Understanding Shariah Compliance in IPOs and Stocks:

Investing wisely is essential for both financial growth and ethical alignment. For those interested in making investments that comply with Islamic law, understanding the Shariah status of Initial Public Offerings (IPOs) and stocks is crucial. This article aims to provide insights into the Shariah compliance of Oval Projects Engineering Ltd, ensuring that your investment choices are not only profitable but also ethical.

Table of Contents

Analyzing The Company

Company Name: Oval Projects Engineering Ltd

Industry: Civil Construction

Listing At: BSE SME

Overview:

Founded in 2013, OVAL Projects Engineering Limited has established itself as a leader in infrastructure development for the oil and gas, city gas distribution, urban development, and energy industries in India. The company, which began in Agartala, has since expanded its reach across the entire nation. Its commitment to high standards is demonstrated by its MSME, ISO 14001:2015, ISO 9001:2015, and OHSAS 18001:2007 certifications.

OVAL Projects offers turnkey solutions from project conceptualization to execution. Their services include pipeline engineering and construction, turnkey project solutions, infrastructure development and maintenance, and RTP, CGD, PNG, and CNG works. With a focus on end-to-end project management, they specialize in delivering projects in the most challenging environments.

The company’s mission is to deliver high-quality infrastructure projects that adhere to the highest standards of safety, efficiency, and environmental responsibility, contributing to sustainable development. Their vision is to become an industry leader by setting new standards in quality, innovation, and customer satisfaction, building enduring relationships rooted in trust.

The team at OVAL Projects is composed of seasoned professionals who use advanced technology and industry best practices. Their core values are quality, integrity, innovation, and sustainability. They are committed to delivering exceptional quality, operating with honesty and transparency, embracing new technologies, and prioritizing environmentally responsible practices. OVAL Projects aims to be a partner committed to excellence, sustainability, and results-driven performance.

Shariah Status

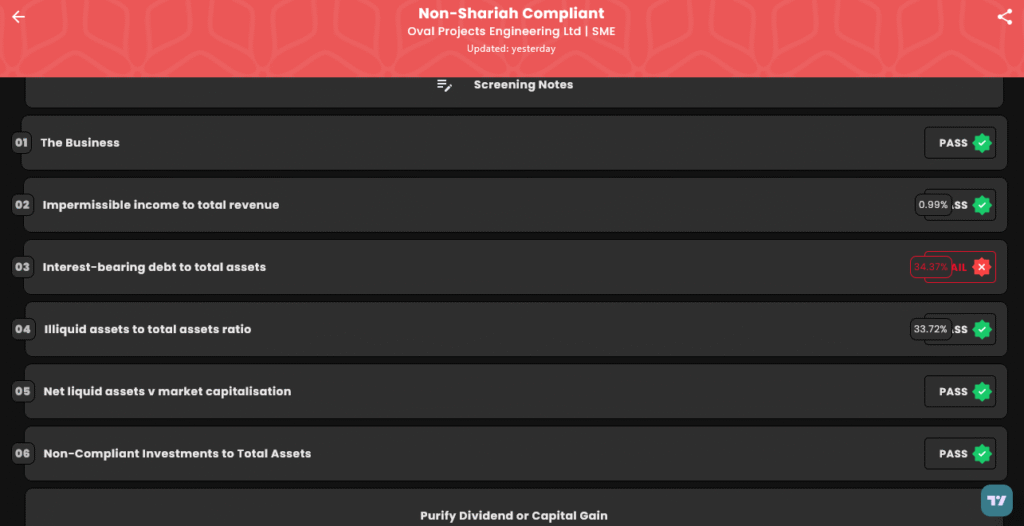

The IPO is Non-Shariah Compliant, please see below image.

IPO Timeline (Tentative Schedule)

| IPO Open Date | Thu, Aug 28, 2025 |

| IPO Close Date | Mon, Sep 1, 2025 |

| Tentative Allotment | Tue, Sep 2, 2025 |

| Initiation of Refunds | Wed, Sep 3, 2025 |

| Credit of Shares to Demat | Wed, Sep 3, 2025 |

| Tentative Listing Date | Thu, Sep 4, 2025 |

| Cut-off time for UPI mandate confirmation | 5 PM on September 1, 2025 |

Lot Size

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Individual investors (Retail) (Min) | 2 | 3,200 | ₹2,72,000 |

| Individual investors (Retail) (Max) | 2 | 3,200 | ₹2,72,000 |

| S-HNI (Min) | 3 | 4,800 | ₹4,08,000 |

| S-HNI (Max) | 7 | 11,200 | ₹9,52,000 |

| B-HNI (Min) | 8 | 12,800 | ₹10,88,000 |

Financials

Oval Projects Engineering Limited’s financial performance demonstrates substantial growth. Between March 31, 2023, and March 31, 2025, the company’s Profit After Tax (PAT) more than doubled, increasing from ₹3.19 crore to ₹9.33 crore. Revenue, reflected in Total Income, grew from ₹64.09 crore to ₹103.44 crore over the same period. The company also strengthened its financial position, with Assets rising from ₹82.25 crore to ₹156.23 crore. Additionally, EBITDA saw a significant increase, climbing from ₹3.46 crore to ₹18.08 crore, indicating improved operational profitability. These metrics collectively highlight a robust two-year period of expansion and enhanced financial health.

KPI

| KPI | Values |

|---|---|

| ROE | 20.85% |

| ROCE | 21.32% |

| RoNW | 20.85% |

| PAT Margin | 9.12% |

| EBITDA Margin | 17.68% |

| Price to Book Value | 2.67 |

LINKS

Ready to invest in Shariah-compliant opportunities? Explore more at IslamicStock & consider opening a demat account from the below link!

- Open Demat Account:

- Visit our Website: www.IslamicStock.in

- Read our Blog: blog.islamicstock.in

- Download our App:

SEBI Disclaimer

Investing in IPOs involves risks. Please read the offer document carefully before investing. This article is for informational purposes only and does not constitute financial advice. Investors should consult their financial advisors before making any investment decisions.