Understanding Shariah Compliance in IPOs and Stocks:

Investing wisely is essential for both financial growth and ethical alignment. For those interested in making investments that comply with Islamic law, understanding the Shariah status of Initial Public Offerings (IPOs) and stocks is crucial. This article aims to provide insights into the Shariah compliance of Mehul Colours Ltd IPO (MEHULCOLOURS), ensuring that your investment choices are not only profitable but also ethical.

Table of Contents

What is Shariah Compliance?

Shariah compliance refers to the adherence to Islamic law, which governs various aspects of life, including financial transactions. When it comes to investments, certain criteria must be met to ensure that they are permissible under Shariah law. For example, investments should avoid sectors related to alcohol, gambling, pork, and any form of interest (Riba), etc.

Analyzing Mehul Colours Ltd IPO (MEHULCOLOURS)

Company Name: Mehul Colours Ltd

Industry: Specialiy Chemicals

Listing At: BSE SME

Overview:

Mehul Colours is a leading manufacturer and exporter of Black, White, and Colour Masterbatches in India. Established in 1975 and incorporated in 1995, the company is ISO 9001:2015 certified and operates multiple manufacturing units around Mumbai. Mehul Colours specializes in developing masterbatch solutions that enhance the performance, appearance, and durability of plastics used in packaging, automotive, and construction industries.

The company’s product range includes customized blends of pigments, additives, and resins designed for vibrant colors, UV resistance, and special functionalities. Its commitment to quality, sustainability, and innovation is supported by state-of-the-art infrastructure and a technically skilled team focused on customer satisfaction.

All manufacturing units are equipped with advanced machinery, including high-torque compounding systems, gravimetric feeding, and precision weighing and filtering equipment. Conveniently located, these facilities have fast connectivity to Mumbai’s ports and major transport routes, ensuring efficient distribution.

Mehul Colours also maintains fully equipped laboratories with computerized colour-matching software, spectrophotometers, injection moulding machines, melt flow indexers, and testing equipment. This setup allows the company to consistently meet high standards in quality, quantity, cost-efficiency, and on-time delivery.

With decades of expertise and a professional, customer-centric approach, Mehul Colours continues to provide innovative and reliable masterbatch solutions that shape the future of plastics.

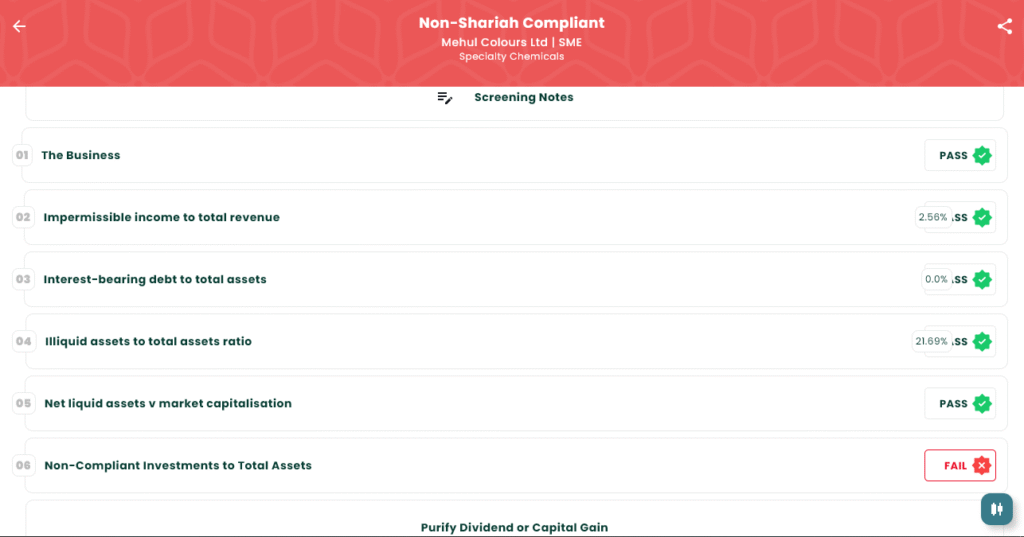

Shariah Status

The IPO is Non-Shariah Compliant, please see below image.

Additional Considerations:

When opting for Shariah-compliant investments, it is essential to regularly check the status in our App. This ensures that the evolving nature of businesses or other financial data does not compromise the compliance status of your investments.

IPO Timeline (Tentative Schedule)

| IPO Open Date | Wed, Jul 30, 2025 |

| IPO Close Date | Fri, Aug 1, 2025 |

| Tentative Allotment | Mon, Aug 4, 2025 |

| Initiation of Refunds | Tue, Aug 5, 2025 |

| Credit of Shares to Demat | Tue, Aug 5, 2025 |

| Tentative Listing Date | Wed, Aug 6, 2025 |

| Cut-off time for UPI mandate confirmation | 5 PM on August 1, 2025 |

Lot Size

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Individual investors (Retail) (Min) | 2 | 3,200 | ₹2,30,400 |

| Individual investors (Retail) (Max) | 2 | 3,200 | ₹2,30,400 |

| S-HNI (Min) | 3 | 4,800 | ₹3,45,600 |

| S-HNI (Max) | 8 | 12,800 | ₹9,21,600 |

| B-HNI (Min) | 9 | 14,400 | ₹10,36,800 |

Financials

Assets demonstrate consistent growth, rising from 10.82 in 2023 to 18.95 in 2025. Revenue also shows a steady increase, reaching 23.71 by 2025. Significantly, Profit After Tax nearly doubled from 2.94 to 5.50 over the period, indicating improved profitability. EBITDA similarly increased, and Net Worth grew substantially from 8.36 to 17.06, reflecting increasing shareholder value. Reserves and Surplus also saw a healthy rise. Notably, Total Borrowing is only reported for 2024 at 0.36. Overall, the data points to a financially strengthening company.

KPI

| KPI | Values |

|---|---|

| ROE | 38.46% |

| ROCE | 43.53% |

| RoNW | 32.26% |

| PAT Margin | 24.11% |

| EBITDA Margin | 30.17% |

| Price to Book Value | 4.70 |

LINKS

Ready to invest in Shariah-compliant opportunities? Explore more at IslamicStock & consider opening a demat account from the below link!

- Open Demat Account:

- Visit our Website: www.IslamicStock.in

- Read our Blog: blog.islamicstock.in

- Download our App:

SEBI Disclaimer

Investing in IPOs involves risks. Please read the offer document carefully before investing. This article is for informational purposes only and does not constitute financial advice. Investors should consult their financial advisors before making any investment decisions.