Understanding Shariah Compliance in IPOs and Stocks:

Investing wisely is essential for both financial growth and ethical alignment. For those interested in making investments that comply with Islamic law, understanding the Shariah status of Initial Public Offerings (IPOs) and stocks is crucial. This article aims to provide insights into the Shariah compliance of Laxmi India Finance Ltd IPO (LAXMIINDIA), ensuring that your investment choices are not only profitable but also ethical.

Table of Contents

What is Shariah Compliance?

Shariah compliance refers to the adherence to Islamic law, which governs various aspects of life, including financial transactions. When it comes to investments, certain criteria must be met to ensure that they are permissible under Shariah law. For example, investments should avoid sectors related to alcohol, gambling, pork, and any form of interest (Riba), etc.

Analyzing Laxmi India Finance Ltd IPO (LAXMIINDIA)

Company Name: Laxmi India Finance Ltd

Industry: NBFC

Listing At: BSE & NSE (MAINBOARD)

Overview From Company’s Website:

Laxmi India Finance Limited

We are a non-deposit taking non-banking financial company focused on serving the financial needs of underserved customers in India’s lending market. As on September 30, 2024, our operational network spans across 139 branches in rural, semi-urban and urban areas in the states of Rajasthan, Gujarat, Madhya Pradesh and Chhattisgarh. Our product portfolio includes MSME loans, vehicle loans, construction loans and other lending products catering to the diverse financial needs of our customers. Our MSME lending fuels economic growth and promotes financial inclusion by supporting small businesses and entrepreneurs, with over 80% of our MSME loans qualifying as Priority Sector Lending under RBI guidelines.

Shariah Status

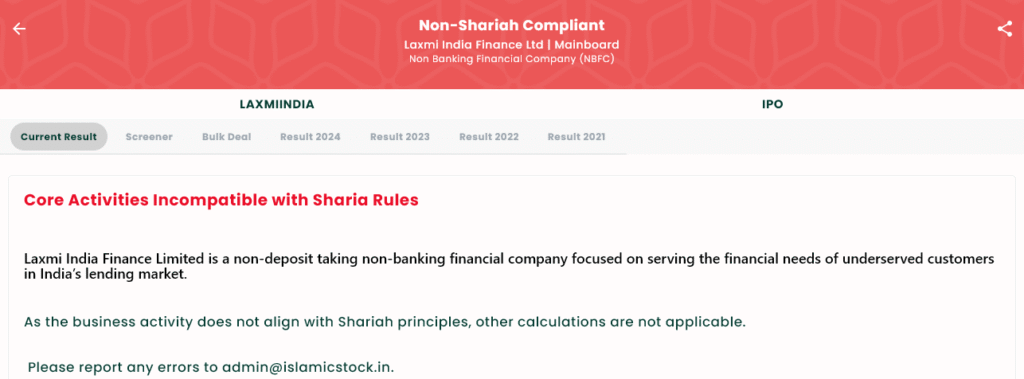

The IPO is Non-Shariah Compliant, please see below image.

Additional Considerations:

When opting for Shariah-compliant investments, it is essential to regularly check the status in our App. This ensures that the evolving nature of businesses or other financial data does not compromise the compliance status of your investments.

IPO Timeline (Tentative Schedule)

| IPO Open Date | Tue, Jul 29, 2025 |

| IPO Close Date | Thu, Jul 31, 2025 |

| Tentative Allotment | Fri, Aug 1, 2025 |

| Initiation of Refunds | Mon, Aug 4, 2025 |

| Credit of Shares to Demat | Mon, Aug 4, 2025 |

| Tentative Listing Date | Tue, Aug 5, 2025 |

| Cut-off time for UPI mandate confirmation | 5 PM on July 31, 2025 |

Lot Size

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Retail (Min) | 1 | 94 | ₹14,852 |

| Retail (Max) | 13 | 1,222 | ₹1,93,076 |

| S-HNI (Min) | 14 | 1,316 | ₹2,07,928 |

| S-HNI (Max) | 67 | 6,298 | ₹9,95,084 |

| B-HNI (Min) | 68 | 6,392 | ₹10,09,936 |

Grey Market Premium (GMP)

The Grey Market Premium (GMP) for Shree Refrigerations Ltd IPO is currently ₹10, representing 6.33% premium over the issue price.

LINKS

Ready to invest in Shariah-compliant opportunities? Explore more at IslamicStock.in & consider opening a demat account from below link!

- Open Demat Account:

- Visit our Website: www.IslamicStock.in

- Read our Blog: blog.islamicstock.in

- Download our App:

SEBI Disclaimer

Investing in IPOs involves risks. Please read the offer document carefully before investing. This article is for informational purposes only and does not constitute financial advice. Investors should consult their financial advisors before making any investment decisions.