Understanding Shariah Compliance in IPOs and Stocks:

Investing wisely is essential for both financial growth and ethical alignment. For those interested in making investments that comply with Islamic law, understanding the Shariah status of Initial Public Offerings (IPOs) and stocks is crucial. This article aims to provide insights into the Shariah compliance of Bluestone Jewellery & Lifestyle Ltd, ensuring that your investment choices are not only profitable but also ethical.

Table of Contents

Analyzing The Company

Company Name: Bluestone Jewellery & Lifestyle Ltd

Industry: Gems, Jewellery And Watches

Listing At: NSE & BSE (Mainboard)

Overview:

Established in 2011, BlueStone has emerged as India’s premier destination for high-quality fine jewelry featuring exquisite designs. The company’s objective is to transform the fine jewelry and lifestyle sector in India by prioritizing craftsmanship, quality, and customer experience. In a relatively short period, BlueStone has cultivated a large base of loyal customers both within India and internationally.

The company offers a selection of over 8,000 unique designs. Each of these designs is meticulously crafted, and customers have the flexibility to customize aspects such as the gold purity and color or diamond clarity to meet their specific preferences. BlueStone’s physical stores have been crucial in expanding its reach, providing a world-class experience with friendly staff and a dazzling array of jewelry.

With an award-winning design team, the company ensures that each product is a symbol of perfection, utilizing cutting-edge innovation and the latest technology. BlueStone also demonstrates its commitment to customer satisfaction through a 30-Day Money Back guarantee, jewelry certified by independent establishments like GSI, IGI & SGL, and a Lifetime Exchange policy. The company further enhances its customer-centric approach by offering customization services.

Shariah Status

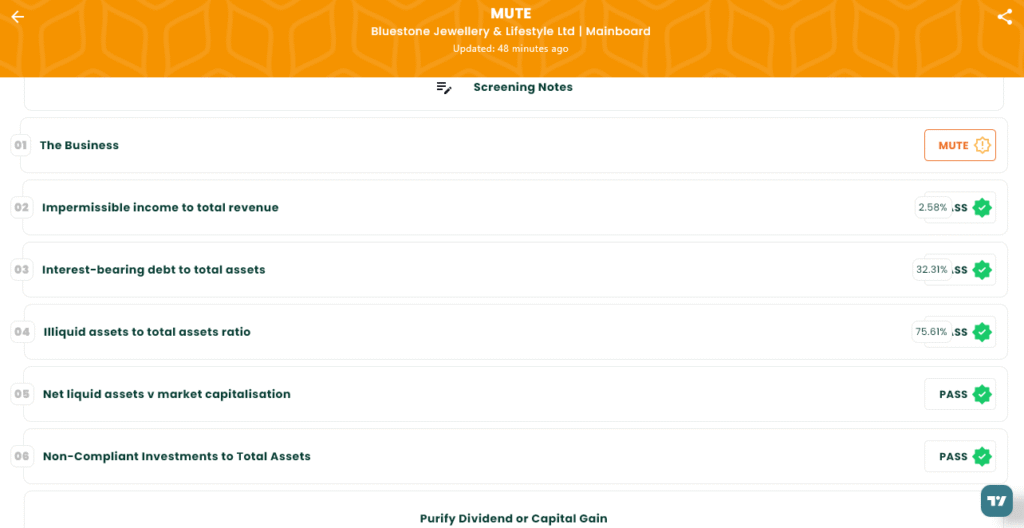

The IPO is MUTE, please see below image & read Screening Notes available in the app for reason of MUTE.

Additional Considerations:

When opting for Shariah-compliant investments, it is essential to regularly check the status in our App. This ensures that the evolving nature of businesses or other financial data does not compromise the compliance status of your investments.

IPO Timeline (Tentative Schedule)

| IPO Open Date | Mon, Aug 11, 2025 |

| IPO Close Date | Wed, Aug 13, 2025 |

| Tentative Allotment | Thu, Aug 14, 2025 |

| Initiation of Refunds | Mon, Aug 18, 2025 |

| Credit of Shares to Demat | Mon, Aug 18, 2025 |

| Tentative Listing Date | Tue, Aug 19, 2025 |

| Cut-off time for UPI mandate confirmation | 5 PM on August 13, 2025 |

Lot Size

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Retail (Min) | 1 | 29 | ₹14,993 |

| Retail (Max) | 13 | 377 | ₹1,94,909 |

| S-HNI (Min) | 14 | 406 | ₹2,09,902 |

| S-HNI (Max) | 66 | 1,914 | ₹9,89,538 |

| B-HNI (Min) | 67 | 1,943 | ₹10,04,531 |

Financials

Based on the provided financial data for BlueStone Jewellery & Lifestyle Ltd., a concerning picture emerges. Despite a stated increase in revenue, the company’s profit after tax (PAT) has plunged by a staggering 56%, sinking even further into the negative. This indicates a profound inability to translate sales into profitability. The company’s total borrowings have also surged to over ₹728 crore, more than tripling in just two years. This heavy reliance on debt, combined with persistent losses, suggests a precarious financial footing and a highly unsustainable business model.

KPI

| KPI | Values |

|---|---|

| ROE | -34.53% |

| ROCE | -3.67% |

| Debt/Equity | 0.80 |

| RoNW | -24.45% |

| PAT Margin | -12.53% |

| EBITDA Margin | 4.13% |

| Price to Book Value | 2.01 |

LINKS

Ready to invest in Shariah-compliant opportunities? Explore more at IslamicStock & consider opening a demat account from the below link!

- Open Demat Account:

- Visit our Website: www.IslamicStock.in

- Read our Blog: blog.islamicstock.in

- Download our App:

SEBI Disclaimer

Investing in IPOs involves risks. Please read the offer document carefully before investing. This article is for informational purposes only and does not constitute financial advice. Investors should consult their financial advisors before making any investment decisions.