Understanding Shariah Compliance in IPOs and Stocks:

Investing wisely is essential for both financial growth and ethical alignment. For those interested in making investments that comply with Islamic law, understanding the Shariah status of Initial Public Offerings (IPOs) and stocks is crucial. This article aims to provide insights into the Shariah compliance of National Securities Depository Ltd IPO (NSDL), ensuring that your investment choices are not only profitable but also ethical.

Table of Contents

What is Shariah Compliance?

Shariah compliance refers to the adherence to Islamic law, which governs various aspects of life, including financial transactions. When it comes to investments, certain criteria must be met to ensure that they are permissible under Shariah law. For example, investments should avoid sectors related to alcohol, gambling, pork, and any form of interest (Riba), etc.

Analyzing National Securities Depository Ltd IPO (NSDL)

Company Name: National Securities Depository Ltd

Industry: Capital Markets

Listing At: BSE & NSE (MAINBOARD)

Overview:

NSDL, one of the largest Depositories in the World, established in August 1996 has established a state-of-the-art infrastructure that handles most of the securities held and settled in dematerialized form in the Indian capital market. Although India had a vibrant capital market which is more than a century old, the paper-based settlement of trades caused substantial problems like bad delivery and delayed transfer of title, etc. The enactment of Depositories Act in August 1996 paved the way for establishment of NSDL.

Using innovative and flexible technology systems, NSDL works to support the investors and brokers in the capital market of the country. NSDL aims at ensuring the safety and soundness of Indian marketplaces by developing settlement solutions that increase efficiency, minimize risk and reduce costs. At NSDL, we play a central role in developing products and services that will continue to nurture the growing needs of the financial services industry. In the depository system, securities are held in depository accounts, which is more or less similar to holding funds in bank accounts. Transfer of ownership of securities is done through simple account transfers. This method does away with all the risks and hassles normally associated with paperwork. Consequently, the cost of transacting in a depository environment is considerably lower as compared to transacting in certificates.

NSDL provides bouquet of services to investors, stock brokers, custodians, issuer companies etc. through its nation wide network of Depository Partners.

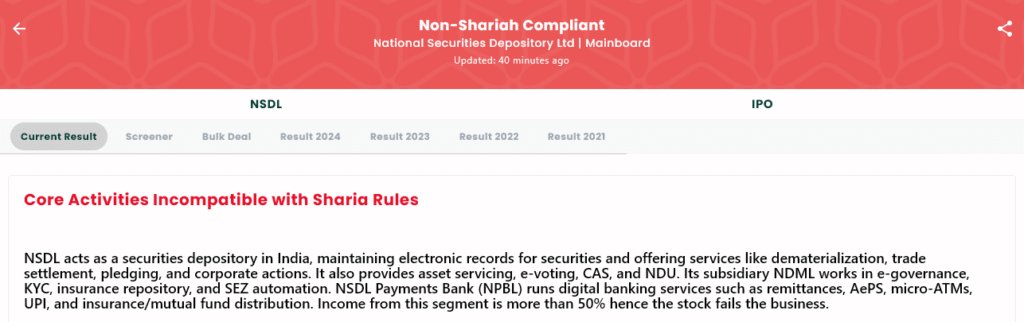

Shariah Status

The IPO is Non-Shariah Compliant, please see below image.

Additional Considerations:

When opting for Shariah-compliant investments, it is essential to regularly check the status in our App. This ensures that the evolving nature of businesses or other financial data does not compromise the compliance status of your investments.

IPO Timeline (Tentative Schedule)

| IPO Open Date | Tue, Jul 30, 2025 |

| IPO Close Date | Thu, Aug 1, 2025 |

| Tentative Allotment | Fri, Aug 4, 2025 |

| Initiation of Refunds | Mon, Aug 5, 2025 |

| Credit of Shares to Demat | Mon, Aug 5, 2025 |

| Tentative Listing Date | Tue, Aug 6, 2025 |

| Cut-off time for UPI mandate confirmation | 5 PM on July 31, 2025 |

LINKS

Ready to invest in Shariah-compliant opportunities? Explore more at IslamicStock.in & consider opening a demat account from below link!

- Open Demat Account:

- Visit our Website: www.IslamicStock.in

- Read our Blog: blog.islamicstock.in

- Download our App:

SEBI Disclaimer

Investing in IPOs involves risks. Please read the offer document carefully before investing. This article is for informational purposes only and does not constitute financial advice. Investors should consult their financial advisors before making any investment decisions.