Understanding Shariah Compliance in IPOs and Stocks:

Investing wisely is essential for both financial growth and ethical alignment. For those interested in making investments that comply with Islamic law, understanding the Shariah status of Initial Public Offerings (IPOs) and stocks is crucial. This article aims to provide insights into the Shariah compliance of Classic Electrodes (India) Ltd, ensuring that your investment choices are not only profitable but also ethical.

Table of Contents

Analyzing The Company

Company Name: Classic Electrodes (India) Ltd

Industry: Other Industrial Products

Listing At: NSE SME

Overview:

Classic Electrodes (India) Limited is a leading electrode manufacturing company in India, recognized as a market leader for more than two decades. Established in 1997, the company serves some of the world’s most well-known manufacturing industries. Its products are highly sought after due to their quality, efficiency, and durability.

The company employs advanced technology in its production processes, and all products are supervised by highly experienced engineers and technicians. This commitment to quality is a significant part of the business, driven by a strategic direction set by professional entrepreneurs with a sound financial background. The executive members are market leaders with a collective experience of over 65 years, possessing exceptional leadership track records, international exposure, and deep strategic expertise. This experience has been an asset in driving transformation and ensuring customer satisfaction.

Classic Electrodes (India) Limited has built a long-standing reputation for manufacturing high-quality products, enabling it to serve top-notch industries in India and gain appreciation from its clients. Recognizing the impact of globalization, the company competes internationally by offering superior quality at economical prices and has successfully supplemented its production to be on par with global manufacturers. Classic Electrodes (India) Limited maintains a portfolio of developing products and services, underscoring its belief in providing technologically advanced solutions to meet modern customer demands.

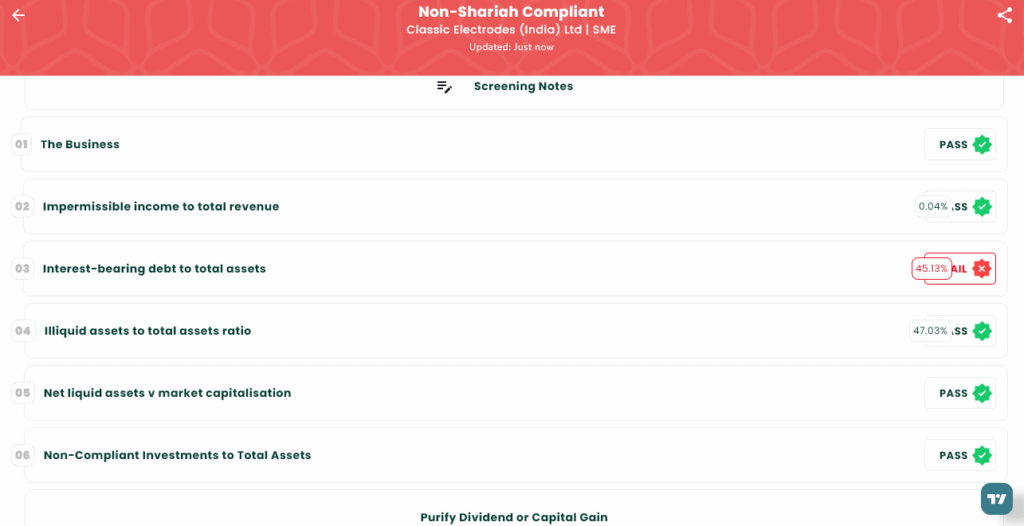

Shariah Status

The IPO is Non-Shariah Compliant, please see below image.

Additional Considerations:

When opting for Shariah-compliant investments, it is essential to regularly check the status in our App. This ensures that the evolving nature of businesses or other financial data does not compromise the compliance status of your investments.

IPO Timeline (Tentative Schedule)

| IPO Open Date | Fri, Aug 22, 2025 |

| IPO Close Date | Tue, Aug 26, 2025 |

| Tentative Allotment | Thu, Aug 28, 2025 |

| Initiation of Refunds | Thu, Aug 28, 2025 |

| Credit of Shares to Demat | Fri, Aug 29, 2025 |

| Tentative Listing Date | Mon, Sep 1, 2025 |

| Cut-off time for UPI mandate confirmation | 5 PM on August 26, 2025 |

Lot Size

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Individual investors (Retail) (Min) | 2 | 3,200 | ₹2,78,400 |

| Individual investors (Retail) (Max) | 2 | 3,200 | ₹2,78,400 |

| S-HNI (Min) | 3 | 4,800 | ₹4,17,600 |

| S-HNI (Max) | 7 | 11,200 | ₹9,74,400 |

| B-HNI (Min) | 8 | 12,800 | ₹11,13,600 |

Financials

Classic Electrodes (India) Ltd. has shown steady financial growth over the last few years, with a particularly strong performance in the 2024 fiscal year.

The company’s total assets grew from ₹74.99 crore in 2022 to ₹116.34 crore by February 2025. Its net worth also increased consistently, rising from ₹19.65 crore to ₹43.60 crore over the same period.

The year ending March 2024 was especially profitable. The company’s profit after tax jumped to ₹12.30 crore, a large increase from ₹2.08 crore the year before. For the first eleven months of the 2025 fiscal year (up to February 28, 2025), the company earned a total income of ₹187.90 crore and a profit of ₹9.57 crore.

The company’s total borrowings have also gradually increased over the years, reaching ₹53.50 crore in the latest period.

KPI

| KPI | Values |

|---|---|

| ROE | 24.66% |

| ROCE | 17.68% |

| Debt/Equity | 1.23 |

| RoNW | 21.95% |

| PAT Margin | 5.10% |

| EBITDA Margin | 10.24% |

| Price to Book Value | 2.63 |

LINKS

Ready to invest in Shariah-compliant opportunities? Explore more at IslamicStock & consider opening a demat account from the below link!

- Open Demat Account:

- Visit our Website: www.IslamicStock.in

- Read our Blog: blog.islamicstock.in

- Download our App:

SEBI Disclaimer

Investing in IPOs involves risks. Please read the offer document carefully before investing. This article is for informational purposes only and does not constitute financial advice. Investors should consult their financial advisors before making any investment decisions.