Understanding Shariah Compliance in IPOs and Stocks:

Investing wisely is essential for both financial growth and ethical alignment. For those interested in making investments that comply with Islamic law, understanding the Shariah status of Initial Public Offerings (IPOs) and stocks is crucial. This article aims to provide insights into the Shariah compliance of Apollo Techno Industries Ltd, ensuring that your investment choices are not only profitable but also ethical.

Table of Contents

LINKS

Explore Shariah-compliant investment opportunities with IslamicStock.

Before we dive in, consider these links to quickly open your demat account.

Our mobile app links are also available below.

- Open Demat Account:

- Visit our Website: www.IslamicStock.in

- Read our Blog: blog.islamicstock.in

- Download our App:

Analyzing The Company

Company Name: Apollo Techno Industries Ltd

Industry: Construction

Listing At: BSE SME

Overview

Apollo Techno Industries Limited Forging a Path of Innovation and Leadership: The Apollo Techno Story

For over four decades, Mr. Rashmikant Patel has been a key figure in transforming the Indian construction equipment manufacturing industry. Mr. Patel is one of the founder promoters of Apollo Group. Under his visionary leadership, Apollo Techno has evolved from a small local business in Mehsana, Gujarat, into a leading player across India and started expanding into the international market.

Mr. Patel has consistently pushed the boundaries of innovation, introducing ground breaking technologies that have changed construction practices nationwide. Notable advancements from Apollo Techno include Horizontal Directional Drilling Rigs, Diaphragm Wall Rigs, and Rotary Drilling Rigs. Each of these innovations marks a significant step forward, improving efficiency and setting high standards for quality in the construction sector.

Mr. Patel’s steadfast commitment to the “Made in India” initiative has significantly reduced the country’s reliance on imported construction equipment. Beyond national borders, Mr. Patel envisions a global presence for Apollo Techno, highlighting India’s technological capabilities on the world stage.

Mr. Parth Rashmikant Patel is now carrying forward Apollo Techno’s ambitious global vision, guided by his father’s mentorship. Together, they are steering the company toward new horizons by harnessing cutting-edge research and development. Their goal is to create innovative products that can compete effectively on the international stage.

With their combined expertise and forward-thinking mindset, they are opening doors to unexplored markets, establishing Apollo Techno as a formidable player in the global construction equipment industry.

As they embark on this exciting new chapter, Mr. Patel legacy of innovation, quality, and visionary leadership continues to shape the future of construction technology, impacting not only India but also markets around the world.

Shariah Status

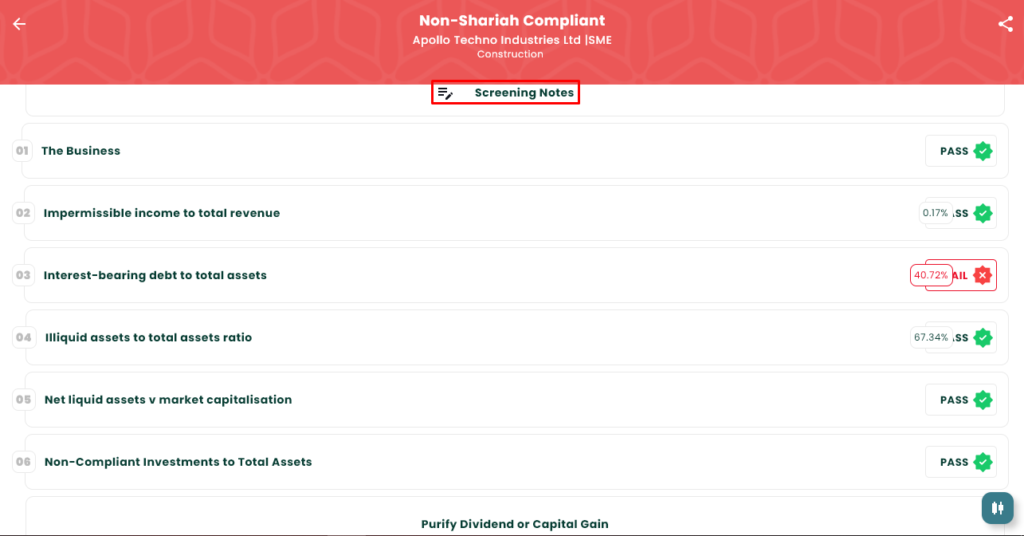

The IPO is Shariah Non-Compliant, please see below image.

IPO Timeline (Tentative Schedule)

| IPO Open Date | Dec 23, 2025 |

| IPO Close Date | Dec 26, 2025 |

| Tentative Allotment | Dec 29, 2025 |

| Initiation of Refunds | Dec 30, 2025 |

| Credit of Shares to Demat | Dec 30, 2025 |

| Tentative Listing Date | Dec 31, 2025 |

| Cut-off time for UPI mandate confirmation | 5 PM on Dec 26, 2025 |

Financials

Apollo Techno Industries delivered strong FY25 results. Revenue rose 44% to ₹99.66 crore from ₹69.28 crore in FY24, while profit after tax jumped 327% to ₹13.79 crore. EBITDA improved to ₹18.15 crore versus ₹7.65 crore, reflecting better operating performance. The balance sheet strengthened: assets increased to ₹76.25 crore (₹67.03 crore in FY24) and net worth more than doubled to ₹25.32 crore from ₹11.57 crore, supported by higher reserves of ₹15.32 crore (₹9.07 crore). Debt reduced to ₹31.75 crore from ₹43.29 crore, lowering leverage. Compared with FY23, revenue was ₹72.57 crore, PAT ₹0.90 crore, and EBITDA ₹2.97 crore, underscoring a clear multi-year turnaround. Early FY26 momentum remains steady: for the quarter ended 30 June 2025, income was ₹24.67 crore, PAT ₹1.08 crore, EBITDA ₹2.07 crore, assets ₹75.06 crore, net worth ₹26.38 crore, and borrowings ₹30.57 crore. Overall, Apollo Techno is growing profitably with improving margins and a healthier capital structure today.

SEBI Disclaimer

Investing in IPOs involves risks. Please read the offer document carefully before investing. This article is for informational purposes only and does not constitute financial advice. Investors should consult their financial advisors before making any investment decisions.