Understanding Shariah Compliance in IPOs and Stocks:

Investing wisely is essential for both financial growth and ethical alignment. For those interested in making investments that comply with Islamic law, understanding the Shariah status of Initial Public Offerings (IPOs) and stocks is crucial. This article aims to provide insights into the Shariah compliance of Sugs Lloyd Ltd, ensuring that your investment choices are not only profitable but also ethical.

Table of Contents

Analyzing The Company

Company Name: Sugs Lloyd Ltd

Industry: Civil Construction

Listing At: BSE SME

Overview:

Established in 2004, Sugs Lloyd has become a leading engineering and construction company, specializing in various engineering products like Auto Reclosers, Sectionalisers, and Cable Joints.

The company is dedicated to continuous research and development to provide customized solutions to its clients. They have expanded their services to offer complete, turnkey solutions for electrical transmission and distribution projects.

By forming strategic joint ventures, Sugs Lloyd has combined its engineering skills and industry knowledge with other businesses to grow and improve its offerings. The company operates on core values of quality, dependability, and technological innovation. Sugs Lloyd is committed to addressing the challenges of making energy accessible, protecting the environment, and acting responsibly for the future.

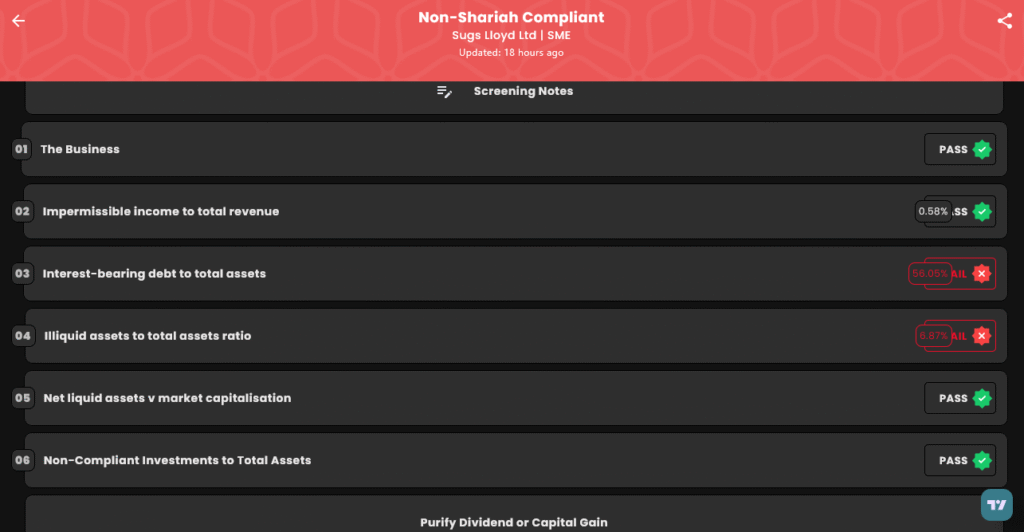

Shariah Status

The IPO is Non-Shariah Compliant, please see below image.

IPO Timeline (Tentative Schedule)

| IPO Open Date | Fri, Aug 29, 2025 |

| IPO Close Date | Tue, Sep 2, 2025 |

| Tentative Allotment | Wed, Sep 3, 2025 |

| Initiation of Refunds | Thu, Sep 4, 2025 |

| Credit of Shares to Demat | Thu, Sep 4, 2025 |

| Tentative Listing Date | Fri, Sep 5, 2025 |

| Cut-off time for UPI mandate confirmation | 5 PM on September 2, 2025 |

Lot Size

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Individual investors (Retail) (Min) | 2 | 2,000 | ₹2,46,000 |

| Individual investors (Retail) (Max) | 2 | 2,000 | ₹2,46,000 |

| S-HNI (Min) | 3 | 3,000 | ₹3,69,000 |

| S-HNI (Max) | 8 | 8,000 | ₹9,84,000 |

| B-HNI (Min) | 9 | 9,000 | ₹11,07,000 |

Financials

Sugs Lloyd Ltd. demonstrated significant financial growth from the financial year ending March 31, 2023, to March 31, 2025. Between 2024 and 2025, the company’s revenue increased by 159%, while profit after tax (PAT) rose by 60%. The data shows a sharp increase in total income, more than tripling from ₹36.36 crore in 2023 to ₹177.87 crore in 2025. Assets also saw a considerable rise, from ₹24.65 crore to ₹133.50 crore over the same period. This trend is mirrored in the company’s net worth, which increased from ₹11.38 crore in 2023 to ₹38.64 crore in 2025. EBITDA also showed robust growth, climbing to ₹25.83 crore from just ₹4.10 crore in 2023. The company’s reserves and surplus increased to ₹22.39 crore from ₹8.13 crore, and total borrowing saw a notable increase to ₹74.83 crore from ₹8.36 crore over the three years.

KPI

| KPI | Values |

|---|---|

| ROE | 55.47% |

| ROCE | 21.58% |

| Debt/Equity | 1.94 |

| RoNW | 43.42% |

| PAT Margin | 9.52% |

| EBITDA Margin | 14.66% |

| Price to Book Value | 9.14 |

LINKS

Ready to invest in Shariah-compliant opportunities? Explore more at IslamicStock & consider opening a demat account from the below link!

- Open Demat Account:

- Visit our Website: www.IslamicStock.in

- Read our Blog: blog.islamicstock.in

- Download our App:

SEBI Disclaimer

Investing in IPOs involves risks. Please read the offer document carefully before investing. This article is for informational purposes only and does not constitute financial advice. Investors should consult their financial advisors before making any investment decisions.