Understanding Shariah Compliance in IPOs and Stocks:

Investing wisely is essential for both financial growth and ethical alignment. For those interested in making investments that comply with Islamic law, understanding the Shariah status of Initial Public Offerings (IPOs) and stocks is crucial. This article aims to provide insights into the Shariah compliance of Yajur Fibres Ltd, a modern choice for ensuring that your investment choices are not only profitable but also ethical.

Table of Contents

LINKS

Explore Shariah-compliant investment opportunities with IslamicStock.

Before we dive in, consider these links to quickly open your demat account.

Our mobile app links are also available below.

- Open Demat Account:

- Visit our Website: www.IslamicStock.in

- Read our Blog: blog.islamicstock.in

- Download our App:

Analyzing The Company

Company Name: Yajur Fibres Ltd

Listing At: BSE (SME)

Overview

Yajur Fibres Limited (YFL) operates as a subsidiary of the Kankaria Group, a multi-billion conglomerate employing over 20,000 people across its operations. Based in West Bengal, India, YFL has established itself as one of India’s largest bast fibre processing and cottonising facilities, specializing in the production of cottonised fibres from flax, jute, and hemp materials.

The company demonstrates significant production capabilities, manufacturing over 60 tons of dry spun flax yarn monthly. YFL’s extensive experience and substantial investment in bast fibre processing form the foundation of its premium cottonised fibre offerings. The organization maintains a strong focus on research and development, with a dedicated team responsible for analysis, improvement, and testing processes.

This commitment to innovation and quality has positioned YFL as the preferred supplier for most leading spinning mills across India, Turkey, Indonesia, and Bangladesh. The company operates under 5S principles and maintains best-in-class machinery within a compliant operational environment.

YFL’s dedication to excellence is evidenced through its comprehensive certification portfolio, including ISO 9000 (quality management), ISO 14000 (environmental management), ISO 45000 (occupational health and safety), OEKO-TEX 100 (textile safety), and European Flax certification, demonstrating adherence to international standards across multiple operational aspects.

Shariah Status

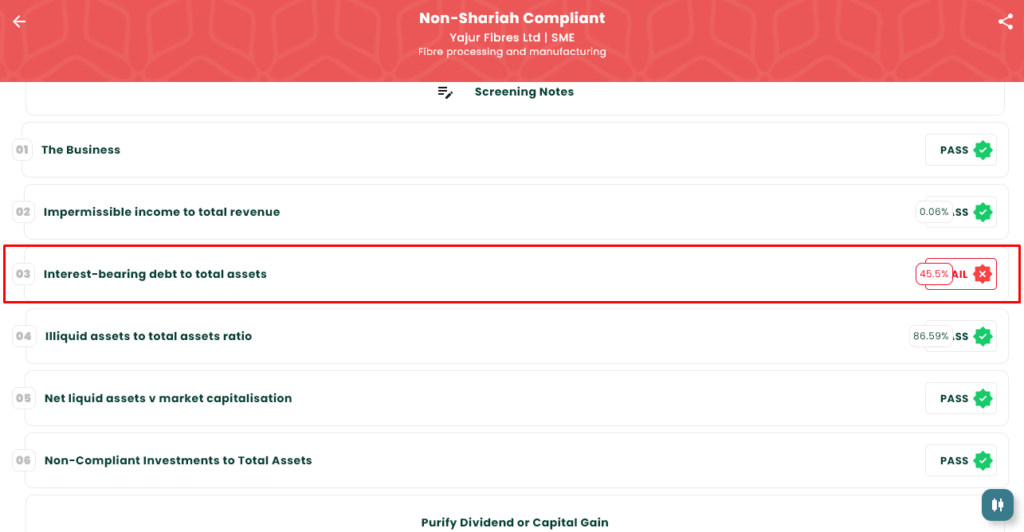

The IPO is Shariah Non-Compliant, please see below image.

IPO Timeline (Tentative Schedule)

| IPO Open Date | Jan 07, 2026 |

| IPO Close Date | Jan 09, 2026 |

| Tentative Allotment | Jan 12, 2026 |

| Initiation of Refunds | Jan 13, 2026 |

| Credit of Shares to Demat | Jan 13, 2026 |

| Tentative Listing Date | Jan 14, 2026 |

Financials

Yajur Fibres Limited’s restated financials through 30 Nov 2025 show clear upward momentum in scale, profitability and balance-sheet strength. Assets nearly doubled from ₹77.76 crore (FY24) to ₹140.73 crore at 31 Mar 2025 and further to ₹161.74 crore as of 30 Nov 2025, indicating recent capital investment or working-capital buildup to support higher volumes. Total income rose from ₹61.84 crore (FY23) to ₹84.85 crore (FY24) and jumped to ₹141.99 crore in FY25, with ₹69.99 crore recorded for the six months to Nov‑25 — a pace consistent with the larger FY25 run-rate.

Operating performance improved markedly: EBITDA climbed from ₹6.68 crore (FY23) to ₹8.01 crore (FY24) and then to ₹18.85 crore (FY25), with a six‑month EBITDA of ₹12.31 crore, showing better margins and operational leverage. PAT followed suit, increasing from ₹3.55 crore (FY23) to ₹4.27 crore (FY24) and ₹11.68 crore (FY25), with ₹7.12 crore in H1 FY26, reflecting stronger bottom‑line conversion.

Net worth expanded from ₹26.41 crore (FY23) to ₹42.32 crore (FY25) and ₹49.44 crore by Nov‑25, supported by rising reserves (₹28.65 → ₹33.44 → ₹40.56 crore). However, leverage also increased: total borrowings rose from ₹34.78 crore (FY23) to ₹66.18 crore (FY25) and ₹73.59 crore (Nov‑25). Overall, YFL is scaling rapidly with improving profitability and equity cushions, but elevated borrowings warrant monitoring of cash flows and debt servicing as the company executes growth plans.

SEBI Disclaimer

Investing in IPOs involves risks. Please read the offer document carefully before investing. This article is for informational purposes only and does not constitute financial advice. Investors should consult their financial advisors before making any investment decisions.