Understanding Shariah Compliance in IPOs and Stocks:

Investing wisely is essential for both financial growth and ethical alignment. For those interested in making investments that comply with Islamic law, understanding the Shariah status of Initial Public Offerings (IPOs) and stocks is crucial. This article aims to provide insights into the Shariah compliance of Galaxy Medicare Ltd, ensuring that your investment choices are not only profitable but also ethical.

Table of Contents

Analyzing The Company

Company Name: Galaxy Medicare Ltd

Industry: Healthcare

Listing At: NSE SME

Overview:

Galaxy Medicare Limited, a leading manufacturer of medical devices based in Bhubaneswar, India, specializes in producing and exporting a wide range of surgical products. The company, established in 1992, is known for its experienced team and a commitment to customer satisfaction. It holds ISO 9001:2015 and ISO 13485:2016 certifications, which validate its adherence to international quality standards in the manufacturing of surgical dressings, Plaster of Paris (POP) bandages, adhesive tapes, compression bandages, and wound care products.

The company’s operations include manufacturing its own flagship brands like POP BAND and CARETAPE, providing OEM services, fulfilling institutional sales through government tenders, and exporting products to international markets. Galaxy Medicare Limited has a strong market presence with 27 registered trademarks in India. Its products are widely used by government health departments, corporate hospitals, and private entities. With a focus on quality, the company uses premium raw materials sourced from trusted vendors and maintains an in-house Quality Assurance and R&D department. As of March 2025, the company employs 190 people and is recognized for its experienced leadership, strong customer relationships, and a well-established manufacturing facility.

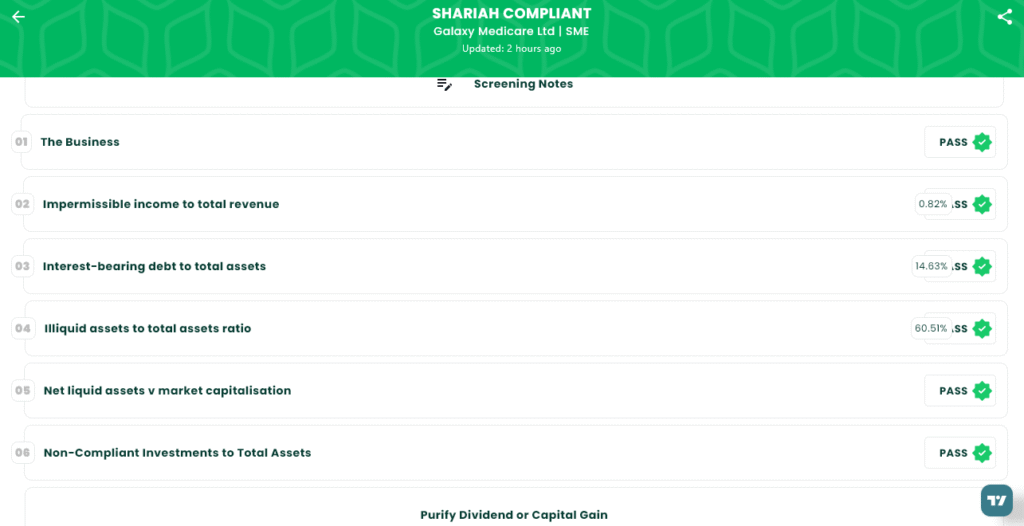

Shariah Status

The IPO is Shariah Compliant, please see below image.

IPO Timeline (Tentative Schedule)

- IPO Open Date: Monday, September 10, 2025

- IPO Close Date: Wednesday, September 12, 2025

- Tentative Allotment: Thursday, September 15, 2025

- Initiation of Refunds: Monday, September 16, 2025

- Credit of Shares to Demat: Monday, September 16, 2025

- Tentative Listing Date: Tuesday, September 17, 2025

- Cut-off time for UPI mandate confirmation: 5 PM on September 12, 2025

Lot Size

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Individual investors (Retail) (Min) | 2 | 4,000 | ₹2,16,000 |

| S-HNI (Min) | 3 | 6,000 | ₹3,24,000 |

| S-HNI (Max) | 9 | 18,000 | ₹9,72,000 |

| B-HNI (Min) | 10 | 20,000 | ₹10,80,000 |

Financials

Based on the financial data for Galaxy Medicare Ltd., the company’s performance for the fiscal year ending March 31, 2025, showed a mixed trend compared to the previous year. Revenue, or Total Income, increased by approximately 9% to ₹40.27 crore, up from ₹36.94 crore in 2024. However, despite the rise in revenue, Profit After Tax (PAT) dropped by 9%, from ₹3.71 crore to ₹3.37 crore. This indicates that while the company’s sales grew, its profitability declined, likely due to a disproportionate increase in expenses. Other key figures also show changes: EBITDA decreased from ₹5.26 crore to ₹4.58 crore, and Total Borrowing was significantly reduced to ₹4.61 crore from ₹8.12 crore in the prior year. The company’s Net Worth also saw an increase, reaching ₹18.36 crore. Overall, the company’s top-line growth didn’t translate into improved bottom-line performance.

KPI

| KPI | Value |

| ROE | 19.88% |

| ROCE | 22.38% |

| Debt/Equity | 0.25 |

| RoNW | 18.35% |

| PAT Margin | 8.60% |

| EBITDA Margin | 11.69% |

| Price to Book Value | 3.49 |

LINKS

Ready to invest in Shariah-compliant opportunities? Explore more at IslamicStock & consider opening a demat account from the below link!

- Open Demat Account:

- Visit our Website: www.IslamicStock.in

- Read our Blog: blog.islamicstock.in

- Download our App:

SEBI Disclaimer

Investing in IPOs involves risks. Please read the offer document carefully before investing. This article is for informational purposes only and does not constitute financial advice. Investors should consult their financial advisors before making any investment decisions.