Understanding Shariah Compliance in IPOs and Stocks:

Investing wisely is essential for both financial growth and ethical alignment. For those interested in making investments that comply with Islamic law, understanding the Shariah status of Initial Public Offerings (IPOs) and stocks is crucial. This article aims to provide insights into the Shariah compliance of Regaal Resources Ltd, ensuring that your investment choices are not only profitable but also ethical.

Table of Contents

Analyzing The Company

Company Name: Regaal Resources Ltd

Industry: Other Agricultural Products

Listing At: NSE & BSE (Mainboard)

Overview:

Regaal Resources Limited (RRL) is a prominent agro-processing company in India that specializes in the manufacturing of high-quality maize starch, specialty starches, food-grade starches, and various starch derivative products.

Founded in 2016, with production commencing in 2018, the company has experienced significant growth. It has rapidly expanded its daily crushing capacity from 180 Metric Tonne Per Day (MTPD) to over 750 MTPD, establishing itself as the second-largest player in Eastern India and the fastest-growing company in the country’s corn wet milling industry.

RRL’s headquarters are located in Kolkata’s IT Hub, Sector V, while its state-of-the-art manufacturing facility, which spans over 50 acres, is situated in Kishanganj, Bihar—a major hub for maize production in India.

As an ISO-certified organization, the company is committed to delivering top-quality products to customers both domestically and internationally. Its products are widely utilized across various industries, including paper, pharmaceuticals, food, textile, and animal feed.

The company has also been recognized as a ‘Great Place to Work,’ and it consistently aims to provide excellent facilities and opportunities for the personal and professional development of all its employees.

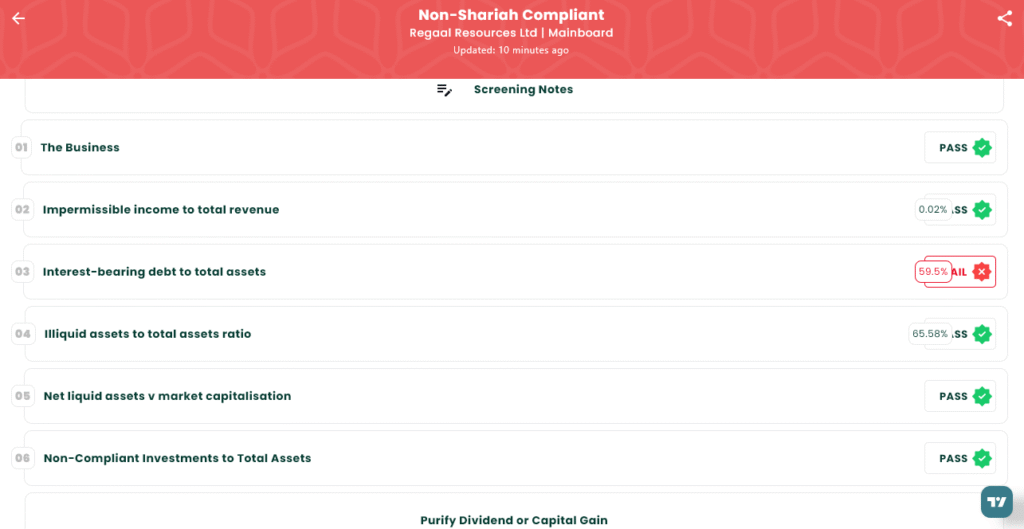

Shariah Status

The IPO is Non-Shariah Compliant, please see below image.

Additional Considerations:

When opting for Shariah-compliant investments, it is essential to regularly check the status in our App. This ensures that the evolving nature of businesses or other financial data does not compromise the compliance status of your investments.

IPO Timeline (Tentative Schedule)

| IPO Open Date | Tue, Aug 12, 2025 |

| IPO Close Date | Thu, Aug 14, 2025 |

| Tentative Allotment | Mon, Aug 18, 2025 |

| Initiation of Refunds | Tue, Aug 19, 2025 |

| Credit of Shares to Demat | Tue, Aug 19, 2025 |

| Tentative Listing Date | Wed, Aug 20, 2025 |

| Cut-off time for UPI mandate confirmation | 5 PM on August 14, 2025 |

Lot Size

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Retail (Min) | 1 | 144 | ₹14,688 |

| Retail (Max) | 13 | 1,872 | ₹1,90,944 |

| S-HNI (Min) | 14 | 2,016 | ₹2,05,632 |

| S-HNI (Max) | 68 | 9,792 | ₹9,98,784 |

| B-HNI (Min) | 69 | 9,936 | ₹10,13,472 |

Financials

Based on the financial data for Regaal Resources Ltd., a troubling trend is evident. While the company boasts significant increases in revenue and profit after tax, a closer examination reveals a precarious financial strategy. The company’s total borrowings have ballooned to over ₹507 crore, showing a staggering increase from the previous year. This massive reliance on debt to fuel its growth is highly concerning. The company’s net worth, despite increasing, is dwarfed by its liabilities, suggesting that its rapid expansion is built on a foundation of unsustainable borrowing rather than robust, self-funded growth.

KPI

| KPI | Values |

|---|---|

| ROE | 20.25% |

| ROCE | 14.17% |

| Debt/Equity | 2.08 |

| RoNW | 20.25% |

| PAT Margin | 5.19% |

| EBITDA Margin | 12.32% |

| Price to Book Value | 6.18 |

LINKS

Ready to invest in Shariah-compliant opportunities? Explore more at IslamicStock & consider opening a demat account from the below link!

- Open Demat Account:

- Visit our Website: www.IslamicStock.in

- Read our Blog: blog.islamicstock.in

- Download our App:

SEBI Disclaimer

Investing in IPOs involves risks. Please read the offer document carefully before investing. This article is for informational purposes only and does not constitute financial advice. Investors should consult their financial advisors before making any investment decisions.