Understanding Shariah Compliance in IPOs and Stocks:

Investing wisely is essential for both financial growth and ethical alignment. For those interested in making investments that comply with Islamic law, understanding the Shariah status of Initial Public Offerings (IPOs) and stocks is crucial. This article aims to provide insights into the Shariah compliance of Aditya Infotech Ltd IPO (ADITYAINFO), ensuring that your investment choices are not only profitable but also ethical.

Table of Contents

What is Shariah Compliance?

Shariah compliance refers to the adherence to Islamic law, which governs various aspects of life, including financial transactions. When it comes to investments, certain criteria must be met to ensure that they are permissible under Shariah law. For example, investments should avoid sectors related to alcohol, gambling, pork, and any form of interest (Riba), etc.

Analyzing Aditya Infotech Ltd IPO (ADITYAINFO)

Company Name: Aditya Infotech Ltd

Industry: Security and Surveillance Equipment Industry

Listing At: BSE & NSE MAINBOARD

Overview From Company’s Website:

About AIL

After launching CP PLUS over 17 years ago, Aditya Infotech Limited became India’s Leading surveillance brand with the most extensive CCTV & Security Products portfolio in the entire industry. AIL offers a wide range of products and services to meet the varied needs of government, commercial, residential, and industrial customers and its products are successfully deployed in every nook and corner of India in all vertical segments.

With a sprawling network of over 30,000 channel partners, 1800+ System Integrators, 54 branch offices & RMA Centers spanning every corner of the country, AIL brings cutting-edge surveillance closer to Indians everywhere.

Proudly aligned with the Prime Minister’s vision of Atmanirbhar Bharat through the Make-in-India initiative, AIL had established its manufacturing facility for indigenous surveillance solutions in Kadapa, Andhra Pradesh. Today, our production capacity stands at over 2M million units per month, with ample room for further expansion, growth and lot of backward integration.

Setting roots deep in Indian soil, AIL has also established a local R&D Center in Noida and an Offshore Development Center in Manesar. These centers underscore our dedication to understanding and meeting the unique needs of the Indian market and the teams design & develop CCTV hardware, firmware, source code, with highest levels of cyber security incorporated inside the same.

AIL has also been actively involved in various training initiatives aimed at Skill Development & Capacity Building in the security industry. In collaboration with the Ministry of Skill Development and Entrepreneurship, AIL undertook the formidable responsibility of upskilling and educating India’s CCTV workforce. Under Mission Tech and other training programs organized by AIL, the brand has successfully engaged more than 50,000 participants nationwide.

The AIL vision is “To make the World safer, better, & secure for everyone, by providing & enabling the use of Best-in-World Video IoT Security Products, Solutions & Services”. And we strive to contribute towards the mission of our Honorable PM of Viksit Bharat by employing a 4000 manpower with more than 70% female workforce at our factory.

Our Mission

To become one of the Top 3 Global Surveillance Players – With widespread exports around the world, we aim to become a billion-dollar global enterprise – Strengthening our manufacturing and R&D capabilities further.

Our Vision

To make the world safer, better, and secure for everyone – by providing & enabling the use of Best-in-World Video IoT Security Products, Solutions, & Services.

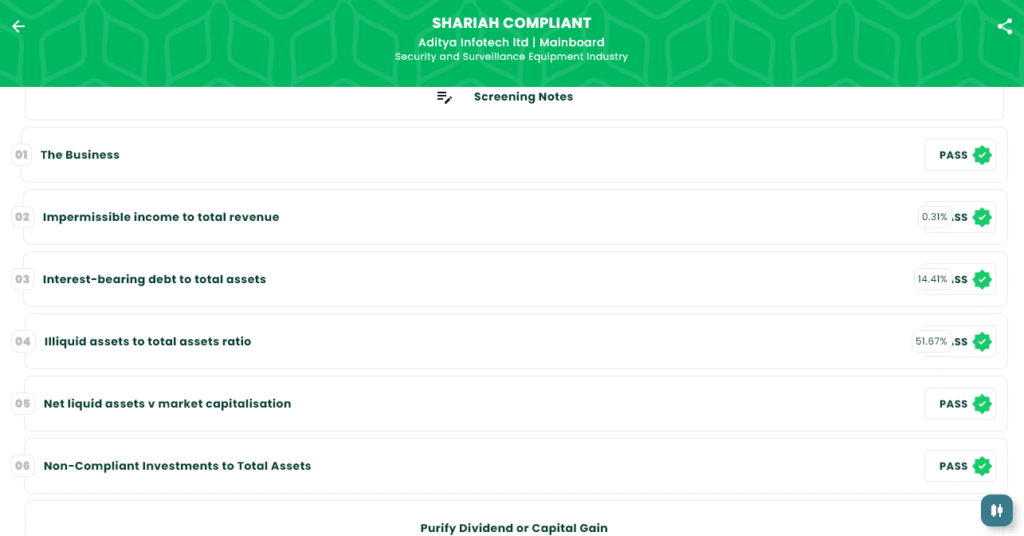

Shariah Status

The IPO is Shariah Compliant, please see below image.

Additional Considerations:

When opting for Shariah-compliant investments, it is essential to regularly check the status in our App. This ensures that the evolving nature of businesses or other financial data does not compromise the compliance status of your investments.

IPO Timeline (Tentative Schedule)

| IPO Open Date | Tue, Jul 29, 2025 |

| IPO Close Date | Thu, Jul 31, 2025 |

| Tentative Allotment | Fri, Aug 1, 2025 |

| Initiation of Refunds | Mon, Aug 4, 2025 |

| Credit of Shares to Demat | Mon, Aug 4, 2025 |

| Tentative Listing Date | Tue, Aug 5, 2025 |

| Cut-off time for UPI mandate confirmation | 5 PM on July 31, 2025 |

Lot Size

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Retail (Min) | 1 | 22 | ₹14,850 |

| Retail (Max) | 13 | 286 | ₹1,93,050 |

| S-HNI (Min) | 14 | 308 | ₹2,07,900 |

| S-HNI (Max) | 67 | 1,474 | ₹9,94,950 |

| B-HNI (Min) | 68 | 1,496 | ₹10,09,800 |

Financials

Aditya Infotech Ltd.’s revenue rose by 12% to ₹3,122.93 crore in FY 2025 from ₹2,795.96 crore in FY 2024. Profit after tax jumped 205% to ₹351.37 crore. EBITDA also improved to ₹258.39 crore. The company’s assets nearly doubled to ₹3,174.54 crore, while net worth increased to ₹1,017.66 crore. Reserves rose significantly, but borrowings remained almost flat. Overall, the company showed strong growth in profits and financial strength.

KPI

| KPI | Values |

|---|---|

| ROE | 34.53% |

| ROCE | 33.27% |

| Debt/Equity | 0.41 |

| RoNW | 34.53% |

| PAT Margin | 11.25% |

| EBITDA Margin | 8.27% |

| Price to Book Value | 7.06 |

Grey Market Premium (GMP)

The Grey Market Premium (GMP) for Aditya Infotech Ltd IPO is currently ₹225, representing 33.33% premium over the issue price.

LINKS

Ready to invest in Shariah-compliant opportunities? Explore more at IslamicStock & consider opening a demat account from the below link!

- Open Demat Account:

- Visit our Website: www.IslamicStock.in

- Read our Blog: blog.islamicstock.in

- Download our App:

SEBI Disclaimer

Investing in IPOs involves risks. Please read the offer document carefully before investing. This article is for informational purposes only and does not constitute financial advice. Investors should consult their financial advisors before making any investment decisions.