only profitable but also ethical.

Table of Contents

Analyzing The Company

Company Name: Current Infraprojects Limited

Industry: Civil Construction

Listing At: NSE SME

Overview:

CIPL Group, formerly known as Current Service Consultants, is a leading Engineering, Procurement, and Construction (EPC) company headquartered in Jaipur, Rajasthan. Established in 2000, CIPL has emerged as a trusted force in India’s infrastructure development, combining cutting-edge technology, engineering excellence, and sustainability-first solutions across diverse sectors.

Over the past two decades, CIPL has built a solid foundation in electrical infrastructure development, turnkey EPC projects, and quality-driven execution. The company consistently delivers high-performance outcomes across power transmission, distribution, and large-scale civil and industrial projects. With a strong focus on value engineering and cost-effective delivery, CIPL meets stringent performance, quality, and safety benchmarks.

CIPL is recognized for its growing expertise in Third-Party Quality Monitoring (TPQM), indoor and outdoor electrical testing, and project auditing. These services enhance compliance, ensure reliability, and strengthen its position as a dependable partner for infrastructure excellence. As India transitions toward clean and sustainable energy, CIPL is advancing as a leading solar EPC solutions provider, offering grid-connected and rooftop solar installations that are scalable, efficient, and future-ready.

The company follows globally accepted quality standards including ISO 9001:2015, ECBC, NBC-2005, and ASHRAE. These frameworks guide its commitment to precision, safety, and environmental responsibility across all projects. In March 2025, CIPL transitioned into a Public Limited Company, marking a significant milestone in its growth journey. This move reflects its dedication to transparency, corporate governance, and long-term stakeholder value.

With a forward-looking vision, innovation-led leadership, and a commitment to sustainable engineering, CIPL Group is firmly positioned at the forefront of India’s infrastructure and renewable energy transformation. The company continues to deliver reliable, future-focused solutions that contribute to a smarter and greener nation.

The company aims to leverage its engineering excellence and execution capabilities to deliver scalable, bankable, and high-performance solar solutions. This move aligns with national energy goals and global sustainability benchmarks, while positioning CIPL as a reliable contributor to the renewable energy ecosystem.

Quality remains a non-negotiable priority. CIPL follows rigorous national and international standards including ECBC, NBC-2005, ISO 9001:2015, and ASHRAE, ensuring compliance, safety, and engineering precision across all projects. In March 2025, CIPL transitioned into a Public Limited Company, marking a significant step in its growth journey. This strategic move reflects the company’s commitment to transparency, governance, and long-term value creation for stakeholders. With a clear mission, future-focused leadership, and proven execution capabilities, CIPL Group is strategically positioned to drive transformative growth in India’s infrastructure and renewable energy sectors.

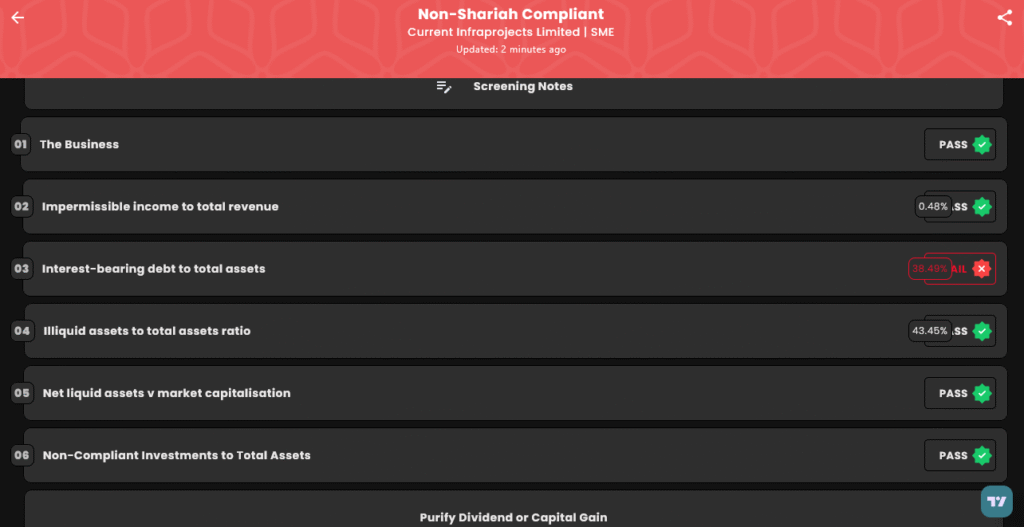

Shariah Status

The IPO is Non-Shariah Compliant, please see below image.

IPO Timeline (Tentative Schedule)

| IPO Open Date | Tue, Aug 26, 2025 |

| IPO Close Date | Fri, Aug 29, 2025 |

| Tentative Allotment | Mon, Sep 1, 2025 |

| Initiation of Refunds | Tue, Sep 2, 2025 |

| Credit of Shares to Demat | Tue, Sep 2, 2025 |

| Tentative Listing Date | Wed, Sep 3, 2025 |

| Cut-off time for UPI mandate confirmation | 5 PM on August 29, 2025 |

Lot Size

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Individual investors (Retail) (Min) | 2 | 3,200 | ₹2,56,000 |

| Individual investors (Retail) (Max) | 2 | 3,200 | ₹2,56,000 |

| S-HNI (Min) | 3 | 4,800 | ₹3,84,000 |

| S-HNI (Max) | 7 | 11,200 | ₹8,96,000 |

| B-HNI (Min) | 8 | 12,800 | ₹10,24,000 |

Financials

For the period ending on March 31, 2025. All monetary figures are in Crore. The company reported Assets of 79.52 Crore and Total Income of 91.33 Crore. The Profit After Tax was 9.45 Crore, while EBITDA stood at 14.75 Crore. The company’s Net Worth was 23.73 Crore, with Reserves and Surplus accounting for 10.23 Crore. Additionally, Total Borrowing was listed at 30.60 Crore.

KPI

| KPI | Values |

|---|---|

| ROE | 49.75% |

| ROCE | 26.49% |

| Debt/Equity | 1.29 |

| RoNW | 39.84% |

| PAT Margin | 10.40% |

| EBITDA Margin | 16.23% |

| Price to Book Value | 4.55 |

LINKS

Ready to invest in Shariah-compliant opportunities? Explore more at IslamicStock & consider opening a demat account from the below link!

- Open Demat Account:

- Visit our Website: www.IslamicStock.in

- Read our Blog: blog.islamicstock.in

- Download our App:

SEBI Disclaimer

Investing in IPOs involves risks. Please read the offer document carefully before investing. This article is for informational purposes only and does not constitute financial advice. Investors should consult their financial advisors before making any investment decisions.