Table of Contents

1. IPO Snapshot – SACHEEROME

- Company Name: Sacheerome Ltd

- Issue opens: June 9, 2025

- Issue closes: June 11, 2025

- Price band: ₹96 to ₹102 per share

- Lot size: 1,200 shares (minimum investment ~₹122,400)

- Issue size: ₹61.62 crore via issuance of 6.04 million shares

- Listing platform: NSE SME with tentative date of June 16, 2025

2. Company Overview

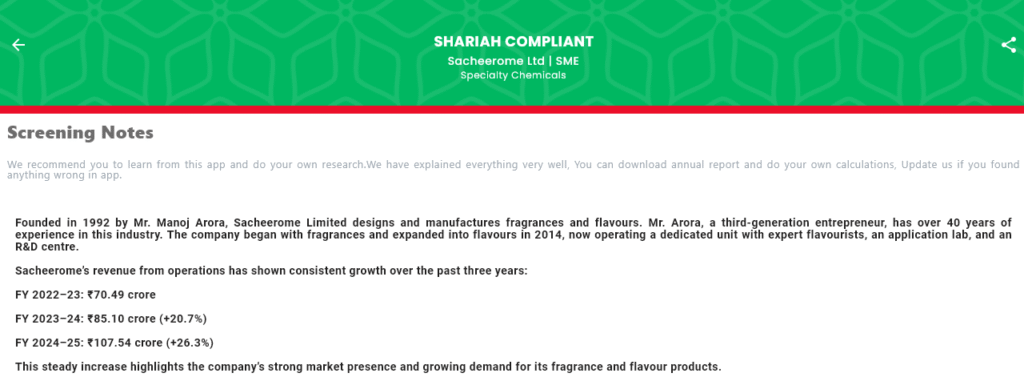

Sacheerome Limited is a Delhi-based company that was established in 1992 by Mr. Manoj Arora. He is a third-generation entrepreneur with over 40 years of experience in the fragrance and flavour industry. The company started its journey with fragrances and later expanded into the flavour segment in 2014. Over the years, Sacheerome has built a strong foundation, backed by a dedicated team of expert flavourists, an application lab, and a research and development center.

The company is involved in the design, development, and manufacturing of both fragrances and flavours. Its product portfolio is wide and serves various industries.

Fragrance segment:

Sacheerome creates custom fragrance solutions for multiple sectors, including personal care, body care, hair care, home care, baby care, fabric care, air fresheners, men’s grooming products, pet care, and hygiene-based products. These fragrances are used in daily consumer items such as soaps, shampoos, detergents, room fresheners, and more.

Flavour segment:

The flavour division provides taste solutions for food and beverage manufacturers. Sacheerome’s flavours are used in drinks, bakery items, confectioneries, dairy products, health and nutrition supplements, oral care items, shisha (flavoured tobacco), meat products, dry spice blends, and seasonings. The flavours are tailored to suit regional and international taste preferences, which helps in meeting the unique demands of different customer groups.

The company has invested in innovation and product development. Its R&D unit plays a crucial role in creating new formulas and improving existing ones to stay ahead in a competitive market. By combining creativity with technical expertise, Sacheerome aims to deliver both quality and consistency.

Financial performance:

Sacheerome has shown strong and steady revenue growth over the past three financial years:

- In FY 2022–23, the revenue stood at ₹70.49 crore

- In FY 2023–24, it increased to ₹85.10 crore, marking a growth of 20.7 percent

- In FY 2024–25, the revenue reached ₹107.54 crore, a further growth of 26.3 percent

Along with revenue, the company’s profitability has also improved. The profit after tax (PAT) rose from ₹10.67 crore in FY 2023–24 to ₹15.98 crore in FY 2024–25. This performance reflects good operational efficiency and increasing demand for its products.

Sacheerome has also developed strong relationships with its clients across different regions. The company’s ability to serve both domestic and international markets has given it a competitive advantage in the specialty chemicals sector.

Overall, Sacheerome Ltd stands out as an experienced and growing player in the fragrance and flavour industry. With its continuous investment in innovation, solid leadership, and a wide customer base, the company is well-positioned to benefit from the rising demand in both sectors.

3. Grey Market Premium (GMP)

In the unofficial (grey) market, Sacheerome shares are trading around ₹132, giving a GMP of ₹30, nearly a 29.5% premium over the upper price band.

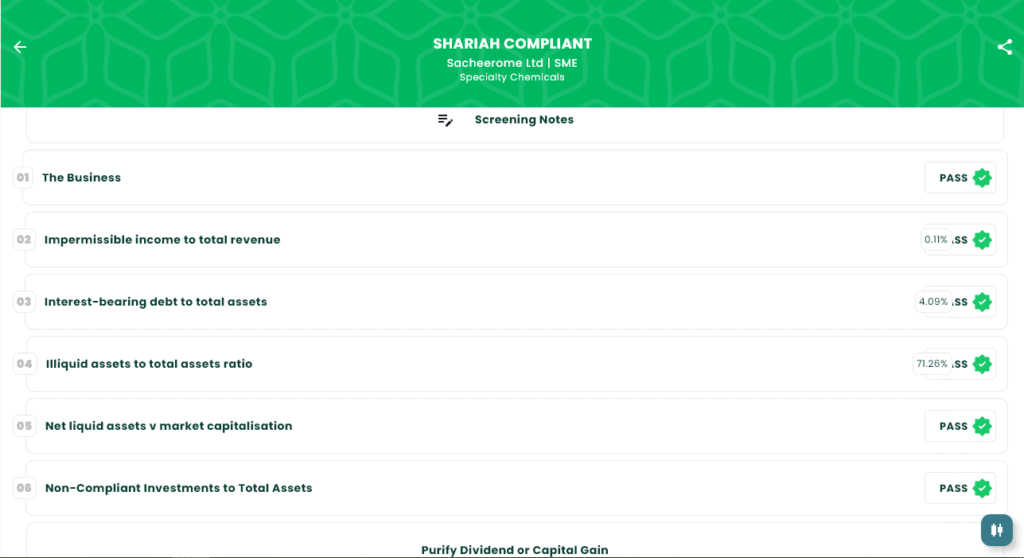

4. Shariah Compliance Status

According to the IslamicStock screening, overall compliance checks are passed, indicating Shariah alignment.

Screening notes highlight the company’s consistent growth, strong R&D center, and seasoned leadership.

5. Subscription Status

Demand has been strong.

On Day 1:Entire IPO fully subscribed within one hour (~1.03x).

- By mid-day, overall subscription reached 3.97x- retail 5.64x, NII 4.11x, QIB low at 0.01x.

This shows strong participation, especially from retail and non-institutional investors.

6. Final Thoughts

The steady financial growth, leadership experience, and successful product diversification (fragrances to flavours) paint a positive picture. Strong grey market demand and high Day 1 subscription suggest market confidence. The low institutional interest may indicate limited big-ticket investor participation, though retail enthusiasm is promising.

Overall, for investors aligned with SMEs and looking for Shariah-compliant options, this IPO presents a compelling case. The grey market premium suggests potential for listing gains, but caution is advised given its SME status and low institutional subscription.

7. Disclaimer (as per SEBI)

Investments in IPOs are subject to market risk. Please read the Draft Red Herring Prospectus carefully before applying. This article is for informational purposes only and does not constitute financial advice. Consult a licensed financial advisor with regard to your individual situation. This information complies with SEBI guidelines.