Understanding Shariah Compliance in IPOs and Stocks:

Investing wisely is essential for both financial growth and ethical alignment. For those interested in making investments that comply with Islamic law, understanding the Shariah status of Initial Public Offerings (IPOs) and stocks is crucial. This article aims to provide insights into the Shariah compliance of Airfloa Rail Technology Ltd, ensuring that your investment choices are not only profitable but also ethical.

Table of Contents

Analyzing The Company

Company Name: Airfloa Rail Technology Ltd

Industry: Railway Wagons

Listing At: BSE SME

Overview:

Airfloa Rail Technology Limited, incorporated in December 1998, is a leading Indian manufacturer and supplier of railway rolling stock equipment and custom-designed products for the transportation industry. The company is certified with ISO and IRIS standards, demonstrating its commitment to quality and management systems.

Airfloa specializes in designing, developing, and manufacturing composite parts for railway vehicles and transportation systems. The company’s products are known for their high reliability and quality, a result of a strong emphasis on engineering, design, and adherence to international standards. Airfloa also maintains a modern in-house R&D division. With two dedicated manufacturing facilities, including a composites division near Chennai, the company has successfully secured and executed major orders from transportation industries despite global competition.

Indian Railways is a major customer for Airfloa, accounting for about 80% of its turnover. The company is a key supplier of high-precision components and turnkey interior projects for prestigious railway projects, including the Vande Bharat Express, the Agra-Kanpur Metro, and the Sri Lankan DEMU. Airfloa also supplies components for various railway units, such as the Integral Coach Factory, MRVC, and Kolkata Metros. Its product range includes a variety of doors (e.g., automatic sliding doors, saloon sliding doors), seats, windows, lighting units, and complete interior furnishing packages in aluminum composite panels.

In addition to the railway sector, Airfloa has expanded its expertise to the aerospace and defense sectors, manufacturing complex and crucial parts for projects like AMCA ground simulators and artillery tank bodies.

The company’s competitive strengths include its robust manufacturing capabilities, which allow it to produce high-quality components for multiple sectors. As a turnkey railway provider, it offers end-to-end solutions that streamline project execution. The company is also supported by advanced machinery, a strong work order book, and an experienced leadership team. With a workforce of 281 employees as of July 31, 2025, Airfloa is well-positioned for continued growth.

The company’s vision is to be a global player in the railway industry, enriching mobility with international standards. Its mission is to continuously provide specialized services in the railway sector while adhering to high standards of quality, health, safety, and environmental norms. Airfloa has achieved several milestones, including being the first Indian company to secure a metro train door project and a pioneer in providing semi-automatic doors for Indian Railways’ LHB coaches. It also supplied automatic doors for India’s flagship Double Decker train and was involved in the interiors of India’s first Air-conditioned EMU and MRVC Phase 2.

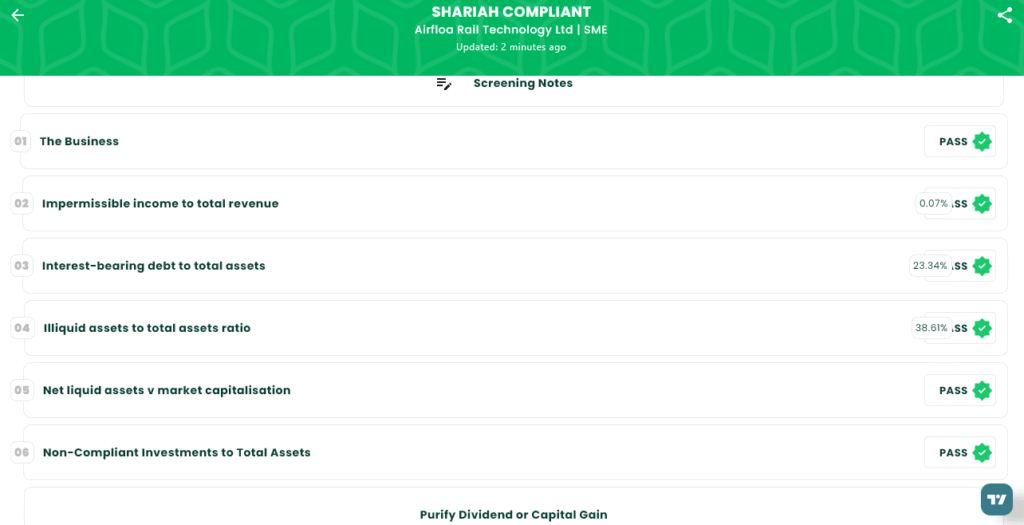

Shariah Status

The IPO is Shariah Compliant, please see below image.

IPO Timeline (Tentative Schedule)

- IPO Open Date: Monday, September 11, 2025

- IPO Close Date: Wednesday, September 15, 2025

- Tentative Allotment: Thursday, September 16, 2025

- Initiation of Refunds: Monday, September 17, 2025

- Credit of Shares to Demat: Monday, September 17, 2025

- Tentative Listing Date: Tuesday, September 18, 2025

- Cut-off time for UPI mandate confirmation: 5 PM on September 15, 2025

Lot Size

| Application Type | Lots | Shares | Amount (₹) |

| Individual investors (Retail) (Min) | 2 | 2,000 | 2,80,000 |

| S-HNI (Min) | 3 | 3,000 | 4,20,000 |

| S-HNI (Max) | 7 | 7,000 | 9,80,000 |

| B-HNI (Min) | 8 | 8,000 | 11,20,000 |

Financials

Based on the financial data, the company has shown a trend of strong growth over the past three years. Assets have consistently increased, from ₹163.89 crore in March 2023 to ₹201.99 crore in March 2024, and further to ₹256.94 crore in March 2025. Total income has also risen significantly each year, reaching ₹192.66 crore by March 2025 from ₹95.33 crore in March 2023. Profitability has shown remarkable improvement, with profit after tax climbing from ₹1.49 crore to ₹14.23 crore, and then to ₹25.55 crore. EBITDA has followed a similar positive trajectory, growing from ₹14.68 crore to ₹34.58 crore, and finally to ₹47.41 crore. The company’s net worth has more than doubled over the period, from ₹41.75 crore to ₹110.80 crore, with a corresponding increase in reserves and surplus. Total borrowing remained relatively stable, with a slight increase from ₹60.22 crore in 2023 to ₹63.80 crore in 2024, before decreasing to ₹59.98 crore in 2025.

KPI

| KPI | Value |

| ROE | 30.64% |

| ROCE | 26.28% |

| Debt/Equity | 0.54 |

| RoNW | 23.06% |

| PAT Margin | 13.28% |

| EBITDA Margin | 24.61% |

| Price to Book Value | 2.19 |

LINKS

Ready to invest in Shariah-compliant opportunities? Explore more at IslamicStock & consider opening a demat account from the below link!

- Open Demat Account:

- Visit our Website: www.IslamicStock.in

- Read our Blog: blog.islamicstock.in

- Download our App:

SEBI Disclaimer

Investing in IPOs involves risks. Please read the offer document carefully before investing. This article is for informational purposes only and does not constitute financial advice. Investors should consult their financial advisors before making any investment decisions.