Understanding Shariah Compliance in IPOs and Stocks:

Investing wisely is essential for both financial growth and ethical alignment. For those interested in making investments that comply with Islamic law, understanding the Shariah status of Initial Public Offerings (IPOs) and stocks is crucial. This article aims to provide insights into the Shariah compliance of Shadowfax Technologies Ltd, a modern choice for ensuring that your investment choices are not only profitable but also ethical.

Table of Contents

LINKS

Explore Shariah-compliant investment opportunities with IslamicStock.

Before we dive in, consider these links to quickly open your demat account.

Our mobile app links are also available below.

- Open Demat Account:

- Visit our Website: www.IslamicStock.in

- Read our Blog: blog.islamicstock.in

- Download our App:

Analyzing The Company

Company Name: Shadowfax Technologies Ltd

Listing At: NSE & BSE (Mainboard)

Overview

Shadowfax: India’s Premier Logistics Service Provider

Shadowfax stands as India’s leading logistics service provider, specializing in e-commerce, express parcel, and value-added services. The company has established market leadership through an extensive distribution network covering over 2,300 cities and more than 14,700 PIN codes, leveraging strategic thinking and forward-focused solutions to meet evolving market demands.

Service Excellence & Innovation

Celebrating 10 years of transforming the logistics landscape, Shadowfax continues to lead the industry through speed, agility, innovation, and service excellence. The company’s versatility spans lightning-fast intracity deliveries to same-day fulfillment, supported by tech-driven AI solutions including SF Maps and SF Shield, which deliver exceptional value and establish new industry benchmarks. With relentless focus on operational efficiency and intelligent automation, Shadowfax has become the preferred logistics partner for India’s top e-commerce and hyperlocal brands.

Vision & Mission

Shadowfax’s vision is to enable seamless commerce by empowering lives through technology-driven logistics services, creating opportunities for everyone, everywhere, across India. This forward-thinking approach positions the company at the forefront of logistics innovation.

The company’s mission focuses on building the fastest and most reliable logistics network by empowering a million micro-entrepreneurs through technology to deliver anything, anywhere. This commitment reflects Shadowfax’s dedication to democratizing logistics access and fostering entrepreneurial growth across India’s diverse markets, shaping the future of logistics operations nationwide.

Shariah Status

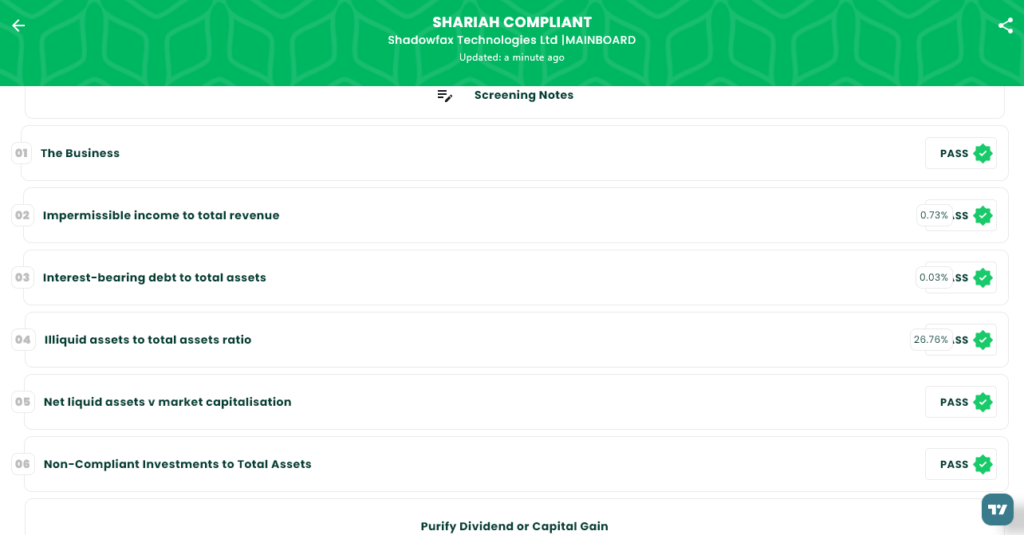

The IPO is Shariah Compliant, please see below image.

IPO Timeline (Tentative Schedule)

| IPO Open Date | Jan 20, 2026 |

| IPO Close Date | Jan 22, 2026 |

| Tentative Allotment | Jan 23, 2026 |

| Initiation of Refunds | Jan 27, 2026 |

| Credit of Shares to Demat | Jan 27, 2026 |

| Tentative Listing Date | Jan 28, 2026 |

Financials

Shadowfax’s consolidated financials show strong growth and a return to profitability for the periods ending 31 Mar 2023 through 30 Sep 2025 (amounts in ₹ crore). Total assets rose sharply from ₹442.73 crore (Mar 2023) to ₹1,453.16 crore (Sep 2025), reflecting rapid expansion. Total income increased from ₹1,422.89 crore (Mar 2023) to ₹1,819.80 crore (Sep 2025), peaking at ₹2,514.66 crore in Mar 2025. After earlier large losses (PAT –₹142.64 crore in Mar 2023 and –₹11.88 crore in Mar 2024), the company returned to profit with PAT of ₹6.06 crore (Mar 2025) and ₹21.04 crore (Sep 2025). EBITDA improved dramatically from negative ₹113.47 crore (Mar 2023) to positive ₹64.34 crore (Sep 2025), indicating stronger operating performance and margin recovery. Net worth expanded from ₹176.32 crore to ₹693.53 crore, supported by rising reserves and surplus (₹171.20 crore to ₹281.26 crore). Total borrowing increased to ₹147.44 crore (Sep 2025) but remains proportionate to growth. Overall, Shadowfax shows improving profitability, healthier operating cash generation, and a strengthened balance sheet amid fast scale-up.

SEBI Disclaimer

Investing in IPOs involves risks. Please read the offer document carefully before investing. This article is for informational purposes only and does not constitute financial advice. Investors should consult their financial advisors before making any investment decisions.