Understanding Shariah Compliance in IPOs and Stocks:

Investing wisely is essential for both financial growth and ethical alignment. For those interested in making investments that comply with Islamic law, understanding the Shariah status of Initial Public Offerings (IPOs) and stocks is crucial. This article aims to provide insights into the Shariah compliance of B. D. Industries (Pune) Ltd IPO (BDINPUNE), ensuring that your investment choices are not only profitable but also ethical.

Table of Contents

What is Shariah Compliance?

Shariah compliance refers to the adherence to Islamic law, which governs various aspects of life, including financial transactions. When it comes to investments, certain criteria must be met to ensure that they are permissible under Shariah law. For example, investments should avoid sectors related to alcohol, gambling, pork, and any form of interest (Riba), etc.

Analyzing B. D. Industries (Pune) Ltd IPO (BDINPUNE)

Company Name: B. D. Industries (Pune) Ltd

Industry: Plastic Products – Industrial

Listing At: BSE SME

Overview:

B.D. Industries was established in 1984 in Mumbai to manufacture high-quality roto-molded battery boxes and water tanks. The business quickly outgrew the space and expanded into other cities in India, moving on to newer products and challenging applications. BDI diversified in to automotive parts, road safety products, healthcare parts, waste management products, material handling pallets and crates, amongst other products.

BDI Group of Companies are certified for ISO 9001 : 2015, IATF 16949 : 2016, amongst others and having experience of over 35 years in development, manufacturing & supplying of rotomolded plastic Products, for the Indian & Global Market.

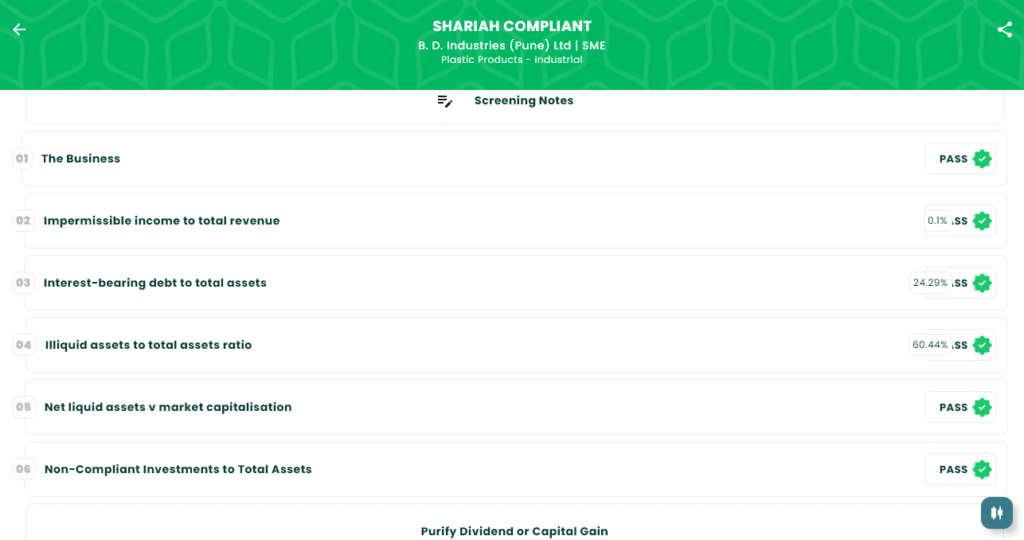

Shariah Status

The IPO is Shariah Compliant, please see below image.

Additional Considerations:

When opting for Shariah-compliant investments, it is essential to regularly check the status in our App. This ensures that the evolving nature of businesses or other financial data does not compromise the compliance status of your investments.

IPO Timeline (Tentative Schedule)

| IPO Open Date | Wed, Jul 30, 2025 |

| IPO Close Date | Fri, Aug 1, 2025 |

| Tentative Allotment | Mon, Aug 4, 2025 |

| Initiation of Refunds | Tue, Aug 5, 2025 |

| Credit of Shares to Demat | Tue, Aug 5, 2025 |

| Tentative Listing Date | Wed, Aug 6, 2025 |

| Cut-off time for UPI mandate confirmation | 5 PM on August 1, 2025 |

Lot Size

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Individual investors (Retail) (Min) | 2 | 2,400 | ₹2,59,200 |

| Individual investors (Retail) (Max) | 2 | 2,400 | ₹2,59,200 |

| S-HNI (Min) | 3 | 3,600 | ₹3,88,800 |

| S-HNI (Max) | 7 | 8,400 | ₹9,07,200 |

| B-HNI (Min) | 8 | 9,600 | ₹10,36,800 |

Financials

Assets surged dramatically from 27.18 in 2023 to 68.90 in 2025, indicating significant expansion. Revenue also saw substantial growth, increasing from 55.10 to 84.13 over the period. Profit After Tax showed exceptional improvement, more than five-folding from 1.49 to 8.15. EBITDA followed a similar strong upward trend. Net Worth more than doubled, reflecting increased shareholder value. While Reserves and Surplus saw some fluctuation, Total Borrowing increased notably in 2025, possibly funding the asset growth. Overall, the company shows very strong growth.

KPI

| KPI | Values |

|---|---|

| ROE | 43.86% |

| ROCE | 43.50% |

| Debt/Equity | 1.05 |

| RoNW | 35.97% |

| PAT Margin | 9.23% |

| EBITDA Margin | 18.92% |

| Price to Book Value | 6.42 |

LINKS

Ready to invest in Shariah-compliant opportunities? Explore more at IslamicStock & consider opening a demat account from the below link!

- Open Demat Account:

- Visit our Website: www.IslamicStock.in

- Read our Blog: blog.islamicstock.in

- Download our App:

SEBI Disclaimer

Investing in IPOs involves risks. Please read the offer document carefully before investing. This article is for informational purposes only and does not constitute financial advice. Investors should consult their financial advisors before making any investment decisions.