Understanding Shariah Compliance in IPOs and Stocks:

Investing wisely is essential for both financial growth and ethical alignment. For those interested in making investments that comply with Islamic law, understanding the Shariah status of Initial Public Offerings (IPOs) and stocks is crucial. This article aims to provide insights into the Shariah compliance of Shreeji Global FMCG Ltd, ensuring that your investment choices are not only profitable but also ethical.

Table of Contents

Analyzing The Company

Company Name: Shreeji Global FMCG Ltd

Industry: Food Products

Listing At: NSE (SME)

Corporate Evolution

Shreeji Global FMCG Limited was originally incorporated as “Shreeji Agri Commodity Private Limited” on February 01, 2018, under the Companies Act, 2013, with the Registrar of Companies (ROC), Ahmedabad. The company underwent significant corporate restructuring over the years:

- June 25, 2024: Converted to a public limited company and renamed “Shreeji Agri Commodity Limited”

- January 12, 2025: Name changed to “Shreeji Global FMCG Limited” following shareholder approval

- January 23, 2025: Fresh Certificate of Incorporation issued by ROC, Ahmedabad

Corporate Identification Number (CIN): U51909GJ2018PLC100732

Market Context & Opportunity

India has long been renowned as the land of spices, where spice usage is deeply woven into cultural and culinary heritage. From household kitchens to diverse regional cuisines, unique varieties of spices and blends create distinctive flavors and aromas. Historically, Indian homemakers manually ground and prepared their own spice mixes, reflecting tradition and regional preferences.

Recognizing the strong demand and deep-rooted significance of spices in Indian households and global markets, the company’s promoters identified a valuable opportunity in this sector.

Leadership & Journey

The company’s journey began under the visionary leadership of Jitendra Kakkad and Vivek Kakkad, starting humbly in agri-commodities sourcing and supply, particularly in:

- Coriander

- Groundnut

- Chana

The promoters expanded operations to include processing activities such as cleaning, grading, sorting, and grinding, ensuring higher quality and value addition at every stage.

Current Operations

Core Business Activities

Shreeji Global FMCG is currently engaged in the manufacturing and processing of:

| Product Category | Items |

|---|---|

| Ground & Whole Spices | Coriander powder, red chilli powder, turmeric powder |

| Seeds | Cumin seeds (jeera), coriander seeds, sesame seeds, fennel seeds, kalonji seeds |

| Grains & Pulses | Channa, various pulses |

| Flour Products | Atta and other flour varieties |

| Oilseeds | Groundnut and other varieties |

Brand Portfolio

- Primary Brand: Products marketed under “SHETHJI” brand name

- White Label: Custom products under customer logos

- Dual Market Approach: Serving both retail and bulk segments

Manufacturing Excellence

The company employs a structured manufacturing sequence involving:

- Cleaning – Removing impurities and foreign materials

- Grading – Sorting by quality standards

- Sorting – Categorizing by specifications

- Grinding – Processing into powdered forms

This integrated process flow enables delivery of raw, processed, and value-added agro-products under the company’s own brand, catering to various customer needs in retail and bulk segments.

Infrastructure & Operations

Facilities

- Registered Office: Located in Rajkot

- Manufacturing Units: Two well-equipped manufacturing facilities

- Branch Offices: Strategically located in key APMC markets

Organizational Structure

- In-house sourcing team

- Dedicated domestic sales team

- Marketing & sales team focused on export markets

- Active promoter management with multi-level employee support

Supply Chain & Market Reach

The company serves diverse customer segments including:

- Wholesalers

- Retailers

- Institutional buyers

- Regional distributors

Import Strategy: The company imports certain agri-commodities to meet raw material requirements, supporting efficient supply chain operations.

Digital Transformation & Future Plans

E-commerce Initiative

Shreeji Global FMCG ventured into e-commerce in 2019-20 to reach retail consumers online. While initially secondary to export focus, the company is now exploring strategies to strengthen its digital presence and meet growing online demand.

Forward Integration Plans

- Blended spices development

- Millet-based flours production

- Integrated cold storage facilities for quality maintenance

Strategic Vision

Through an expanded product portfolio including innovative blends and health-focused multigrain flours, the company aims to align with evolving consumer preferences and build a sustainable, future-ready business model.

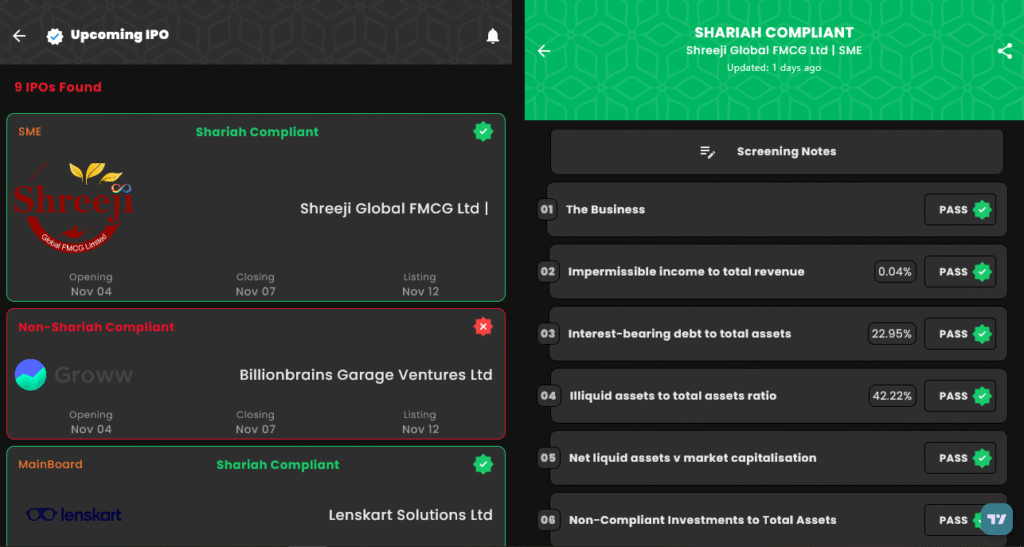

Shariah Status

The IPO is Shariah Compliant, please see below image.

IPO Timeline (Tentative Schedule)

| Event | Date |

|---|---|

| IPO Open Date | Tue, Nov 4, 2025 |

| IPO Close Date | Fri, Nov 7, 2025 |

| Tentative Allotment | Mon, Nov 10, 2025 |

| Initiation of Refunds | Tue, Nov 11, 2025 |

| Credit of Shares to Demat | Tue, Nov 11, 2025 |

| Tentative Listing Date | Wed, Nov 12, 2025 |

| Cut-off time for UPI mandate confirmation | 5 PM on Fri, Nov 7, 2025 |

Lot Size

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Individual investors (Retail) (Min) | 2 | 2,000 | ₹2,50,000 |

| Individual investors (Retail) (Max) | 2 | 2,000 | ₹2,50,000 |

| S-HNI (Min) | 3 | 3,000 | ₹3,75,000 |

| S-HNI (Max) | 8 | 8,000 | ₹10,00,000 |

| B-HNI (Min) | 9 | 9,000 | ₹11,25,000 |

Financials

Shreeji Global FMCG Ltd. reported notable financial improvement, with total income for FY 2024-25 rising to ₹650.85 crore (from ₹588.99 crore in FY 2023-24) and revenue growth of about 11%, while Profit After Tax (PAT) more than doubled, rising 122% year-on-year to ₹12.15 crore; assets expanded to ₹128.76 crore as of 31 Aug 2025, EBITDA increased to ₹20.37 crore for FY 2024-25, net worth strengthened to ₹38.76 crore, reserves and surplus rose to ₹22.80 crore, and total borrowings remained controlled at ₹29.55 crore, reflecting expanded operations, improved operational efficiency, and a healthier balance sheet.

LINKS

Ready to invest in Shariah-compliant opportunities? Explore more at IslamicStock & consider opening a demat account from the below link!

- Open Demat Account:

- Visit our Website: www.IslamicStock.in

- Read our Blog: blog.islamicstock.in

- Download our App:

SEBI Disclaimer

Investing in IPOs involves risks. Please read the offer document carefully before investing. This article is for informational purposes only and does not constitute financial advice. Investors should consult their financial advisors before making any investment decisions.