Understanding Shariah Compliance in IPOs and Stocks:

Investing wisely is essential for both financial growth and ethical alignment. For those interested in making investments that comply with Islamic law, understanding the Shariah status of Initial Public Offerings (IPOs) and stocks is crucial. This article aims to provide insights into the Shariah compliance of Anlon Healthcare Limited, ensuring that your investment choices are not only profitable but also ethical.

Table of Contents

Analyzing The Company

Company Name: Anlon Healthcare Limited

Industry: Pharmaceuticals

Listing At: NSE & BSE (Mainboard)

Overview:

Anlon Healthcare, based in Rajkot, is a research-intensive manufacturing unit specializing in pharmaceutical bulk drugs and intermediates. The company has gained global recognition for producing high-quality products that meet the stringent regulatory requirements of leading health authorities, including the FDA, PMDA, KFDA, cGMP, and WHO-GMP.

With strong R&D capabilities, advanced API manufacturing facilities, and a robust product pipeline, Anlon Healthcare positions itself as an ideal partner for API needs. The company offers comprehensive technical and regulatory support throughout the entire production process, from the initial project phase to final production. Its manufacturing facility is equipped with high-precision instruments to ensure quality at every stage.

In response to the competitive pharmaceutical landscape, Anlon Healthcare proactively enhances customer value and business competency by continually upgrading its products to keep pace with the evolving global environment. This strategy, along with a range of high-quality APIs and advanced drug intermediates, has enabled the company to successfully carve out a competitive niche in the market.

Anlon Healthcare’s vision is to leverage technology and research to become a leading global pharmaceutical company that delivers maximum consumer satisfaction. Its mission is to drive efficiency and productivity while delivering tangible results through a compelling, inclusive, and visionary approach to innovation.

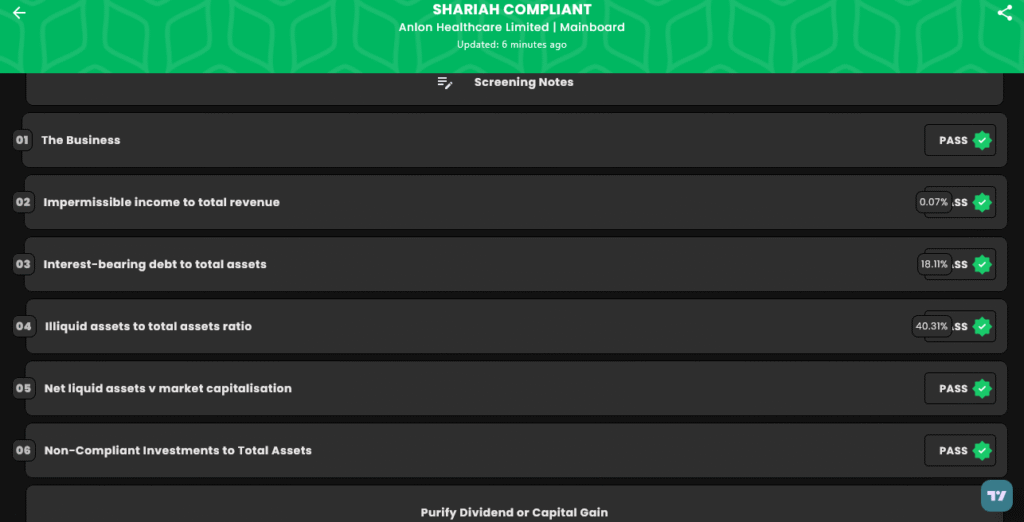

Shariah Status

The IPO is Shariah Compliant, please see below image.

IPO Timeline (Tentative Schedule)

| IPO Open Date | Tue, Aug 26, 2025 |

| IPO Close Date | Fri, Aug 29, 2025 |

| Tentative Allotment | Mon, Sep 1, 2025 |

| Initiation of Refunds | Tue, Sep 2, 2025 |

| Credit of Shares to Demat | Tue, Sep 2, 2025 |

| Tentative Listing Date | Wed, Sep 3, 2025 |

| Cut-off time for UPI mandate confirmation | 5 PM on August 29, 2025 |

Lot Size

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Retail (Min) | 1 | 164 | ₹14,924 |

| Retail (Max) | 13 | 2,132 | ₹1,94,012 |

| S-HNI (Min) | 14 | 2,296 | ₹2,08,936 |

| S-HNI (Max) | 67 | 10,988 | ₹9,99,908 |

| B-HNI (Min) | 68 | 11,152 | ₹10,14,832 |

Financials

Anlon Healthcare Ltd. experienced significant growth between the financial years ending March 31, 2024, and March 31, 2025. The company’s revenue increased by 81%, while its profit after tax (PAT) saw a rise of 112%. The financial data shows that total income grew from ₹66.69 crore in March 2024 to ₹120.46 crore in March 2025. Over the same period, assets increased from ₹128.00 crore to ₹181.30 crore, and profit after tax rose from ₹9.66 crore to ₹20.52 crore. Additionally, EBITDA grew from ₹15.57 crore to ₹32.38 crore, and net worth surged from ₹21.03 crore to ₹80.42 crore. The company’s total borrowings decreased from ₹74.56 crore to ₹58.35 crore, further indicating a stronger financial position.

Additionally, approx. ₹33.72 crore Unsecured Loans are interest free.

KPI

| KPI | Values |

|---|---|

| ROE | 40.45% |

| ROCE | 21.93% |

| Debt/Equity | 0.73 |

| RoNW | 25.51% |

| PAT Margin | 17.06% |

| EBITDA Margin | 26.88% |

| Price to Book Value | 4.51 |

LINKS

Ready to invest in Shariah-compliant opportunities? Explore more at IslamicStock & consider opening a demat account from the below link!

- Open Demat Account:

- Visit our Website: www.IslamicStock.in

- Read our Blog: blog.islamicstock.in

- Download our App:

SEBI Disclaimer

Investing in IPOs involves risks. Please read the offer document carefully before investing. This article is for informational purposes only and does not constitute financial advice. Investors should consult their financial advisors before making any investment decisions.