Bismillah

There are many Financial Screening Criterias, out of theme, We at the IslamicStock uses the following criteria

| Rule 1 | The Business | – |

| Rule 2 | Impermissible income to total revenue | 5% |

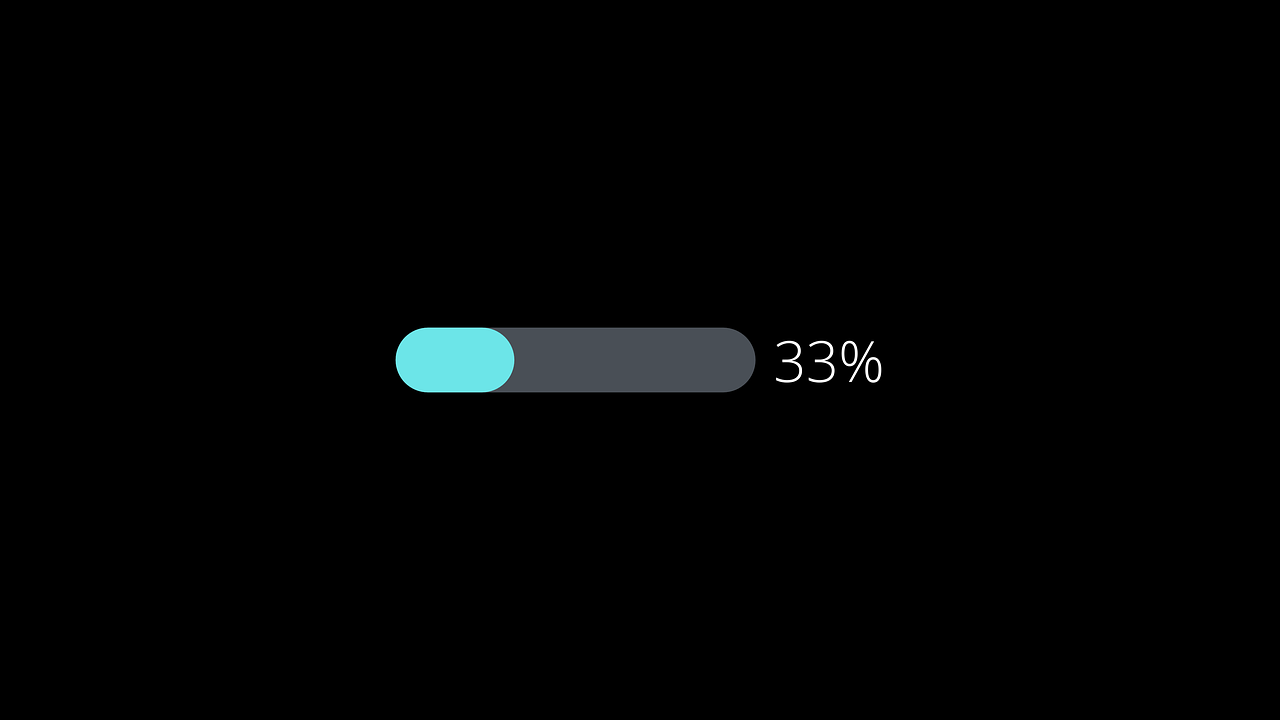

| Rule 3 | Interest-bearing debt to total assets | 33% |

| Rule 4 | Illiquid assets to total assets ratio | 20% |

| Rule 5 | Net liquid assets v market capitalisation | – |

| Rule 6 | Non Sharia Investment to total assets | 33% |

Tolerance Threshold

As can be seen from above Table (IslamicStock Screening Criteria) , there is no consensus on the level of the tolerance threshold used for financial screening criteria since it varies from one Sharīʿah board to another. The commonly used thresholds are, (30-33%) level of conventional debt, (30 – 33%) interest-based investment/deposit, (33% – 50%) liquidity and (5% – 25%) of impure income.

The question that naturally arises here is as to where these thresholds are deduced from. The 33% tolerance threshold was chosen by scholars since one-third is not considered as an excessive portion from a Sharīʿah perspective.

This is based on a Ḥadīth of Prophet (SAAW) and a fiqh rule. In terms of the Ḥadīth, the Prophet (SAAW) advised one of his companions not to donate more than one-third of his wealth in a will, and commented: “onethird is too much.” Furthermore, the maxim of majority is used which states that ‘the majority deserves to be treated as the whole of a thing’. That implies that if securities represent composite assets, the rule of the dominating asset (having more that 50 percent) will apply to the security.It is argued that the threshold range of between 33% and 49% is deduced from this Sharīʿah maxim whereby the majority can be classified as a ‘simple majority’ in the case of more than 50% and a ‘super majority’ in the case of more than 67%. With regards to the 5% threshold, it seems to be that this threshold is based on the ijtihād of contemporary scholars, rather than being explicit in the Qur’ān or Sunnah.

The criticisms of financial screening

The current practice of Sharīʿah screening process allows investment in companies which deal with (Sharīʿah-impermissible) interest-based debt or interest-bearing securities, as long as the exposure to such impermissible activities does not exceed the one-third threshold believed to be not excessive. However, it is argued that the use of the ḥadīth that the Prophet advised one of his companions not to donate more than one third of his wealth, and commented that, “One third is too much” to tolerate interest-based activities is debatable, since it is used out of its context.This is because the situations described differ widely from the screening processes in which they are used here. In particular, the context of the above Ḥadīth was for donation which is a noble act, as the companion wanted to give away all of his wealth, but the Prophet advised him not to donate more than one third to keep some of his wealth for his inheritors. This is vastly different field from the tolerance of Sharīʿah-impermissible interest-based activities In addition, some scholars argue that the issue of ribā cannot be tolerated at all in Islam, regardless of the amount involved. The severity of ribā is evident from the Qur’ānic verse (2:279), in which God declares war on people who deal with it. There are also many Aḥadīth of Prophet (pbuh) which show how severe it is to get even a negligible amount of ribā. This might explain why the commonly used Sharīʿah screening criteria have not yet been approved by a credible independent Sharīʿah authority, such as the International Islamic Fiqh Academy.

Conclusion

The most distinctive feature of the Islamic economic and finance system is to eliminate ribā, gharar, maysir and Sharīʿah-impermissible businesses. Therefore, the Sharīʿah investment screening processes emphasize sector and financial screening criteria to ensure permissibility of the investment, from a Sharīʿah point of view. However, fully Sharīʿah-compliant companies are rare, since ribā and some sorts of gharar are embedded in the modern conventional financial system. Therefore, some scholars relax some Islamic constraints, by allowing investment in companies (even if they have interest-based activities and/or have some exposure to Sharīʿah-impermissible activities), as long as their primary business is Sharīʿah-permissible. However, the Sharīʿah impermissible activities must not exceed the tolerable level, believed not to be excessive, and that the impure income portion should be purified by giving it away to charities. Such a purification requirement seems to be unique to Islamic investment.

To follow your Taqwa IslamicStock App have unique feature call “TAQWA SETTINGS“. Who want to follow 0, 0 ratio feel free to use Taqwa setting for others App works on default 33% and 5% ratio.

JazakAllah Khair for reading the blog