Understanding Shariah Compliance in IPOs and Stocks:

Investing wisely is essential for both financial growth and ethical alignment. For those interested in making investments that comply with Islamic law, understanding the Shariah status of Initial Public Offerings (IPOs) and stocks is crucial. This article aims to provide insights into the Shariah compliance of Jay Ambe Supermarkets Ltd, ensuring that your investment choices are not only profitable but also ethical.

Table of Contents

Analyzing The Company

Company Name: Jay Ambe Supermarkets Ltd

Industry: Diversified Retail

Listing At: BSE SME

Overview:

City Square Mart, a growing retail chain in Gujarat, aims to provide a convenient, affordable, and enjoyable shopping experience. It offers a wide variety of products, including groceries, home goods, clothing, and electronics, all in one place. The company prides itself on catering to the diverse needs of its customers by offering quality products at fair prices through a constant focus on promotions and deals.

With a spacious and well-organized store layout, City Square Mart makes it easy for shoppers to find what they need. Its friendly and knowledgeable staff are always available to help.

The company has served over 6 million customers across its 17 stores throughout Gujarat, with a total retail space of over 96,500 square feet. City Square Mart’s mission is to provide the best shopping experience for daily essentials at a fair price, supported by skilled retail professionals. Its vision is to become a trusted retail brand known for its integrity, quality, and focus on the customer.

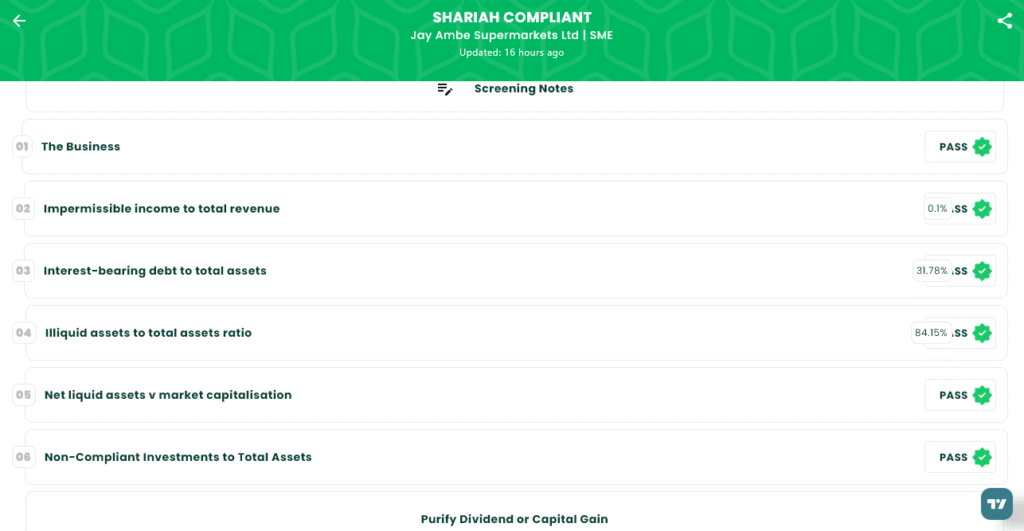

Shariah Status

The IPO is Shariah Compliant, please see below image.

IPO Timeline (Tentative Schedule)

- IPO Open Date: Monday, September 10, 2025

- IPO Close Date: Wednesday, September 12, 2025

- Tentative Allotment: Thursday, September 15, 2025

- Initiation of Refunds: Monday, September 16, 2025

- Credit of Shares to Demat: Monday, September 16, 2025

- Tentative Listing Date: Tuesday, September 17, 2025

- Cut-off time for UPI mandate confirmation: 5 PM on September 12, 2025

Lot Size

| Application | Lots | Shares | Amount |

| Individual investors (Retail) (Min) | 2 | 3,200 | ₹2,49,600 |

| Individual investors (Retail) (Min) | 2 | 3,200 | ₹2,49,600 |

| S-HNI (Min) | 3 | 4,800 | ₹3,74,400 |

| S-HNI (Max) | 8 | 12,800 | ₹9,98,400 |

| B-HNI (Min) | 9 | 14,400 | ₹11,23,200 |

Financials

Based on the financial data, Jay Ambe Supermarkets Ltd. experienced significant growth between the fiscal years ending March 31, 2023, and March 31, 2025. Over this two-year period, the company’s total income increased from ₹32.69 crore in 2023 to ₹47.40 crore in 2025. Profit after tax saw a remarkable increase, jumping from ₹0.35 crore in 2023 to ₹2.75 crore in 2025, while EBITDA also showed strong growth, rising from ₹1.24 crore to ₹4.99 crore. The company’s financial health improved, with its net worth growing from ₹3.09 crore to ₹13.57 crore, driven by a substantial increase in reserves and surplus from ₹1.36 crore to ₹7.06 crore. Assets also expanded significantly from ₹16.79 crore to ₹26.78 crore, demonstrating the company’s growth. While total borrowing increased from ₹7.47 crore to ₹8.71 crore, it appears to be managed in line with the company’s expanding asset base and improved profitability. Overall, the financials indicate a strong trajectory of revenue growth, improved profitability, and a strengthening balance sheet.

KPI

| KPI | Value |

| ROE | 26.07% |

| ROCE | 24.12% |

| Debt/Equity | 0.64 |

| RoNW | 20.29% |

| PAT Margin | 5.82% |

| EBITDA Margin | 10.53% |

| Price to Book Value | 6.20 |

LINKS

Ready to invest in Shariah-compliant opportunities? Explore more at IslamicStock & consider opening a demat account from the below link!

- Open Demat Account:

- Visit our Website: www.IslamicStock.in

- Read our Blog: blog.islamicstock.in

- Download our App:

SEBI Disclaimer

Investing in IPOs involves risks. Please read the offer document carefully before investing. This article is for informational purposes only and does not constitute financial advice. Investors should consult their financial advisors before making any investment decisions.