Understanding Shariah Compliance in IPOs and Stocks:

Investing wisely is essential for both financial growth and ethical alignment. For those interested in making investments that comply with Islamic law, understanding the Shariah status of Initial Public Offerings (IPOs) and stocks is crucial. This article aims to provide insights into the Shariah compliance of Gabion Technologies India Ltd, a modern choice for ensuring that your investment choices are not only profitable but also ethical.

Table of Contents

LINKS

Explore Shariah-compliant investment opportunities with IslamicStock.

Before we dive in, consider these links to quickly open your demat account.

Our mobile app links are also available below.

- Open Demat Account:

- Visit our Website: www.IslamicStock.in

- Read our Blog: blog.islamicstock.in

- Download our App:

Analyzing The Company

Company Name: Gabion Technologies India Ltd

Industry: Construction

Listing At: BSE SME

Overview

The company was incorporated in 2008 and started manufacturing steel wire mesh Gabions and providing services and technology in the fields of Geo-systems, Geotechnical Engineering and Ground Improvement Techniques.

The company, based in New Delhi, the capital of the Indian subcontinent, operates with a strong production base in Paonta Saheb, Himachal Pradesh. GTI is a reputable manufacturer specializing in steel wires and gabions, overseeing every aspect of production and distribution to ensure the highest quality standards are met across our operations.

Shariah Status

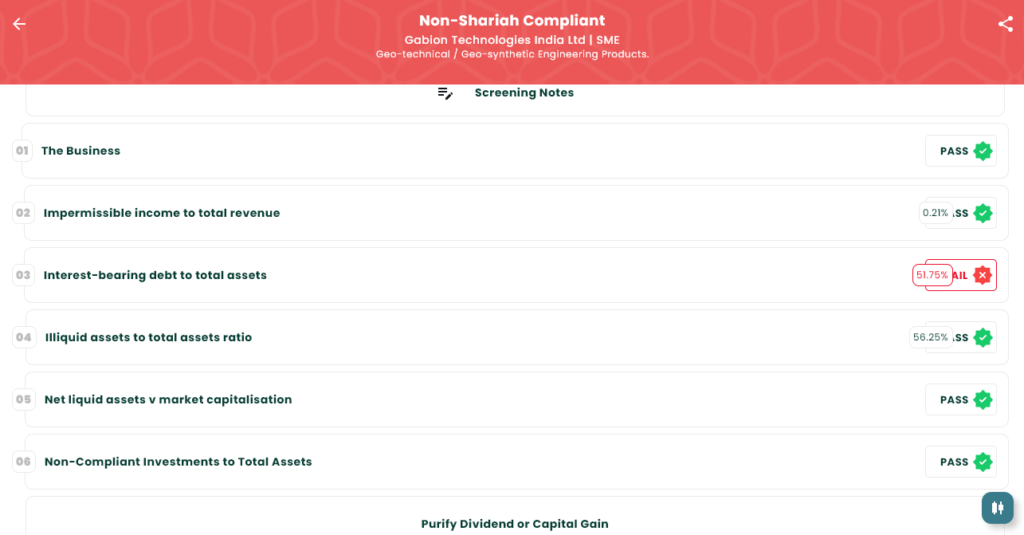

The IPO is Shariah Non-Compliant, please see below image.

IPO Timeline (Tentative Schedule)

| IPO Open Date | Jan 06, 2026 |

| IPO Close Date | Jan 08, 2026 |

| Tentative Allotment | Jan 09, 2026 |

| Initiation of Refunds | Jan 12, 2026 |

| Credit of Shares to Demat | Jan 12, 2026 |

| Tentative Listing Date | Jan 13, 2026 |

Financials

Gabion Technologies India Ltd. showed mixed but generally improving financials. For year ended March 31, 2025, consolidated total income dipped slightly to ₹101.17 crore from ₹104.97 crore a year earlier (≈4% decline), yet profitability strengthened: PAT rose to ₹6.63 crore (FY24: ₹5.82 crore) and EBITDA increased to ₹15.06 crore (FY24: ₹13.16 crore), indicating better margin management. Total assets expanded to ₹87.52 crore (FY24: ₹70.12 crore), while net worth grew to ₹22.03 crore from ₹15.41 crore, reflecting equity accretion. Reserves stood at ₹12.02 crore. However, leverage rose — total borrowings increased to ₹46.71 crore (FY24: ₹36.37 crore), raising financial risk despite net worth gains. Interim numbers to 30 Nov 2025 show continued expansion: assets ₹100.58 crore, income ₹60.66 crore, EBITDA ₹10.76 crore and borrowings ₹52.05 crore. Overall, the company is scaling with improved operating profitability but higher debt levels that warrant monitoring for coverage and liquidity going forward.

SEBI Disclaimer

Investing in IPOs involves risks. Please read the offer document carefully before investing. This article is for informational purposes only and does not constitute financial advice. Investors should consult their financial advisors before making any investment decisions.