Understanding Shariah Compliance in IPOs and Stocks:

Investing wisely is essential for both financial growth and ethical alignment. For those interested in making investments that comply with Islamic law, understanding the Shariah status of Initial Public Offerings (IPOs) and stocks is crucial. This article aims to provide insights into the Shariah compliance of NIS Management Ltd, ensuring that your investment choices are not only profitable but also ethical.

Table of Contents

Analyzing The Company

Company Name: NIS Management Ltd

Industry: Other Consumer Services

Listing At: BSE SME

Overview:

Founded by Mr. Debajit Choudhury, the Managing Director of the Company, NIS is a reputed brand name today. Our company emanates the spirit of innovation, dedication and aspires to provide world class services to its customers. Being in a service sector, client satisfaction is at the heart of our business. Also, NIS would fail to run without people, it is a business that thrives on manpower, therefore employee satisfaction is vital to us. Our company today has a strength of approximately 16000 personnel, operating in 14 states across India.

NIS has a specialized cell run by senior professionals who are expert in developing all security related SOPs, Manuals, Crisis Management Plans, Contingency Planning, and Occupational Safety & Health Policies.

At NIS we believe in building sustainable long-term relationships, which help us to deliver personalized services to our customers in all areas of work. Staying united, being compassionate and working diligently are the key factors that play a pivotal role behind our achievement.

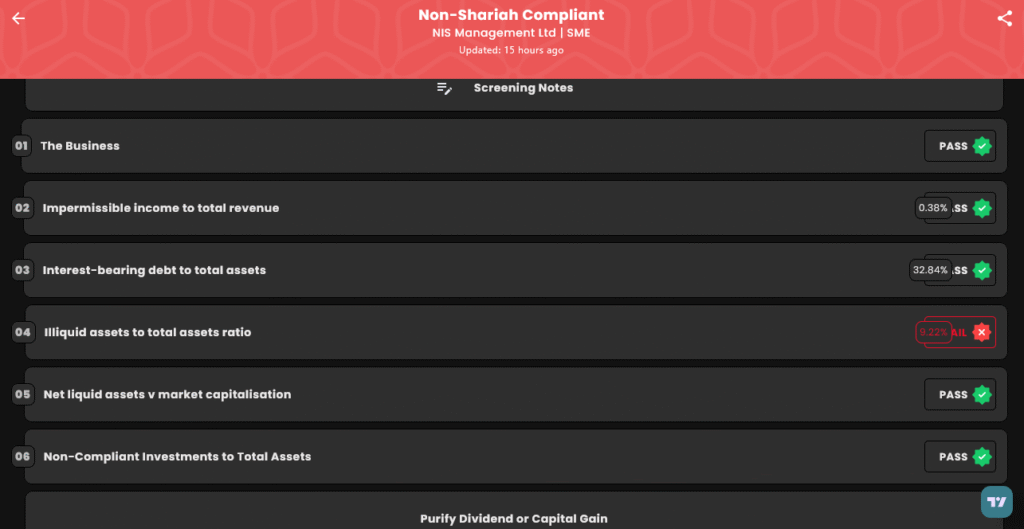

Shariah Status

The IPO is Non-Shariah Compliant, please see below image.

IPO Timeline (Tentative Schedule)

| IPO Open Date | Mon, Aug 25, 2025 |

| IPO Close Date | Thu, Aug 28, 2025 |

| Tentative Allotment | Fri, Aug 29, 2025 |

| Initiation of Refunds | Mon, Sep 1, 2025 |

| Credit of Shares to Demat | Mon, Sep 1, 2025 |

| Tentative Listing Date | Tue, Sep 2, 2025 |

| Cut-off time for UPI mandate confirmation | 5 PM on August 28, 2025 |

Lot Size

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Individual investors (Retail) (Min) | 2 | 2,400 | ₹2,66,400 |

| Individual investors (Retail) (Max) | 2 | 2,400 | ₹2,66,400 |

| S-HNI (Min) | 3 | 3,600 | ₹3,99,600 |

| S-HNI (Max) | 7 | 8,400 | ₹9,32,400 |

| B-HNI (Min) | 8 | 9,600 | ₹10,65,600 |

Financials

The financial data for NIS Management Ltd. for the financial years ending March 31, 2025, 2024, and 2023 is as follows.

The company’s revenue increased by 7% and its profit after tax (PAT) grew by 2% between the 2024 and 2025 fiscal years. Total Income rose from ₹341.93 in 2023 to ₹405.33 in 2025, while Net Worth grew from ₹114.55 to ₹152.00.

KPI

| KPI | Values |

|---|---|

| ROE | 13.10% |

| ROCE | 17.63% |

| Debt/Equity | 0.55 |

| RoNW | 13.10% |

| PAT Margin | 4.64% |

| EBITDA Margin | 6.54% |

| Price to Book Value | 0.61 |

LINKS

Ready to invest in Shariah-compliant opportunities? Explore more at IslamicStock & consider opening a demat account from the below link!

- Open Demat Account:

- Visit our Website: www.IslamicStock.in

- Read our Blog: blog.islamicstock.in

- Download our App:

SEBI Disclaimer

Investing in IPOs involves risks. Please read the offer document carefully before investing. This article is for informational purposes only and does not constitute financial advice. Investors should consult their financial advisors before making any investment decisions.