Table of Contents

IPO Snapshot

Symbol: GLOBECIVIL

IPO Open Date: June 24, 2025

IPO Close Date: June 26, 2025

IPO Allotment Date: June 27, 2025

IPO Listing Date: July 1, 2025

Issue Size: ₹119 crore (1,67,60,560 shares)

Issue Type: Bookbuilding IPO

Price Band: ₹67 to ₹71 per share

Lot Size: 211 shares

Minimum Investment: ₹14,981

Listing Exchange: BSE, NSE

Company Overview

Globe Civil Projects Limited is an EPC (Engineering, Procurement, and Construction) company based in New Delhi. It started in 2002 and has over 20 years of experience. The company handles civil, structural, and infrastructure projects across India. So far, it has completed 37 projects and is currently working on 13 projects in 11 different states, including major areas like Maharashtra, Gujarat, and Karnataka.

Its work includes infrastructure like transport and social buildings, and non-infrastructure like residential and office spaces. The company is also capable of taking on advanced projects like airport terminals and hospitals. It also provides MEP, HVAC, fire systems, and architectural services. As of August 31, 2024, the company’s order book was worth ₹892.95 crore across 14 projects. With 112 full-time employees, the company focuses on safety, timely delivery, and quality construction. Its clients include several well-known names, making it a strong player in the EPC industry.

Grey Market Premium (GMP)

Currently, the grey market premium for this IPO is reported to be less than ₹15, suggesting a moderate premium of under 20 percent over the issue price. Since the IPO has not yet started, these numbers can change quickly. This early sign shows some investor interest, but it’s too soon to judge. Investors should wait for official subscription data and also review the company’s financial details before deciding to apply. GMP can offer hints, but it should not be the only factor for investing.

Shariah Compliance Status

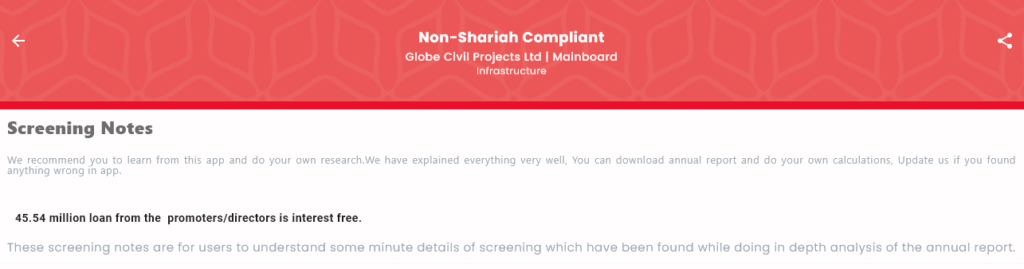

Globe Civil Projects Limited is not Shariah compliant. Although it passes most checks, it fails on one important point: its interest-bearing debt is more than 35 percent of its total assets. The Shariah limit is 33 percent. So, even though other parts of the business meet the guidelines, this single issue makes it non-compliant.

Notes also show that a portion of the debt is interest-free and given by promoters, which is a good sign. But rules look at total debt, not just the type, so the company does not qualify.

Other areas like impermissible income, non-compliant investments, and asset structure are all within limits. The company runs a mostly clean business, but due to the debt level, it is not suitable for investors who only choose halal or Shariah-compliant stocks.

Subscription Status

The IPO has not opened yet. The subscription window is from June 24 to June 26, 2025. As of now, there is no data on how much interest investors have shown. Once the IPO opens, the demand from different groups like QIBs, NIIs, and retail investors will be available.

Right now, investors can review the red herring prospectus, check financial reports, and understand the company’s position in the market. The company’s project pipeline and industry focus may draw investor attention, but actual results will be clear only after bidding begins.

Final Thoughts

Globe Civil Projects Limited has experience, a good track record, and a strong project pipeline. It works in many states and handles both simple and complex projects. This could make it attractive to investors. However, its non-compliance with Shariah rules and high debt should be noted. Investors should look at all aspects such as company fundamentals, grey market trends, and market conditions before deciding. The IPO offers a chance to invest in India’s growing infrastructure sector, but thoughtful research is advised.

Disclaimer

This article is only for general information and not investment advice. Investing in the stock market involves risks. Before investing, always read the offer documents carefully.

As per SEBI rules, investors should go through the Red Herring Prospectus, talk to a financial advisor, and decide based on personal financial goals and risk level. The platform or writer is not responsible for any loss from decisions based on this article.