Below is a point-wise breakdown of the Oswal Pumps Ltd IPO, featuring its Shariah compliance, GMP trends, and other essential details regarding OSWALPUMPS.

Table of Contents

1. IPO Snapshot

Symbol: OSWALPUMPS

IPO Open Date: 13 June 2025

IPO Close Date: 17 June 2025

IPO Allotment Date: 18 June 2025

IPO Listing Date: 20 June 2025

Issue Size: ₹1,387.34 crore (₹890 Cr fresh issue + ₹497.34 Cr offer for sale)

Issue Type: Book-built Mainboard IPO

Price Band: ₹584 to ₹614 per share

Lot Size: 24 shares

Minimum Investment: ₹14,016 (24 shares at ₹584)

Listing Exchange: BSE & NSE

2. Company Overview

Oswal Pumps Ltd is a leading Indian manufacturer of pumping solutions with a strong presence in both domestic and international markets. The company was incorporated in 2003 and operates under the brand name “Oswal”, which is well-recognized in the water management and solar energy sectors.

As part of its innovative product line, OSWALPUMPS focuses on creating sustainable solutions to meet the growing demand in the market.

Among its various offerings, OSWALPUMPS has gained recognition for its solar pumps that align with renewable energy initiatives.

The innovative approach of OSWALPUMPS contributes to the efficiency of water management systems.

With OSWALPUMPS’ in-house manufacturing, customers can expect superior quality and reliability.

OSWALPUMPS ensures that all solar water pumping systems are designed to meet client needs effectively.

The distribution network of OSWALPUMPS spans the entire country, ensuring accessibility for all customers.

Investors are keen on OSWALPUMPS due to its strong growth trajectory and market positioning.

The IPO proceeds will empower OSWALPUMPS to further enhance its operational capabilities.

The company manufactures a wide range of products including submersible pumps, monoblock pumps, sewage pumps, open-well pumps, pressure booster systems, solar pumps, motors, and control panels. It has over 1,250+ active product models and caters to multiple end users including agriculture, industrial, residential, and solar power applications.

Oswal Pumps Ltd operates from two integrated manufacturing facilities located in Karnal, Haryana. One unit focuses on conventional pumps and motors, while the second is dedicated to solar equipment, including solar panels and solar water pumping systems. The solar division aligns with the Government of India’s push for renewable energy and contributes significantly to the company’s revenue.

What sets Oswal apart is its in-house manufacturing capabilities. The company controls almost every part of its production process—from casting, rotor and stator manufacturing, copper wire winding, motor body assembly, to powder coating and final packaging. This vertical integration ensures better cost control, product quality, and scalability.

The company also offers turnkey solutions for solar water pumping systems. This includes everything from engineering and design to installation, commissioning, and post-sale services. This end-to-end approach makes it easier for customers to adopt solar technologies with minimal technical hurdles.

Oswal Pumps has a wide distribution and service network across India. It has tie-ups with more than 2,000 dealers and a presence in 20+ states. The brand is known for its reliability, low maintenance costs, and energy efficiency, which have helped it build strong customer trust over the years.

From a financial perspective, the company has demonstrated strong growth. As per recent financials, Oswal Pumps Ltd has achieved a revenue CAGR of over 45% between FY22 and FY24, and has shown steady improvement in profit margins. The strong balance sheet, increasing demand for solar products, and robust order book support a positive business outlook.

In summary, Oswal Pumps Ltd is a well-diversified manufacturing company with deep expertise in water and solar pumping technologies. Its strong operational infrastructure, brand strength, and focus on sustainable energy make it a strong player in the industrial and agricultural utility space. The company aims to use IPO proceeds to further scale operations, improve working capital, and explore new growth areas in clean energy and water management.

3. Grey Market Premium (GMP)

Ahead of the IPO opening, Oswal Pumps shares were trading at a grey market premium of ₹70, indicating around 11% premium over the upper band of ₹614.

But on the last day, the GMP dropped & came at ₹57.

This reflects moderate sentiment but investors should treat GMP as speculative and rely more on fundamentals.

4. Shariah Compliance Status

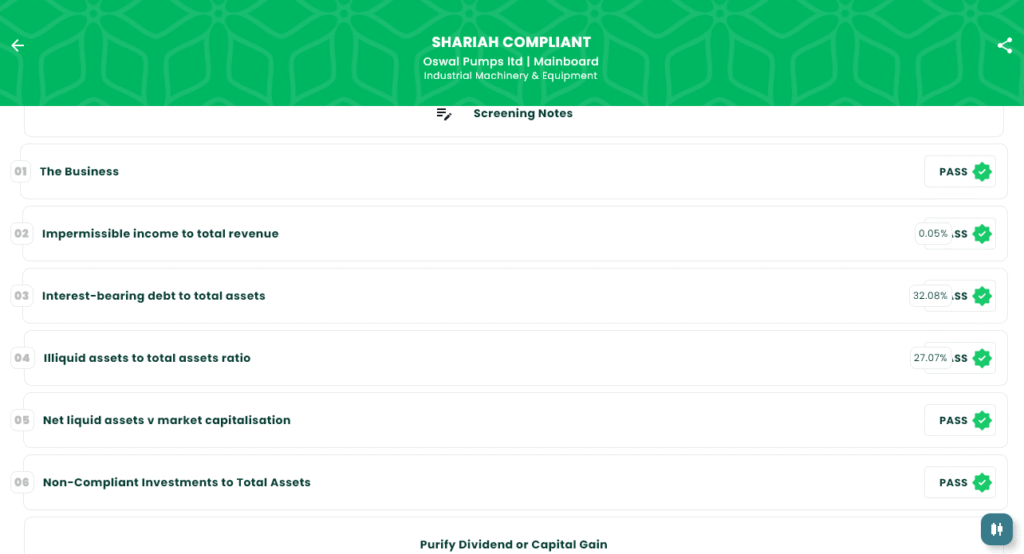

According to IslamicStock app, Oswal Pumps Ltd is Shariah Compliant, having cleared all business and financial screens:

OSWALPUMPS’ commitment to sustainable practices makes it a strong contender in the green technology sector.

✅ Business activity is halal (pump manufacturing)

✅ Impermissible income to total revenue is less than 5 percent

✅ Interest-bearing debt to total assets is less than 33 percent

✅ Illiquid assets to total assets are more than 20 percent

✅ Net liquid assets vs market capitalization is also passed

✅ Non-compliant investments are less than 33 percent

Understanding the potential of OSWALPUMPS is essential for making informed investment decisions.

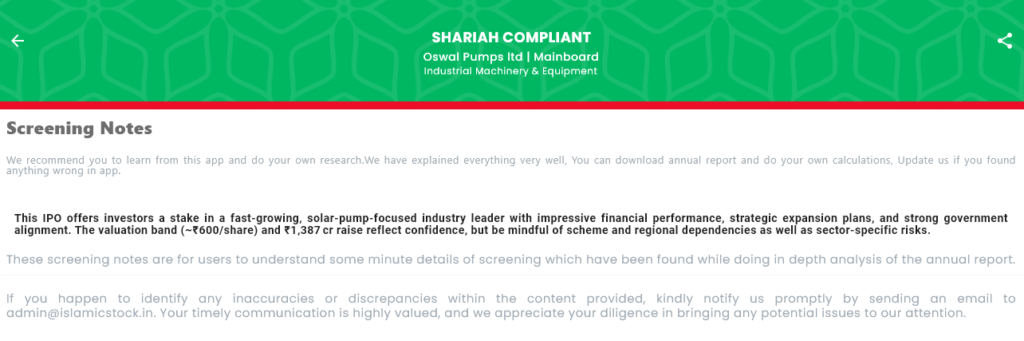

All ratios fall within acceptable Shariah thresholds. Investors should note regional and scheme-related dependencies, per IslamicStock’s screening notes.

5. Subscription Status

As of Day 3 (June 17, 2025), the Oswal Pumps IPO has been subscribed 3.30 times in total, showing significant demand in the NII (HNI) and Retail segments.

Here’s the category-wise breakdown:

- QIB: 0.34x (45,19,024 shares offered; 15,55,464 shares bid)

- NII (Total): 10.99x

- bNII (₹10L+): 12.83x (22,59,511 shares offered; 2,89,88,928 shares bid)

- sNII (Below ₹10L): 6.98x (11,29,756 shares offered; 78,81,600 shares bid)

- Retail: 1.70x (79,08,290 shares offered; 1,34,37,984 shares bid)

- Total Applications: 4,97,512

- Overall Subscription: 3.30x (1,58,16,581 shares offered; 5,22,33,936 shares bid)

This strong response, especially from HNIs, indicates high investor interest.

6. Final Thoughts

Oswal Pumps is well-positioned in a high-growth solar pump segment with a vertically integrated setup, strong financials, and government-aligned business model.

The valuation band is reasonable given recent earnings (revenue FY24 ~₹761 cr; PAT ~₹98 cr).

It is fully Shariah compliant, offering a halal investment choice. However, investors should assess the large minimum investment, monitor subscription trends, and stay alert to sector-specific risks including region or policy fluctuations.

7. Disclaimer

This article is for informational purposes only and is not a buy or sell recommendation. Investors should read the red herring prospectus, track live subscription updates, consult financial advisors, and conduct personal due diligence before investing. IslamicStock’s Shariah screening reflects the latest detailed report data; users are encouraged to verify or point out any errors.