Purify Interest Bearing Debt or Non-Sharia Income?

“Do we need to purify the amount which is equivalent to Interest-Bearing Debt of the Companies” (This is wrong statement)

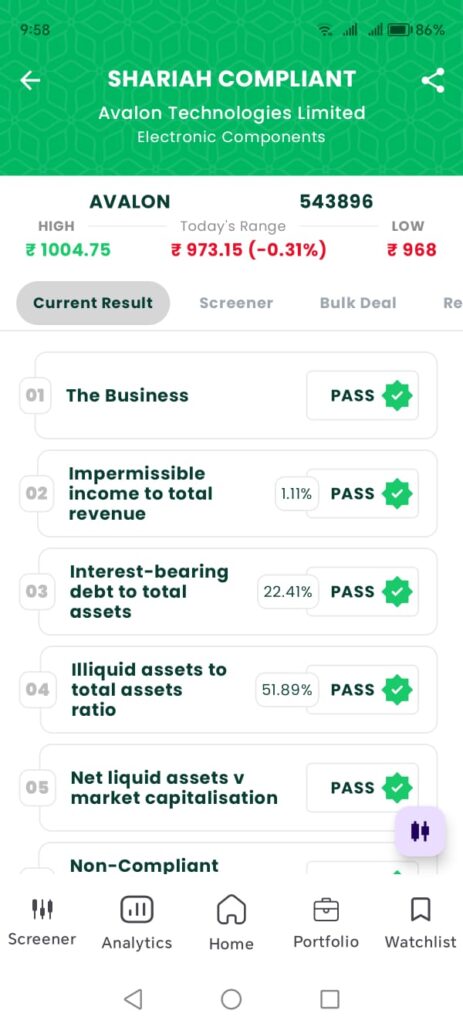

One of my friends has shown me the below Stock with his calculation (See Above Attached Screenshot)

Stock Name: AVALON

Interest-Bearing Debt: 22.41%

The purification amount will be 22.41% of my total Profit (From Capital Gain or Dividend)

He asked if it was correct or not.

I told him it was a wrong understanding of purification calculation.

The right calculation of the purification amount is the percentage of non-Sharia income companies are getting, which is mixed with our profits, either in capital gain or dividend income.

So, in the above-mentioned Stock Name AVALON

The amount needed to purify from the profits (From Capital Gain or Dividend) is 1.11% which is the Impermissible income of this company AVALON.

Note: Let’s understand both

1. What is Interest Bearing Debt of any company? and why is it not considered for purification purposes?

Answer: Interest Bearing Debt means companies taking Interest-Based Loan ( Soodi Qarz ). So, if companies take interest based loan it means he has to pay the interest to the Bank.

Khulasa kalam yeh hoa ki soodi qarz company ne kitna liya hai yeh uska percentage dikhata hai jo ki ooper ke example me 22.41% hai.

Chunki yeh company ne qarz lia hai aur uska sood pay kerti hai to yeh hamare profit ( (Capital Gain or Dividend) me koi asar nahi daalta hai isliye isko purification ke liye consider nahi kia jata hai.

2. What is the Non-Sharia Income of any company? and why is it considered for purification purposes?

Answer: Non-Sharia Income means companies earning benefits from Non-Sharia activities ( Like; fixed Soodi Deposit Interest or any other Non-Sharia Activities ).

So, if companies earn from above mentioned activities which is not allowed in Islam if we get Profits (Capital Gain or Dividend) from these companies we need to remove this much amount from our Profits. Jo ki ooper ke example me 1.11% hai.

Chunki yeh company ne earn kiya hai jo ki islam me allow nahi tha isliye isko purification ke liye consider kia jata hai.

Conclusion:

Sood Dena aur Sood Lena dono alag alag cheez hai isko samzah gaye to yeh masla bahoot asaani se samazh ajayegi.

Sood Dena: Interest Bearing Debt me Sood diya jata hai

Sood Lena: Sood lene ka amal Non-Sharia Income me aata hai (Include any other Non-Sharia Income also)

Hope it is clear now why we purify from Non-Sharia Income instead of Interest-Bearing Debt.

Jis Income/Profits ke saath ganda maal shamil hota hai usi ki safai (Purify) ki jayegi.