Understanding Shariah Compliance in IPOs and Stocks:

Investing wisely is essential for both financial growth and ethical alignment. For those interested in making investments that comply with Islamic law, understanding the Shariah status of Initial Public Offerings (IPOs) and stocks is crucial. This article aims to provide insights into the Shariah compliance of ARC Insulation & Insulators Ltd, ensuring that your investment choices are not only profitable but also ethical.

Table of Contents

Analyzing The Company

Company Name: ARC Insulation & Insulators Ltd

Industry: Other Industrial Products

Listing At: NSE SME

Overview:

ARC Insulation and Insulators Ltd., formerly known as ARC Insulation & Insulators Private Limited, is a leading manufacturer of high-performance glass fiber reinforced polymer (GFRP) composite products. Founded in 2003 as a proprietorship and incorporated in 2008, the company has been at the forefront of bringing innovative GFRP solutions to the construction, infrastructure, chemical processing, and other industrial sectors.

What sets ARC apart is its commitment to continuous research and development in advanced composite materials. A dedicated team of engineers and material scientists works to push the boundaries of GFRP applications, creating products that outperform traditional materials like steel, wood, and aluminum in strength, durability, and longevity.

ARC has developed a comprehensive product range to serve diverse customers, from public utilities to heavy industry. Key products include GFRP rebar, structural profiles, pipes, tanks, cable trays, gratings, ladders, and handrails. These components are produced in state-of-the-art manufacturing facilities that employ pultrusion and other advanced techniques, ensuring consistent and high-quality output under stringent quality control.

With decades of expertise in advanced composite design and engineering, ARC provides customer-focused technical guidance. The company’s GFRP solutions not only offer superior performance and lower overall lifetime costs through longer service life but are also more environmentally sustainable. They have a lower carbon footprint compared to steel and concrete alternatives, promoting green construction.

Possessing a robust pan-India presence and an expanding global footprint, ARC Insulation and Insulators Ltd. is committed to being a reliable source of technical expertise and innovative GFRP product solutions for years to come.

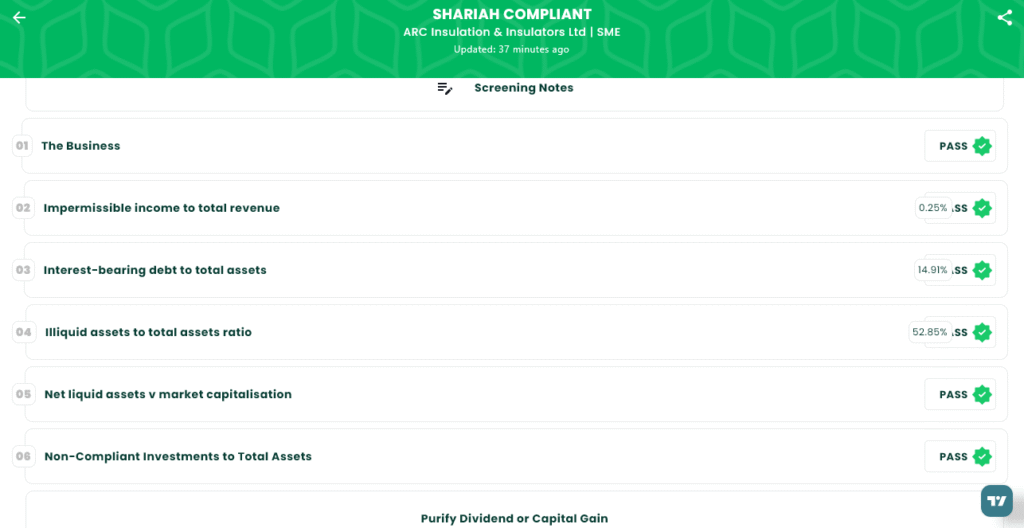

Shariah Status

The IPO is Shariah Compliant, please see below image.

Additional Considerations:

When opting for Shariah-compliant investments, it is essential to regularly check the status in our App. This ensures that the evolving nature of businesses or other financial data does not compromise the compliance status of your investments.

IPO Timeline (Tentative Schedule)

| IPO Open Date | Thu, Aug 21, 2025 |

| IPO Close Date | Mon, Aug 25, 2025 |

| Tentative Allotment | Tue, Aug 26, 2025 |

| Initiation of Refunds | Thu, Aug 28, 2025 |

| Credit of Shares to Demat | Thu, Aug 28, 2025 |

| Tentative Listing Date | Fri, Aug 29, 2025 |

| Cut-off time for UPI mandate confirmation | 5 PM on August 25, 2025 |

Lot Size

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Individual investors (Retail) (Min) | 2 | 2,000 | ₹2,50,000 |

| Individual investors (Retail) (Max) | 2 | 2,000 | ₹2,50,000 |

| S-HNI (Min) | 3 | 3,000 | ₹3,75,000 |

| S-HNI (Max) | 8 | 8,000 | ₹10,00,000 |

| B-HNI (Min) | 9 | 9,000 | ₹11,25,000 |

Financials

For the fiscal year ending March 31, 2025, ARC Insulation & Insulators Ltd. experienced significant financial growth. The company’s revenue increased by 15%, and its profit after tax (PAT) grew by 40% compared to the previous year.

Total income for the year reached ₹33.15 crore, up from ₹28.83 crore in 2024. Profit after tax climbed to ₹8.57 crore from ₹6.10 crore in the prior year.

This performance was supported by broad growth across the company. Total assets increased to ₹39.30 crore from ₹22.42 crore, while the company’s net worth more than doubled to ₹25.22 crore. EBITDA also rose to ₹12.50 crore from ₹9.05 crore in 2024. Total borrowings stood at ₹5.97 crore for the year, an increase from the previous year.

KPI

| KPI | Values |

|---|---|

| ROE | 45.47% |

| ROCE | 49.84% |

| Debt/Equity | 0.24 |

| RoNW | 45.47% |

| PAT Margin | 26.18% |

| EBITDA Margin | 38.22% |

| Price to Book Value | 3.59 |

LINKS

Ready to invest in Shariah-compliant opportunities? Explore more at IslamicStock & consider opening a demat account from the below link!

- Open Demat Account:

- Visit our Website: www.IslamicStock.in

- Read our Blog: blog.islamicstock.in

- Download our App:

SEBI Disclaimer

Investing in IPOs involves risks. Please read the offer document carefully before investing. This article is for informational purposes only and does not constitute financial advice. Investors should consult their financial advisors before making any investment decisions.