Table of Contents

1. IPO Snapshot

Symbol: ELLEN

IPO Open Date: June 24, 2025

IPO Close Date: June 26, 2025

IPO Allotment Date: June 27, 2025

IPO Listing Date: July 1, 2025

Issue Size: ₹852.53 Crores

Issue Type: Bookbuilding IPO (Fresh Issue + Offer for Sale)

Price Band: ₹380 to ₹400 per share

Lot Size: 37 Shares

Minimum Investment: ₹14,800

Listing Exchange: BSE, NSE

2. Company Overview

Incorporated in 1973, Ellenbarrie Industrial Gases Limited (EIGL) is one of India’s oldest and most trusted industrial gas companies. With a legacy of over five decades, it is the largest 100% Indian-owned player in the sector in terms of installed manufacturing capacity, revenue, and profitability in Fiscal 2024. EIGL operates one of India’s largest oxygen plants, boasting a capacity of 1,250 tonnes per day (TPD), and holds a 2.65% market share by revenue.

EIGL manufactures and supplies a wide range of industrial, medical, and specialty gases, including oxygen, nitrogen, helium, hydrogen, argon, carbon dioxide, acetylene, and nitrous oxide. The company also provides synthetic air, dry ice, LPG, welding mixtures, and fire-fighting gases, catering to critical industries such as shipbuilding, pharmaceuticals, defense, engineering, and steel manufacturing.

Beyond gas production, EIGL extends its services through project engineering, including turnkey installation and commissioning of air separation units. It also provides complete medical gas pipeline systems and supplies essential medical equipment like ventilators, anesthesia workstations, and sterilizers to hospitals and institutions.

EIGL’s customer base spans across bulk, packaged, and onsite service models, serving over 1,800 clients in FY2025. Its client portfolio includes prominent names like Dr. Reddy’s Laboratories, Rashtriya Ispat Nigam, AIIMS, and even India’s space and defense agencies. The company has a strong national footprint with eight manufacturing facilities—four in West Bengal, two in Andhra Pradesh, and one each in Telangana and Chhattisgarh.

With 281 permanent and 85 contractual employees as of March 31, 2025, Ellenbarrie continues to lead in reliability, innovation, and localized service delivery in the gas industry. Its consistent quality, expansive infrastructure, and strategic relevance in multiple industries position it as a vital contributor to India’s industrial and medical ecosystem.

3. Grey Market Premium (GMP)

As of now, the IPO of Ellenbarrie Industrial Gases Limited has not yet opened, but the Grey Market Premium (GMP) provides early market sentiment. The stock is currently trading at a premium of less than ₹15, indicating moderate investor interest ahead of the official bidding. This implies a possible listing price slightly above the upper price band of ₹400. While GMP is unofficial and speculative, it can offer insights into potential demand. However, it is important to note that GMP trends can fluctuate significantly and should not be the sole factor for investment decisions. Always consider fundamentals and risks.

4. Shariah Compliance Status

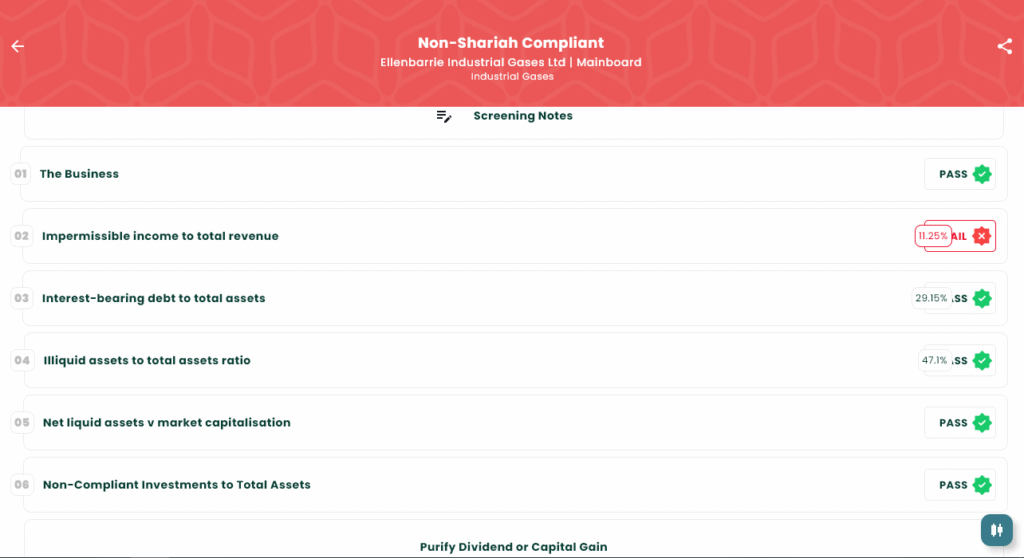

As per the IslamicStock app screening, Ellenbarrie Industrial Gases Ltd is Non-Shariah Compliant. This determination is based on a detailed financial screening that evaluates multiple parameters in accordance with Islamic investment principles. The company fails in the second rule, which measures impermissible income to total revenue. In this case, Ellenbarrie derives 11.25% of its revenue from non-permissible sources such as interest income from investments, bank deposits, and other financial instruments, which exceeds the 5% permissible threshold set by most Shariah standards.

The company does pass other criteria such as:

- Interest-bearing debt to total assets

- Illiquid assets to total assets ratio

- Net liquid assets vs. market capitalization

- Non-compliant investments to total assets

However, failing just one rule is sufficient to make a stock non-compliant under most Islamic screening models.

As explained in the screening notes, the failure of the second rule is critical. While the business itself (industrial gas production and distribution) is permissible under Shariah, its reliance on interest-based income makes it unsuitable for halal investing unless the company purifies or limits that source of revenue.

Muslim investors who strictly adhere to Shariah principles are advised to avoid investing in this IPO unless the non-permissible income is purified and future operations align better with Islamic guidelines. Investors should always refer to updated screening tools or consult a qualified Shariah advisor for the latest compliance insights.

5. Subscription Status

As of now, the Ellenbarrie Industrial Gases IPO has not yet opened, so subscription data is currently unavailable. Investors will be able to track category-wise subscription details such as QIB (Qualified Institutional Buyers), NII (Non-Institutional Investors), and Retail participation once the bidding process begins on June 24, 2025. Subscription status is usually updated multiple times during the IPO window, offering real-time insights into demand across investor segments. These updates help retail and HNI investors gauge market interest and make informed decisions before the final day. Once bidding begins, metrics like oversubscription levels, total applications received, and shares bid for will become available. Until then, potential investors are advised to stay updated through official stock exchange portals or reputed IPO tracking platforms. Early GMP (Grey Market Premium) trends and pre-IPO buzz may offer some indication of investor sentiment, but actual demand will only reflect after subscriptions begin.

6. Final Thoughts

Ellenbarrie Industrial Gases Ltd stands out as one of India’s oldest and largest Indian-owned players in the industrial gas sector, with a strong track record and diversified client base. Its large-scale operations, robust manufacturing footprint, and long-standing government and institutional partnerships position it well for future growth. However, investors should consider the non-Shariah compliance status due to its income from interest-based sources exceeding permissible limits. While the Grey Market Premium (GMP) shows modest interest and indicates early demand, it’s essential to review fundamentals, IPO valuation, and subscription trends before making any investment decisions.

7. Disclaimer

Investing in the securities market is subject to market risks. Please read all scheme-related documents carefully before investing. The information provided herein is for educational and informational purposes only and should not be construed as investment advice or a recommendation to buy, sell, or hold any security. SEBI does not guarantee the accuracy, adequacy, or completeness of any information and is not responsible for any losses arising from the use of this content. Investors are advised to consult with certified financial advisors and conduct their own research before making any investment decisions.