Understanding Shariah Compliance in IPOs and Stocks:

Investing wisely is essential for both financial growth and ethical alignment. For those interested in making investments that comply with Islamic law, understanding the Shariah status of Initial Public Offerings (IPOs) and stocks is crucial. This article aims to provide insights into the Shariah compliance of Sawaliya Food Products Ltd, ensuring that your investment choices are not only profitable but also ethical.

Table of Contents

What is Shariah Compliance?

Shariah compliance refers to the adherence to Islamic law, which governs various aspects of life, including financial transactions. When it comes to investments, certain criteria must be met to ensure that they are permissible under Shariah law. For example, investments should avoid sectors related to alcohol, gambling, pork, and any form of interest (Riba), etc.

Analyzing The Company

Company Name: Sawaliya Food Products Ltd

Industry: Other Agricultural Products

Listing At: NSE SME

Overview:

Sawaliya Food Products Private Limited – Where Freshness Meets Flavors

Established in 2014, Sawaliya Food Products Pvt. Ltd. is an ISO 22000:2005 certified company known for its effective processing and packaging methods. The company manufactures, exports, and wholesales a wide range of dehydrated vegetables and fruits, including onions, garlic, carrots, and French beans. Each product is hygienically packed to preserve taste, nutrition, and essential vitamins.

Mission:

Sawaliya Foods is committed to offering fresh, natural ingredients sourced from trusted farmers, empowering both chefs and home cooks, with a strong focus on purity and sustainability.

Vision:

To become a leading name in the ingredients market for FMCG and ready-to-eat food items, expanding its product portfolio to serve as a one-stop solution for RTE manufacturers.

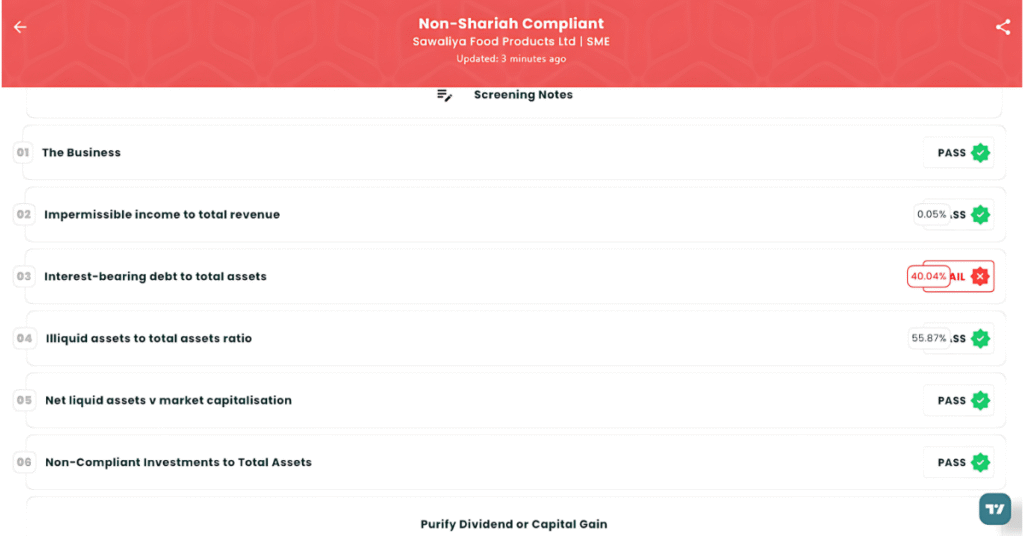

Shariah Status

The IPO is Non-Shariah Compliant, please see below image.

Additional Considerations:

When opting for Shariah-compliant investments, it is essential to regularly check the status in our App. This ensures that the evolving nature of businesses or other financial data does not compromise the compliance status of your investments.

IPO Timeline (Tentative Schedule)

| IPO Open Date | Thu, Aug 7, 2025 |

| IPO Close Date | Mon, Aug 11, 2025 |

| Tentative Allotment | Tue, Aug 12, 2025 |

| Initiation of Refunds | Wed, Aug 13, 2025 |

| Credit of Shares to Demat | Wed, Aug 13, 2025 |

| Tentative Listing Date | Thu, Aug 14, 2025 |

| Cut-off time for UPI mandate confirmation | 5 PM on August 11, 2025 |

Lot Size

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Individual investors (Retail) (Min) | 2 | 2,400 | ₹2,88,000 |

| Individual investors (Retail) (Max) | 2 | 2,400 | ₹2,88,000 |

| S-HNI (Min) | 3 | 3,600 | ₹4,32,000 |

| S-HNI (Max) | 6 | 7,200 | ₹8,64,000 |

| B-HNI (Min) | 7 | 8,400 | ₹10,08,000 |

Financials

The financial performance of Sawaliya Foods Products Ltd. paints a troubling picture despite the initial headline figures. While revenue and profit after tax are reported to have increased significantly, a closer look at the balance sheet reveals cause for concern. The company’s total borrowings have ballooned to ₹22.49 crore, an almost 75% increase from the previous year. This massive debt accumulation overshadows the reported profits, suggesting that the company’s growth is being fueled by unsustainable borrowing rather than robust internal performance. Furthermore, the substantial rise in total borrowings could expose the company to significant financial risk, making it vulnerable to interest rate fluctuations and a potential credit crunch. The reported growth appears to be built on a precarious foundation of debt, casting a dark shadow over its future stability and long-term viability.

KPI

| KPI | Values |

|---|---|

| ROE | 75.70% |

| ROCE | 48.96% |

| Debt/Equity | 1.78 |

| RoNW | 54.91% |

| PAT Margin | 20.32% |

| EBITDA Margin | 35.74% |

| Price to Book Value | 6.94 |

LINKS

Ready to invest in Shariah-compliant opportunities? Explore more at IslamicStock & consider opening a demat account from the below link!

- Open Demat Account:

- Visit our Website: www.IslamicStock.in

- Read our Blog: blog.islamicstock.in

- Download our App:

SEBI Disclaimer

Investing in IPOs involves risks. Please read the offer document carefully before investing. This article is for informational purposes only and does not constitute financial advice. Investors should consult their financial advisors before making any investment decisions.