Understanding Shariah Compliance in IPOs and Stocks:

Investing wisely is essential for both financial growth and ethical alignment. For those interested in making investments that comply with Islamic law, understanding the Shariah status of Initial Public Offerings (IPOs) and stocks is crucial. This article aims to provide insights into the Shariah compliance of Narmadesh Brass Industries Ltd, a modern choice for ensuring that your investment choices are not only profitable but also ethical.

Table of Contents

LINKS

Explore Shariah-compliant investment opportunities with IslamicStock.

Before we dive in, consider these links to quickly open your demat account.

Our mobile app links are also available below.

- Open Demat Account:

- Visit our Website: www.IslamicStock.in

- Read our Blog: blog.islamicstock.in

- Download our App:

Analyzing The Company

Company Name: Narmadesh Brass Industries Ltd

Listing At: NSE (SME)

Overview

Narmadesh Brass Industries Limited (NBIL) operates as a leading manufacturer, exporter, and supplier of high-quality ferrous and non-ferrous metal components, specializing in continuous casting rods and precision-engineered metal solutions. The company has established itself as a reliable industry partner through years of expertise and unwavering commitment to excellence.

Product Portfolio & Market Reach

NBIL has developed over 350 customized components serving diverse industries including electrical, automotive, plumbing, sanitary, hardware, electronics, and kitchen applications. The company’s global presence is demonstrated through successful exports to the USA, Europe, Australia, Canada, South Africa, UAE, and other international markets.

Infrastructure & Capabilities

The organization maintains sophisticated infrastructure equipped with cutting-edge technology, including a brass extrusion plant, VMC, CNC, SPM, forging unit, sheet cutting facilities, and plating plant. This comprehensive setup enables NBIL to maintain the highest quality standards while offering complete manufacturing solutions under one roof, from importing quality raw materials to delivering finished products.

Quality Assurance & Certifications

As an ISO 9001:2015 certified company, NBIL implements stringent in-house quality control measures using advanced instruments and online monitoring systems. The organization also holds EHS and OHSAS certifications, reinforcing its commitment to environmental, health, and safety standards.

Organizational Philosophy

Mission: The Narmadesh Group’s renowned reputation ensures clients receive the best quality products at competitive prices while constantly adapting to evolving customer requirements.

Vision: The company strives to excel in performance and achieve perfection through flawless production, timely delivery, and competitive pricing.

Commitment: NBIL focuses on understanding and exceeding customer expectations while delivering high-quality products, services, and solutions for demanding requirements.

Core Values: The organization emphasizes continuous improvement in products and services, maintaining perfect understanding of client needs while adhering to corporate social responsibility principles. NBIL leverages its highly skilled workforce and well-equipped quality instruments, combined with deep understanding of core manufacturing processes and precision component tolerance levels.

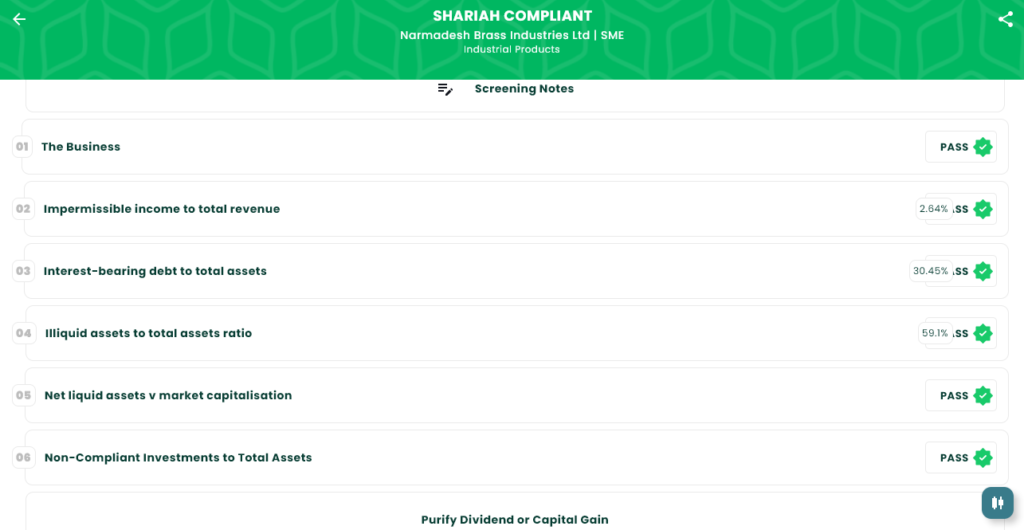

Shariah Status

The IPO is Shariah Compliant, please see below image.

IPO Timeline (Tentative Schedule)

| IPO Open Date | Jan 12, 2026 |

| IPO Close Date | Jan 15, 2026 |

| Tentative Allotment | Jan 16, 2026 |

| Initiation of Refunds | Jan 19, 2026 |

| Credit of Shares to Demat | Jan 19, 2026 |

| Tentative Listing Date | Jan 20, 2026 |

Financials

Narmadesh Brass Industries Limited demonstrates robust financial growth trajectory with improving profitability and balance-sheet strength across the reported periods. Total assets expanded from ₹22.00 crore (FY23) to ₹46.68 crore (FY24) and ₹59.66 crore (FY25), reaching ₹63.10 crore by 30 Sep 2025, reflecting significant capital deployment and operational scaling.

Revenue generation strengthened considerably: total income grew from ₹60.09 crore (FY23) to ₹79.06 crore (FY24) and ₹88.05 crore (FY25), with ₹34.21 crore recorded for the six months to Sep‑25, indicating a consistent growth momentum. Operating efficiency improved markedly, with EBITDA climbing from ₹2.13 crore (FY23) to ₹11.41 crore (FY24) and ₹9.34 crore (FY25), demonstrating enhanced operational leverage despite recent moderation.

Bottom-line profitability surged from ₹0.89 crore (FY23) to ₹7.10 crore (FY24) and ₹5.72 crore (FY25), with ₹4.01 crore in H1 FY26, showing strong earnings conversion. Net worth improved substantially from ₹8.30 crore (FY23) to ₹5.73 crore (FY24), rebounding to ₹11.45 crore (FY25) and ₹22.46 crore by Sep‑25, supported by rising reserves and surplus (₹6.97 → ₹12.69 → ₹23.30 crore).

Total borrowings remained moderate at ₹19.21 crore (Sep‑25), down from ₹24.73 crore (FY25), reflecting disciplined leverage management. Overall, NBIL exhibits strong financial fundamentals with accelerating asset base, improving profitability, strengthened equity, and manageable debt levels.

SEBI Disclaimer

Investing in IPOs involves risks. Please read the offer document carefully before investing. This article is for informational purposes only and does not constitute financial advice. Investors should consult their financial advisors before making any investment decisions.