Understanding Shariah Compliance in IPOs and Stocks:

Investing wisely is essential for both financial growth and ethical alignment. For those interested in making investments that comply with Islamic law, understanding the Shariah status of Initial Public Offerings (IPOs) and stocks is crucial. This article aims to provide insights into the Shariah compliance of Avana Electrosystems Ltd, a modern choice for ensuring that your investment choices are not only profitable but also ethical.

Table of Contents

LINKS

Explore Shariah-compliant investment opportunities with IslamicStock.

Before we dive in, consider these links to quickly open your demat account.

Our mobile app links are also available below.

- Open Demat Account:

- Visit our Website: www.IslamicStock.in

- Read our Blog: blog.islamicstock.in

- Download our App:

Analyzing The Company

Company Name: Avana Electrosystems Ltd

Listing At: NSE (SME)

Overview

Avana Electrosystems is one of the reputed manufacturers and solution provider of custom-engineered control & relay panels, Substation automation, Numerical protection relay, Electro mechanical relay & panel accessories for power system applications. The company specializes in the design, engineering, supply of feeder, transformer, busbar, and capacitor bank protection panels rated up to 220kV. Including indoor & outdoor panels, medium & low-voltage panels, and advanced numerical protection relay systems.

Avana Electrosystems operates with state-of-the-art manufacturing facilities and strong engineering capabilities, supported by a qualified and experienced professional team. The company delivers comprehensive end-to-end solutions encompassing detailed engineering, precision manufacturing, rigorous testing, on-site commissioning of protection & control panels, in full compliance with applicable national and international standards.

Avana Electrosystems has established a strong and credible presence across the power sector, with its solutions successfully implemented by utilities, power generation companies, renewable energy projects—including solar, wind and industrial power infrastructure developers. Guided by an unwavering commitment to engineering excellence, quality, reliability and innovation. The company consistently delivers technologically advanced solutions that address the evolving demands of the global power industry.

Shariah Status

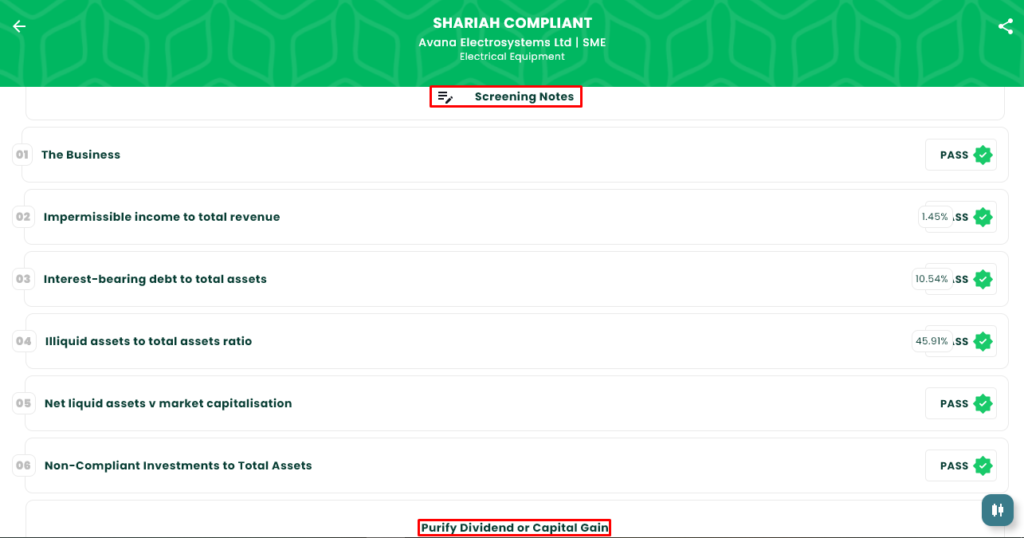

The IPO is Shariah Compliant, please see below image.

IPO Timeline (Tentative Schedule)

| IPO Open Date | Jan 12, 2026 |

| IPO Close Date | Jan 14, 2026 |

| Tentative Allotment | Jan 15, 2026 |

| Initiation of Refunds | Jan 16, 2026 |

| Credit of Shares to Demat | Jan 16, 2026 |

| Tentative Listing Date | Jan 19, 2026 |

Financials

The company’s restated consolidated financials show consistent growth in scale, profitability, and equity over the reported periods. Total assets rose from ₹28.52 crore (FY23) to ₹38.07 crore (FY24) and ₹49.42 crore at 31 Mar 2025, reaching ₹53.91 crore by 30 Sep 2025, indicating continued investment or working-capital expansion. Total income climbed from ₹28.59 crore (FY23) to ₹53.26 crore (FY24) and ₹62.93 crore (FY25), with ₹36.28 crore recorded for the six months to Sep‑25, reflecting a steady revenue trajectory. Operating profitability strengthened: EBITDA increased from ₹1.92 crore (FY23) to ₹7.42 crore (FY24) and ₹12.52 crore (FY25), delivering ₹7.63 crore in H1 FY26 and signalling margin improvement. Profit after tax moved up from ₹0.92 crore (FY23) to ₹4.02 crore (FY24) and ₹8.31 crore (FY25), with ₹5.61 crore in the half year to Sep‑25, showing accelerating bottom-line conversion. Net worth expanded materially from ₹9.46 crore (FY23) to ₹13.49 crore (FY24) and ₹21.80 crore (Mar‑25), reaching ₹27.41 crore by Sep‑25, supported by rising reserves and surplus. Borrowings were moderate: ₹7.33 crore (FY23) to ₹9.27 crore (FY24) then easing to ~₹5.7 crore (Mar/Sep‑25). Overall, the firm demonstrates healthy scaling with improving margins and strengthened equity, while manageable leverage supports near‑term financial stability.

SEBI Disclaimer

Investing in IPOs involves risks. Please read the offer document carefully before investing. This article is for informational purposes only and does not constitute financial advice. Investors should consult their financial advisors before making any investment decisions.