Understanding Shariah Compliance in IPOs and Stocks:

Investing wisely is essential for both financial growth and ethical alignment. For those interested in making investments that comply with Islamic law, understanding the Shariah status of Initial Public Offerings (IPOs) and stocks is crucial. This article aims to provide insights into the Shariah compliance of Lenskart Solutions Ltd, ensuring that your investment choices are not only profitable but also ethical.

Table of Contents

Analyzing The Company

Company Name: Lenskart Solutions Ltd

Industry: Miscellaneous

Listing At: NSE & BSE (Mainboard)

Company Overview

Lenskart was founded in 2010 by an ex-Microsoft professional Peyush Bansal, along with co-founders Amit Chaudhary and Sumeet Kapahi, who established VALYOO Technologies. Starting with no money but tremendous passion to make a difference, Lenskart has evolved into one of the fastest-growing eyewear businesses today.

The company’s founding principle was to truly add ‘valyoo’ to customers’ lives by eliminating retailers, establishing high-quality manufacturing facilities, and supplying directly to consumers. This approach not only reduces costs but also ensures high-quality standards through in-house robotic lens manufacturing and assembly.

Business Model

- Direct-to-consumer approach eliminating middlemen

- Unique combination of strong online presence and uniquely designed physical stores

- Monthly reach of over 1,00,000 customers

- Revolutionizing the traditional eyewear industry

Core Strengths

1. Great Quality

Robotic Manufacturing

- India’s first and only brand to use robotic manufacturing techniques

- German-imported machines ensuring perfection across all fronts

- Precision accuracy to 3 decimal places

- Automated inspection system for lenses, geometric center determination, and lens loading

Zero Error Tolerance

- People committed to zero tolerance for errors

- Call center focused on customer delight and problem resolution

- Continuous feedback implementation

2. Extensive Variety

Product Range

| Category | Details |

|---|---|

| Styles Available | Over 5,000 styles (5x more than any Indian retailer) |

| Brand Portfolio | Big brands (RayBan, Oakley) + best in-house brands |

| Product Types | Sunglasses, reading glasses, contact lenses |

| Target Market | Men, women, kids – all demographics |

Fashion Coverage

- Everyday basics to evening wear

- Annual style updates following global fashion trends

- Inspiration drawn from fashion capitals and world’s best designers

3. Value for Money

Cost Advantage

- Lower prices than local opticians

- Attractive packages on contact lenses

- No middleman costs – direct manufacturer-to-consumer model

- Elimination of extra costs and burdens

4. Customer Trust

Guarantee Policies

| Policy | Details |

|---|---|

| Return Policy | 14-day “no questions asked” refund |

| Warranty | 1-year warranty on all Lenskart products |

| Coverage | Includes prescription lenses |

Mission & Vision

Lenskart aims to help customers “see this beautiful world with more clarity” by providing comprehensive eyewear solutions that combine cutting-edge technology, extensive variety, and exceptional value, all while maintaining the highest standards of quality and customer service.

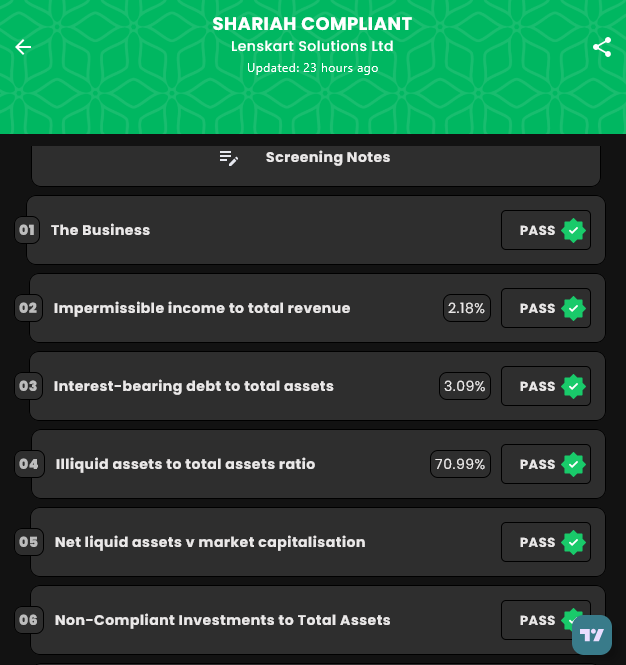

Shariah Status

The IPO is Shariah Compliant, please see below image.

IPO Timeline (Tentative Schedule)

| IPO Open Date | Fri, Oct 31, 2025 |

| IPO Close Date | Tue, Nov 4, 2025 |

| Tentative Allotment | Thu, Nov 6, 2025 |

| Initiation of Refunds | Fri, Nov 7, 2025 |

| Credit of Shares to Demat | Fri, Nov 7, 2025 |

| Tentative Listing Date | Mon, Nov 10, 2025 |

| Cut-off time for UPI mandate confirmation | 5 PM on Tue, Nov 4, 2025 |

Lot Size

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Retail (Min) | 1 | 37 | ₹14,874 |

| Retail (Max) | 13 | 481 | ₹1,93,362 |

| S-HNI (Min) | 14 | 518 | ₹2,08,236 |

| S-HNI (Max) | 67 | 2,479 | ₹9,96,558 |

| B-HNI (Min) | 68 | 2,516 | ₹10,11,432 |

Financials

Lenskart Solutions Ltd. showed robust growth across key metrics between FY2024 and FY2025. Total income surged to ₹7,009.28 crore for the year ended March 31, 2025, up from ₹5,609.87 crore a year earlier (≈25% growth), while interim six‑month income to June 30, 2025 stood at ₹1,946.10 crore. Profit after tax swung markedly into positive territory: PAT rose from a loss of ₹10.15 crore in FY2024 to a profit of ₹297.34 crore in FY2025, with the six‑month PAT at ₹61.17 crore—reflecting improved operational leverage and cost control. EBITDA expanded to ₹971.06 crore in FY2025 from ₹672.09 crore, supporting stronger core profitability. The balance sheet strengthened: assets increased to ₹10,471.02 crore (₹10,845.68 crore as of June 30, 2025) and net worth rose to ₹6,108.30 crore. Reserves and surplus climbed to ₹5,795.00 crore. Total borrowings declined from ₹497.15 crore to ₹345.94 crore, indicating a healthier leverage position.

LINKS

Ready to invest in Shariah-compliant opportunities? Explore more at IslamicStock & consider opening a demat account from the below link!

- Open Demat Account:

- Visit our Website: www.IslamicStock.in

- Read our Blog: blog.islamicstock.in

- Download our App:

SEBI Disclaimer

Investing in IPOs involves risks. Please read the offer document carefully before investing. This article is for informational purposes only and does not constitute financial advice. Investors should consult their financial advisors before making any investment decisions.