Understanding Shariah Compliance in IPOs and Stocks:

Investing wisely is essential for both financial growth and ethical alignment. For those interested in making investments that comply with Islamic law, understanding the Shariah status of Initial Public Offerings (IPOs) and stocks is crucial. This article aims to provide insights into the Shariah compliance of Patel Retail Ltd (PATELRMART), ensuring that your investment choices are not only profitable but also ethical.

Table of Contents

Analyzing The Company

Company Name: Patel Retail Ltd

Industry: Diversified Retail

Listing At: NSE & BSE (Mainboard)

Overview:

Mr. Dhanji Patel, a member of the agricultural Patel community from Gujarat’s Kutch district, moved to Ambarnath, Maharashtra, in 1984. Joining his brother in the grocery business, he worked diligently for six years before opening his own store, Patel Enterprises, in 1990. The store’s success led him to embrace the growing supermarket trend, and he launched the first Patel R Mart in Ambarnath in 2003.

Patel Retail continued to expand, opening multiple stores and venturing into the export industry, earning recognition as a 4-star export house from the Government of India. In 2016, the company established a food processing factory in Dudhai to process various agricultural products like peanuts and spices. The company’s success is built on a direct sourcing model, buying commodities directly from farmers, which provides a reliable market for the agricultural community. This business model, rooted in Mr. Dhanji Patel’s farming heritage, has ensured quality products and a sustainable growth path. What began as a small grocery store has now blossomed into a successful enterprise, driven by a commitment to integrity, innovation, and customer satisfaction.

Shariah Status

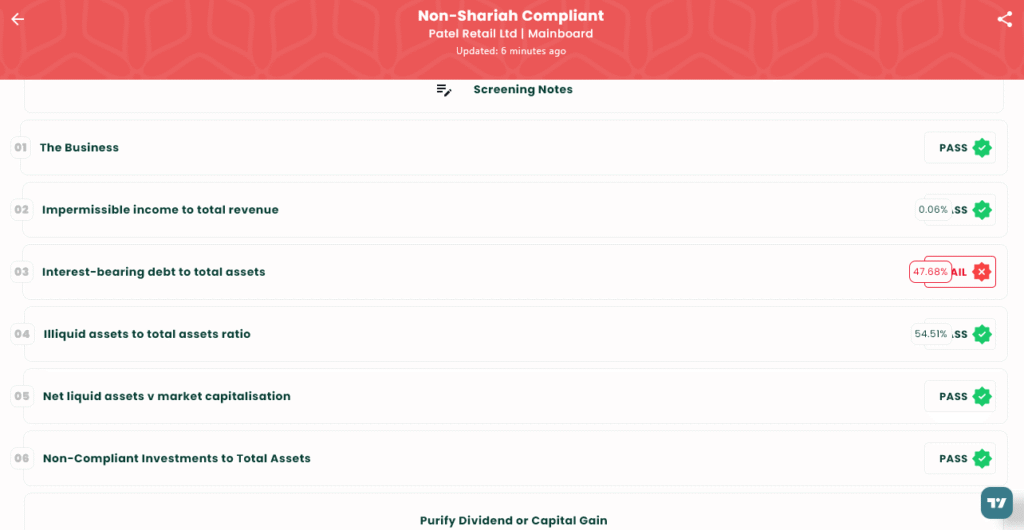

The IPO is Non-Shariah Compliant, please see below image.

Additional Considerations:

When opting for Shariah-compliant investments, it is essential to regularly check the status in our App. This ensures that the evolving nature of businesses or other financial data does not compromise the compliance status of your investments.

IPO Timeline (Tentative Schedule)

| IPO Open Date | Tue, Aug 19, 2025 |

| IPO Close Date | Thu, Aug 21, 2025 |

| Tentative Allotment | Fri, Aug 22, 2025 |

| Initiation of Refunds | Mon, Aug 25, 2025 |

| Credit of Shares to Demat | Mon, Aug 25, 2025 |

| Tentative Listing Date | Tue, Aug 26, 2025 |

| Cut-off time for UPI mandate confirmation | 5 PM on August 21, 2025 |

Lot Size

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Retail (Min) | 1 | 58 | ₹14,790 |

| Retail (Max) | 13 | 754 | ₹1,92,270 |

| S-HNI (Min) | 14 | 812 | ₹2,07,060 |

| S-HNI (Max) | 67 | 3,886 | ₹9,90,930 |

| B-HNI (Min) | 68 | 3,944 | ₹10,05,720 |

Financials

The company’s Total Income has experienced a precipitous decline, dropping from a robust ₹1,019.80 crore in March 2023 to a mere ₹825.99 crore by March 2025.

The company’s Total Borrowing, while showing a slight decrease, remains a heavy burden, highlighting a reliance on debt that could hinder future growth and financial stability.

KPI

| KPI | Values |

|---|---|

| ROE | 19.02% |

| ROCE | 14.43% |

| Debt/Equity | 1.34 |

| RoNW | 19.02% |

| PAT Margin | 3.08% |

| EBITDA Margin | 7.61% |

| Price to Book Value | 4.72 |

LINKS

Ready to invest in Shariah-compliant opportunities? Explore more at IslamicStock & consider opening a demat account from the below link!

- Open Demat Account:

- Visit our Website: www.IslamicStock.in

- Read our Blog: blog.islamicstock.in

- Download our App:

SEBI Disclaimer

Investing in IPOs involves risks. Please read the offer document carefully before investing. This article is for informational purposes only and does not constitute financial advice. Investors should consult their financial advisors before making any investment decisions.