Understanding Shariah Compliance in IPOs and Stocks:

Investing wisely is essential for both financial growth and ethical alignment. For those interested in making investments that comply with Islamic law, understanding the Shariah status of Initial Public Offerings (IPOs) and stocks is crucial. This article aims to provide insights into the Shariah compliance of Shyam Dhani Industries Ltd, ensuring that your investment choices are not only profitable but also ethical.

Table of Contents

LINKS

Explore Shariah-compliant investment opportunities with IslamicStock.

Before we dive in, consider these links to quickly open your demat account.

Our mobile app links are also available below.

- Open Demat Account:

- Visit our Website: www.IslamicStock.in

- Read our Blog: blog.islamicstock.in

- Download our App:

Analyzing The Company

Company Name: Shyam Dhani Industries Ltd

Industry: FMCG

Listing At: NSE SME

About us:

Established on October 10, 2010, as Shyam Dhani Industries Private Limited in Jaipur, Rajasthan, our journey began with a clear mission: to deliver the highest quality spices across India. In line with our strategic growth and vision for expansion, the status of the company has changed from the “Private Limited” company to the “Public Limited” Company w.e.f; 08th October 2024. Consequent upon such conversion the name of the company has changed from “Shyam Dhani Industries Private Limited” to “Shyam Dhani Industries Limited”

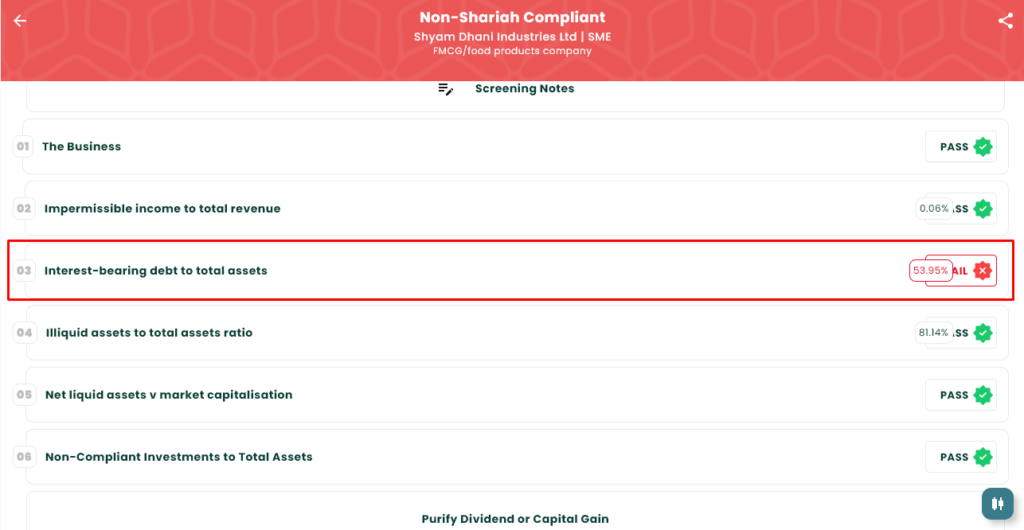

Shariah Status

The IPO is Shariah Non-Compliant, please see below image.

IPO Timeline (Tentative Schedule)

| IPO Open Date | Dec 22, 2025 |

| IPO Close Date | Dec 24, 2025 |

| Tentative Allotment | Dec 26, 2025 |

| Initiation of Refunds | Dec 29, 2025 |

| Credit of Shares to Demat | Dec 29, 2025 |

| Tentative Listing Date | Dec 30, 2025 |

| Cut-off time for UPI mandate confirmation | 5 PM on Dec 24, 2025 |

Financials

Shyam Dhani Industries demonstrates strong growth trajectory across key financial metrics. Between March 31, 2024 and March 31, 2025, revenue increased by 16% while profit after tax (PAT) surged by 28%, indicating improved operational efficiency and profitability.

Key highlights:

- Assets grew from ₹52.84 Cr to ₹88.79 Cr (68% increase)

- NET Worth nearly doubled from ₹15.56 Cr to ₹27.81 Cr

- EBITDA climbed from ₹10.88 Cr to ₹14.52 Cr (33% growth)

- Total Borrowing nearly doubled from ₹24.45 Cr to ₹48.18 Cr

Notable observation: While profitability improved significantly, debt also increased substantially, suggesting the company is leveraging borrowed funds for expansion. The rising reserves (₹14.42 Cr to ₹12.93 Cr in H1 FY26) indicate retained earnings reinvestment.

SEBI Disclaimer

Investing in IPOs involves risks. Please read the offer document carefully before investing. This article is for informational purposes only and does not constitute financial advice. Investors should consult their financial advisors before making any investment decisions.