Understanding Shariah Compliance in IPOs and Stocks:

Investing wisely is essential for both financial growth and ethical alignment. For those interested in making investments that comply with Islamic law, understanding the Shariah status of Initial Public Offerings (IPOs) and stocks is crucial. This article aims to provide insights into the Shariah compliance of Msafe Equipments Ltd, a modern choice for ensuring that your investment choices are not only profitable but also ethical.

Table of Contents

LINKS

Explore Shariah-compliant investment opportunities with IslamicStock.

Before we dive in, consider these links to quickly open your demat account.

Our mobile app links are also available below.

- Open Demat Account:

- Visit our Website: www.IslamicStock.in

- Read our Blog: blog.islamicstock.in

- Download our App:

Analyzing The Company

Company Name: Msafe Equipments Ltd

Listing At: BSE (SME)

Overview

Msafe is a top industry leader in aluminium scaffolding, offering comprehensive solutions in the sales, rental, and manufacturing of premium Aluminium Scaffoldings, MS Scaffoldings, and Aluminium & FRP Ladders. As the top aluminium scaffolding manufacturer in India, we ensure unmatched safety, durability, and performance across the construction, industrial, infrastructure, and maintenance sectors.

Whether you’re searching for reliable scaffolding systems for your projects or specialized ladders for operational needs, Msafe delivers industry-leading quality, service, and reliability. We provide end-to-end access solutions — from product supply (rental or sales) to on-site installation, trained erectors, and certified user training. Safety remains our highest priority at every stage, ensuring full compliance with national and international standards while actively minimizing on-site risks. With a strong Pan-India presence and a rapidly growing international footprint, Msafe is the trusted choice for top builders, infrastructure companies, industrial clients, and facility managers. Our commitment to timely delivery, customized support, and cost-effective solutions sets us apart in a competitive market.

Our operations are powered by a state-of-the-art manufacturing plant, a highly skilled workforce, and a customer-first mindset. From concept to completion, we focus on efficiency, safety, and innovation in everything we do. We continuously invest in technology, training, and stringent quality control to stay ahead of evolving industry demands. At Msafe, our products are not only engineered to perform — they are engineered to protect lives.

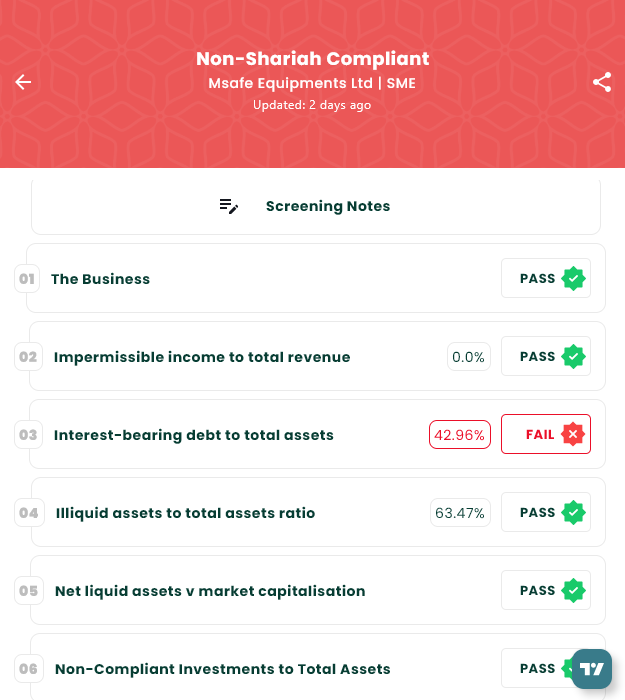

Shariah Status

The IPO is Shariah Non-Compliant, please see below image.

IPO Timeline (Tentative Schedule)

| IPO Open Date | Jan 28, 2026 |

| IPO Close Date | Jan 30, 2026 |

| Tentative Allotment | Feb 02, 2026 |

| Initiation of Refunds | Feb 03, 2026 |

| Credit of Shares to Demat | Feb 03, 2026 |

| Tentative Listing Date | Feb 04, 2026 |

Financials

Msafe Equipments Ltd shows a steady scaling of size, profitability, and balance-sheet strength across the reported periods. Assets rose from ₹33.54 crore (Mar-23) to ₹48.19 crore (Mar-24), ₹73.59 crore (Mar-25), and ₹87.67 crore (Sep-25). Total income moved from ₹29.71 crore to ₹48.34 crore and ₹71.62 crore, with ₹49.07 crore in the Sep-25 period. Profit after tax improved from ₹3.65 crore to ₹6.55 crore, ₹13.01 crore, and ₹10.50 crore. Operating performance strengthened: EBITDA progressed from ₹9.19 crore (Mar-23) to ₹15.12 crore, ₹26.08 crore, and ₹19.21 crore. EBITDA margin expanded from about 31% in FY23 to ~31% in FY24, ~36% in FY25, and ~39% in Sep-25; PAT margin improved from ~12% to ~14%, ~18%, and ~21%. Net worth increased sharply from ₹6.09 crore to ₹12.64 crore, ₹25.65 crore, and ₹36.15 crore. Reserves and surplus stood at ₹5.09 crore, ₹11.64 crore, ₹24.65 crore, and ₹20.15 crore. Borrowings climbed with growth—₹20.37 crore to ₹25.87 crore, ₹32.56 crore, and ₹37.67 crore—yet leverage moderated: debt-to-net-worth reduced from ~3.35x (Mar-23) to ~2.05x, ~1.27x, and ~1.04x. Overall, the company exhibits expanding scale, rising margins, and improving capital structure. Nevertheless, the drop in reserves by September 2025 merits review alongside borrowing trends, working capital needs, and dividend policies ahead.

SEBI Disclaimer

Investing in IPOs involves risks. Please read the offer document carefully before investing. This article is for informational purposes only and does not constitute financial advice. Investors should consult their financial advisors before making any investment decisions.